Rugby Receivables Finance

Do I have options to use rugby receivables finance? It is a question that probably crosses the mind of the rugby team or club owner every once in a while.

Like any other sports industry, rugby or rugby union is also a popular game amongst the nations within the United States, Europe, the UK, Australia, and other nations of the world.

With the Rugby World Cup 2021 round the corner, it is time that rugby teams’ financial managers and owners get themselves familiarized with the concept of what receivables are and how this financing facility can help them during a period of financial uncertainty or growth.

What are Receivables?

Receivables are more commonly known as “account receivables” and in the sports industry “sports receivables” at times. It is the financial amount owed by a customer to a company against providing services, products, or entertainment.

The company provides services to the consumer on credit, and the customer has the ability to pay later, when the invoice or contractual payment becomes due. So fundamentally, these are pending invoices that the customers needs to pay on the due date.

Many companies these days operate on the model of account receivables, for example, your credit card. You use the money by the bank that you do not have, and then you pay it back within the next 30 to 60 days when the invoice becomes due.

A similar phenomenon works in the sports industry, such as broadcasting a rugby match. Although the TV channel broadcast a rugby match live, the payment for that broadcast may not be due until the end of the season.

So from the rugby team’s perspective, the money owed by the TV channel or a broadcasting company is actually “sports or rugby receivables.” It does not appear as the money owed but an asset on the rugby team’s balance sheet.

Why Do Rugby Receivables Matter?

Rugby receivables are a significant factor in a rugby team’s working capital. If it goes too high and the team is slow in collecting what different parties owe to them, the team is highly likely to find themselves in financial turmoil sooner rather than later. It may result in a rugby team or club having financial difficulties and issues with paying their short-term obligations, such as utility bills, day-to-day operational expenses, and other cash payments.

If the outstanding receivables balance is too low, the team may be unwisely damaging their fan base and popularity, resulting in not enough services acquired by the fans, sponsors, and other business partners. For example, a rugby team’s low performance may drive the fans away and thus decrease annual sales.

If a team drops or exits from the main league, they may end up losing prize money and broadcasting revenue from different channels and also losing sponsors’ funding. So, in general, rugby receivables reflects the selling potential of the team as well.

A rugby team or clubs can sometimes use their rugby receivables as security or collateral for borrowing from the banks or lending institutions. The level of accounts receivables of a rugby team can also affect certain vital financial performance aspects and measures, such as days payable, working capital, the current ratio, etc.

However, it is essential to note that any uncollectable receivables is not an asset. Uncollectible receivables or ‘overdue’ may fall into the category of doubtful accounts (depending on the jurisdiction of country incorporation), reducing the account receivables of the rugby team.

Hence, these are the reasons why companies and lenders only allow creditworthy customers to avail of their services, to guarantee the payback of their loaned amount, services, and corresponding products.

Sometimes lending companies or service providers sell their invoices to other collection companies for cents on a dollar. It is then the collection company’s job to recover their receivables if they can.

When you talk about accounts receivables or rugby receivables, there are mainly two ways a rugby team can avail of this facility.

Secured Loan

A secured loan is a facility extended by a bank or lending institution in which a rugby team may receive a loan against a guarantee or providing asset security. An example of this may be their physical premises, such as a stadium, training center, and other types of assets.

In the event that a rugby team is struggling to raise short-term capital, to pay the bills, print the merchandise, and payout the team squad; the team may take a loan out against their stadium or any other physical asset.

The financier will provide them with immediate access to cash, which will help the team meet their financial obligations. Once the team earns sufficient revenue, they can pay the loan back to the financier and release their stadium or other pledged security.

Invoice Factoring

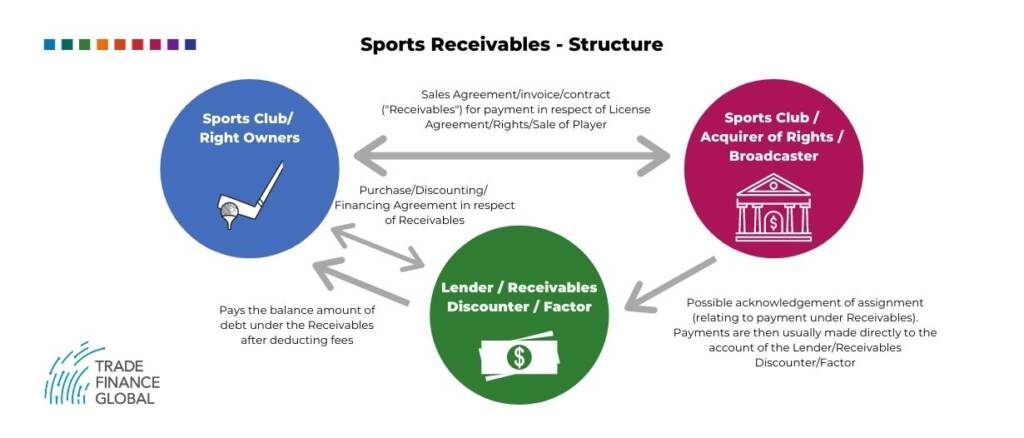

It is the most popular and practiced financial method in the sports industry for the teams, clubs, and owners to fulfill their immediate financial needs. How it works is – say team A sells a player to team B, but the player will transfer to team B by the end of the year 2020 and pay in stages, and that is precisely when team B will commence paying team A.

But team A requires funding earlier, to pay their bills, talent hunt, and refurbish the training grounds. So what do they do?

Team A will sell their player’s transfer invoice to a bank or a lending institution with a slight difference in its actual value. It means the bank will deduct a percentage of the actual value of the invoice and pay the remaining amount to team A.

It will give team A immediate access to capital, so that they can meet their financial obligations. After the player has transferred to team B, and the invoice payments becomes due for team B to pay; either team A or the lender itself will collect the full outstanding monies directly from team B.

Usually, the lenders do take on the responsibility to collect the monies themselves, and many of the borrowing rugby teams prefer it this way. This process takes away the hassle out of running around and collecting the money from relevant outstanding debtors.

Other Receivables

Other rugby receivables can be prize monies from the competition, broadcasting contracts or sponsor contracts.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom