MT 799 (Messaging Types) Explained

MT799 is an essential part of international trade; a ‘free format message’ sent between banks which confirms funds or proof of deposits on a potential trade. MT799 allows banks to communicate between each other freely through the SWIFT system, rather than being a mechanism for transferring funds or paying.

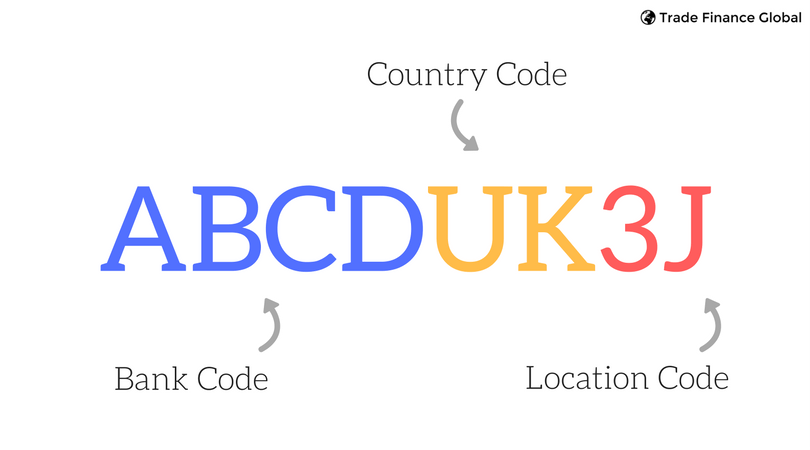

If you deal with Bank Guarantees, Documentary Credits, and Letters of Credit (LCs), you may have heard the term ‘MT799’ being used. A SWIFT code (also commonly referred to as SWIFTBIC) is a unique identifier which banks use to identify and send money to overseas banks.

A SWIFT Code for a bank is identifiable by a series of letters and numbers, as shown in the diagram below:

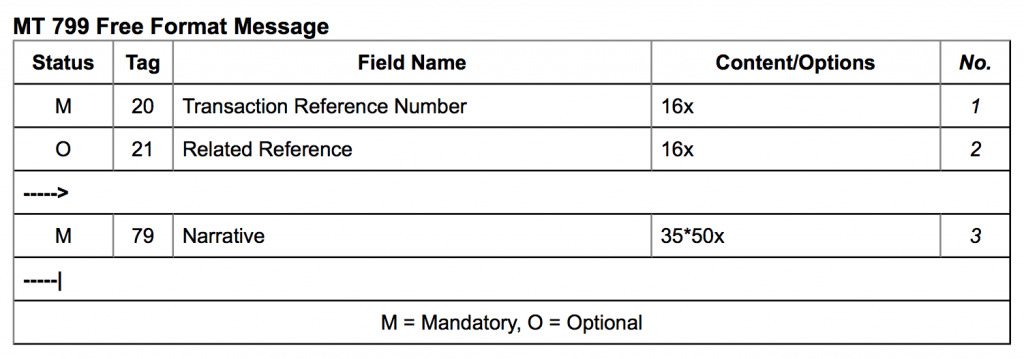

What is the format of MT 799?

‘MT nnn’ stands for Message Type Number: MT 799 messages must include a ‘Transaction Reference Number’ which can contain 16 characters in that field, and a ‘Narrative’ which provides a brief description of a transaction. In the case of the reference number, this field must not start or end with a slash ‘/’ and must not contain two consecutive slashes ‘//’, or it will throw up the error code: T26. With the Narrative, there are no ‘Network Validated Rules’ for MT 799.

Example of an MT 799?

An example of an MT 799 message could be as follows:

We Refer To Our MT [nnn], Date [YYMMDD],

[Input Information on the Beneficiary, Total Letter of Credit amount, Dates etc.]

“Our Client reports funds [XXX], which have not yet been applied, please confirm the transfer status, and whether funds are available”

Thanks,

Bank [SWIFT Code]

How do I start the MT 799 process?

Banks do not like issuing these automated messages (MT 799), as they fear being liable for the cost of the trade. There is usually a requirement for the bank’s client to post a specific level of collateral.

What information is required by the financial institution?

A funder will need to know the name of the advising bank. However, they will request more granular detail, such as the LC Number and LC Amount. This will also include the tenor or length of the draft. This will be alongside the latest date of shipment. The company that is liable for the confirmation fee needs to be known; along with information on what products are being traded, location, port, unloading location and whether the LC is restricted for negotiation or not.

- Name of the advising bank

- Letter of Credit Identifier and Total Value

- Details of the Letter of Credit type (restricted, negotiable)

- Latest shipment date

- Person or company liable for confirmation fee

- A description of the goods / services

- Port and/or country where product will be loaded and unloaded

More information

Other Messaging Types and More Info

1 | Messaging Types (MT) – Introduction >

2 | MT 760 >

3 | MT 798 >

4 | Difference between MT 760 and MT 799 >

5 | MT 799 >

6 | SWIFT Website >

Other Messaging Types and More Info

Speak to our trade finance team

Benefits

- Fast and efficient – speak with our trading team within minutes

- Great rates – beat high street bank rates with Trade Finance Global

- Our partners are regulated and trusted experts

- Experts partners who are specialised in geography and sectors

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom