What are Demand Guarantees?

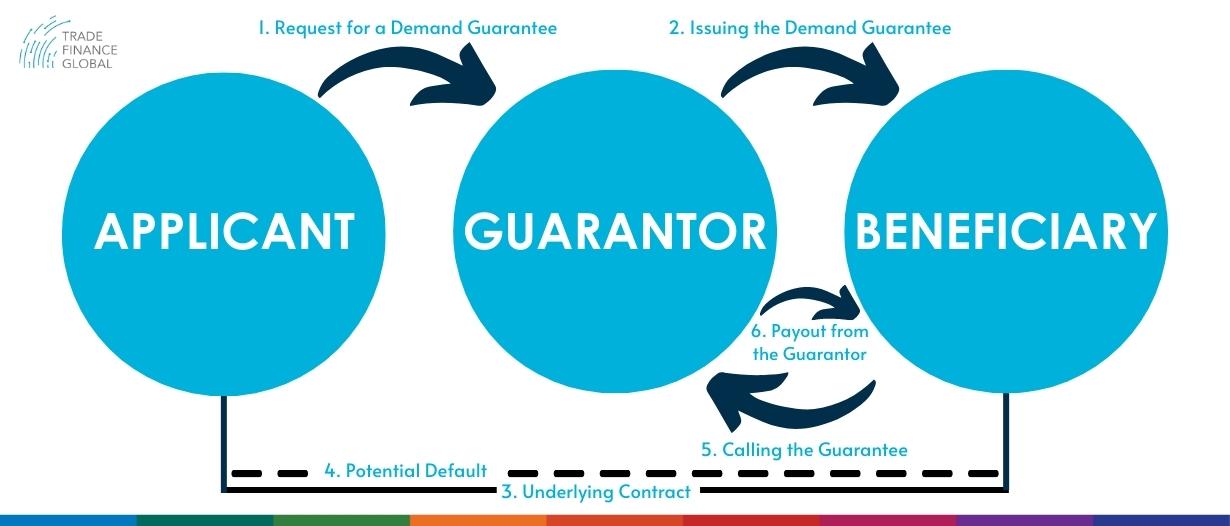

A demand guarantee, defined by the International Chamber of Commerce (ICC), is an agreement issued by a bank or financial institution that assures the payment of a customer’s liability to a third party upon presentation of a demand. This agreement becomes active when the original contract fails and the beneficiary claims the funds. The guaranteeing institution must honour the demand without questioning the original transaction. Demand guarantees play a crucial role in international trade and domestic transactions to ensure fulfilment of contractual obligations.

Promise to pay

A demand guarantee, also known as a guarantee, is a contractual agreement between three parties: the guarantor, the beneficiary, and the applicant. It serves as a secure promise by the guarantor to the beneficiary that they will be compensated if the applicant fails to fulfil their obligations under a contract or agreement. In simpler terms, a demand guarantee ensures that a specified payment will be made upon the beneficiary’s presentation of a compliant demand, regardless of any disputes or controversies that may arise between the applicant and the beneficiary.

Demand guarantees offer several advantages to different stakeholders involved in commercial transactions. For the beneficiary, it provides financial security and peace of mind, ensuring they will be paid if the applicant defaults. Applicants, on the other hand, can benefit from enhanced credibility and trustworthiness, as the guarantee reassures the beneficiary that their contractual obligations will be met. Additionally, demand guarantees provide financial institutions with a regulated framework to manage the risks associated with these transactions.

Purpose and use

Demand guarantees serve as a significant risk mitigation tool in commercial and financial transactions, predominantly in the sphere of international trade. They act as a safety net, providing assurance that contractual obligations will be met, thus fostering trust and reducing potential disputes among trading parties.

In a typical transaction, a buyer and seller may be geographically distant or have different legal systems, which can introduce a level of uncertainty and risk. This is where demand guarantees come into play, bridging the trust gap between the parties involved. By having a reliable third party, usually a bank or financial institution, the buyer is assured of the seller’s performance, and the seller gains confidence about payment.

Demand guarantees are used extensively across a wide range of transactions, including but not limited to:

- Contractual Obligations: To ensure the performance of a contract, especially in construction, supply, and project contracts. Here, they serve as performance guarantees, ensuring the completion of the project as per the contract terms.

- Tenders and Bids: They are often used as tender or bid bonds, assuring the buyer that the bidder will honor the terms of the bid if they win.

- Advance Payments: In cases where an advance payment is made, a demand guarantee may be used to protect the payer’s interest, ensuring that the payee fulfills their obligation.

- Loan Repayments: Banks often use demand guarantees as security for loan repayments, ensuring the borrower repays the loan as agreed.

By providing a form of financial assurance, demand guarantees help parties navigate the complexities of international trade, fostering business growth and global commerce.

Legal Framework of Demand Guarantees

The legal landscape for demand guarantees is grounded in a blend of international commercial law, contractual law, and banking practices. One of the primary principles underlying demand guarantees is their independence from the underlying contract between the applicant and the beneficiary. This means that the guarantor (usually a bank or financial institution) is obligated to pay the beneficiary upon receiving a demand that complies with the terms of the guarantee, regardless of any disputes in the underlying contract.

In terms of international standards, the Uniform Rules for Demand Guarantees (URDG) published by the International Chamber of Commerce (ICC) provides a comprehensive set of guidelines designed to bring clarity and stability to the practice of demand guarantees. While the URDG is not legally binding, it’s widely adopted in many countries and by many international banks due to its comprehensive nature and the credibility of the ICC. The most recent update, URDG 758, covers a range of issues such as the definitions, obligations, and responsibilities of all parties, presentation, examination, and payment of demands, expiry circumstances, and governing law and jurisdiction.

Furthermore, domestic laws can also have a bearing on the operation of demand guarantees. The jurisdiction will typically be specified in the guarantee itself and, in the event of a dispute, local laws can play a vital role in the outcome.

For more details on the rules and principles governing demand guarantees as laid out in URDG 758.

Remember, as with all complex financial instruments, it’s crucial to seek legal advice when dealing with demand guarantees to understand the potential risks and legal obligations involved fully.

Case Study

Here is a hypothetical example of a demand guarantee transaction:

- Importer: A US company, ABC Imports, wants to import a shipment of cars from Japan.

- Exporter: A Japanese company, XYZ Exports, agrees to sell the cars to ABC Imports.

- Bank: ABC Imports’ bank, Bank of America, issues a demand guarantee to XYZ Exports.

The demand guarantee states that if XYZ Exports fails to deliver the cars to ABC Imports, ABC Imports can demand payment from Bank of America. Bank of America will then pay ABC Imports the amount of the guarantee, up to a certain limit.

In this example, the demand guarantee provides a level of security for ABC Imports. If XYZ Exports fails to deliver the cars, ABC Imports will be able to get their money back from Bank of America. This helps to protect ABC Imports from financial loss.

Here are some of the key terms of the demand guarantee in this example:

- Beneficiary: The party who is entitled to payment under the guarantee, in this case ABC Imports.

- Principal: The party who is responsible for the performance of the underlying contract, in this case XYZ Exports.

- Guarantor: The party who issues the guarantee, in this case Bank of America.

- Amount: The maximum amount that the guarantor is liable to pay under the guarantee.

- Conditions: The events that must occur in order for the beneficiary to be entitled to payment under the guarantee.

Demand guarantees are a common tool used in international trade. They can help to protect buyers and sellers from financial loss, and they can help to facilitate trade by providing a level of certainty.

Video - Understanding Demand Guarantees

Download our free SME trade finance research

Download the 2023 export finance guide

Contents – Guarantees Hub

1 | What is a Guarantee

2 | The Basic Concepts of a Guarantee

3 | Rules, Practices, Conventions and Laws

4 | The purpose of a Guarantee

5 | The structure of a Guarantee

6 | Research

7 | Demand Guarantees

8 | URDG 758 Rules and Their Impact on Demand Guarantees

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom