What is Cash and Liquidity Management?

Cash and liquidity management is a sub-function of treasury management that aims to convert sales to available cash as soon as possible and at the lowest processing cost.

It’s a crucial component in treasury operations; operations which are concerned with maximising the benefits of surplus funds and minimising the cost of shortfalls through careful investment and considered borrowing.

Cash management plays an important role in these operations by maximising the amount of liquid funds available at any time to ensure cash shortfalls are minimised and more cash is available for investment purposes.

What Does Cash Management Involve?

Cash management deals with all aspects of working capital management and involves many different tasks. The roles and responsibilities of this department include:

- Forecasting the cash requirements of the business and preparing budgets.

- Establishing necessary banking relationships and providing working capital finance security.

- Managing the credit collection.

- Ensuring that shortfalls are avoided or minimised and that the business can always meet its financial obligations.

- Releasing trapped cash

- Extracting liquidity from working capital

- Releasing working capital

Phases of Cash and Liquidity Management

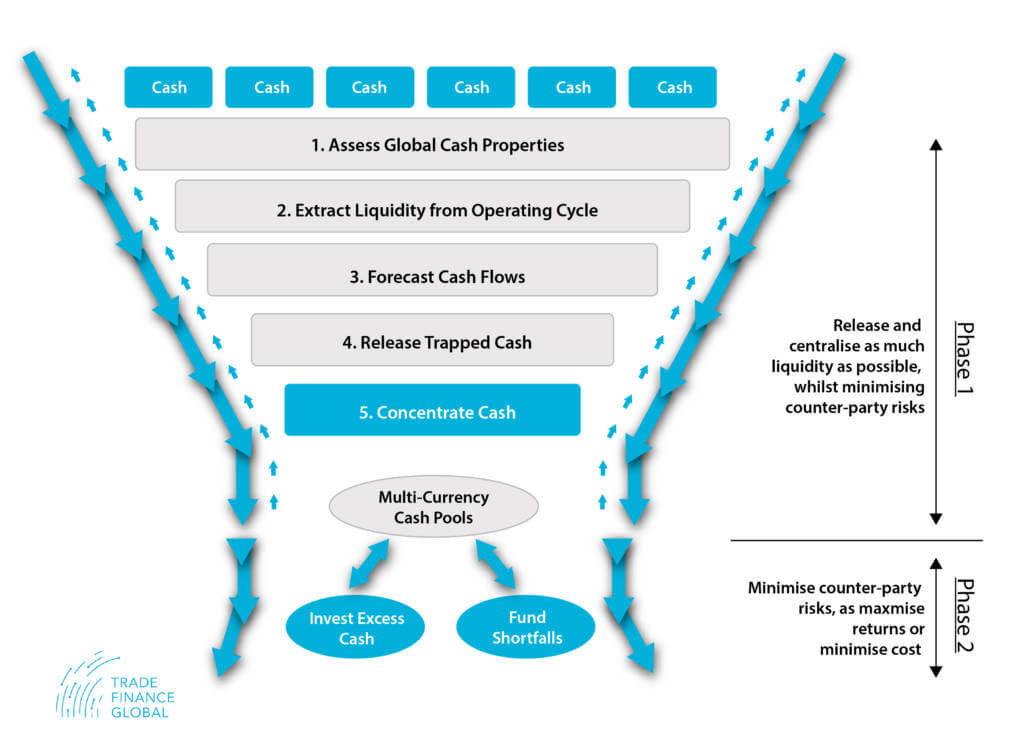

The first phase of cash and liquidity management involves maximising liquidity through releasing and centralising cash. The second phase involves maximising the returns on any cash surplus in the concentrated cash pool or minimising the cost of funding any shortfalls. Together, both phases work to increase the profitability of the business.

The following flow chart illustrates what this should look like in practice:

Releasing Trapped Cash

As the name suggests, trapped cash is simply cash that is trapped in one location and can’t be moved to the centralised treasury. This occurs when there are regulations and constraints which limit cross-border money movement – something which is often seen in emerging markets. This blog explains in more detail what these in-country restrictions include.

As we mentioned earlier, the difficult and important job of releasing trapped cash falls to the cash and liquidity management function. Fortunately, there are several methods that can be used to do this – intercompany transfers, transfer pricing, and payment of dividends to name a few – and companies will typically explore various avenues in their efforts to do this.

Local financial authorities in many countries have banned or blocked the use of these methods, but new techniques are constantly being developed.

Releasing Working Capital

The cash management function is also concerned with releasing working capital which may be tied up in assets like accounts receivables.

In order to do this, they aim to do three things: maximise their DSO (Days Sales Outstanding) and minimise their DIO (Days Of Inventory) and DPO (Days Payables Outstanding).

We can use these three factors to determine the DCC (Days Cash Conversion) through a simple calculation:

In other words, the goal is to make payments as late as possible, collect payments as early as possible, and keep inventories as tight as possible.

Businesses can explore various financing options to release working capital, such as:

- dynamic discounting

- factoring receivables

- invoice discounting and securitisation

- trade finance

A 2017/18 analysis by UwC highlights just how important it is for businesses to work on releasing working capital, as they estimated that there was an opportunity for companies across the world to release €1.2trn of tied-up working capital – money that could be being invested to drive profitability.

Seasonality and Working Capital

Seasonality can have a huge effect on working capital. During periods of slow sales, there may be a lesser influx of cash which can affect the amount of working capital a business has available.

Similarly, a seasonal surge in sales requires larger inventory stocks, which must be ordered in advance. The cost of increasing inventory stocks may put additional strain on working capital during periods in which there is less available to them.

To combat the negative effects this can have on the profitability of the business, the cash management function must ensure they have accurate annual cash flow forecasts. They can then use this information to set limits for the amount of cash the business must hold back throughout the year and more effectively manage accounts receivable.

If the cash management function fails to effectively anticipate and prevent a shortfall in working capital, they may fall back on short-term financing options.

Treasury Management Hub

1 | Introduction to Treasury Management

2 | Cash and Liquidity Management

3 | Liquidity and Risk Management

4 | Corporate Finance

5 | Cash Flow and Advanced Forecasting

6 | Treasury Management Systems

7 | Trade Finance Software

8 | Supply Chain Management

9 | Debtor

10 | Creditor

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom