With the more commonly known Forex Market operating with an average of $5.2 Trillion dollars exchanged per day, what role has Brexit played since the announcement (some 13 months previous at the time of writing)?

Why would Brexit Affect the Currency Market?

Volatility creates margins in which money is made in the financial markets. The more volatile in a market, the more room there is for traders to profit.

The Forex markets are well-known for volatility, which is why it attracts such a large portion of global investment.

Another important aspect of the forex market is the fact that it is largely focused on the short-term. This means when uncertainty is introduced, the result is mass-sell off, which then of course leads to a sharp decline in the price of the currency.

George Soros, seen as one of the most successful investors in the world, explains Brexit’s importance well in his famous quote “Volatility is greatest at turning points, diminishing as a new trend becomes established”.

Brexit was indeed a huge turning point with its implementation affecting all aspects of the macro economy – for more information on what Brexit meant for trade finance, see Trade Finance Global’s “Brexit and the EU Referendum”

Because today’s monetary system involves fiat currencies – intrinsically worthless paper, backed by governing bodies; uncertainty surrounding currencies can cause further volatility. This often pushes more investment toward commodities with an intrinsic value such as gold. Gold’s reaction to the Brexit announcement is explained in our article “Gold’s performance in 2017”.

To put it simply, because Britain and its operations were so well intertwined with European legislation and the Single Market, the prospect of a complicated departure triggered by the starting of Article 50 caused (and continues to) great uncertainty surrounding both the Pound and the Economy.

“Politics is the New Economics”

Writing for Business Insider UK, Will Martin brought to light research carried out by HSBC, in which they found it was politics, not economics that drove large fluctuations in the global currency markets. Forex analysts at the bank have included Brexit in their examples of currency-fluctuating political events, and said that the reactions of the markets to the election of Donald Trump “cemented their belief”.

£ vs € – The story so far

Predictions made pre-Brexit were not positive for the Pound. Because Britain’s national debt is so high (1,682.8 billion, equivalent to 85.3% of GDP to be precise), if separation from the EU and the Single Market triggered a recession, the UK may default on its repayments. To avoid this, we will likely see expansionary monetary policy – usually the lowering of interest rates. Further detail on the outlook of the pound post-Brexit is available on our article “British Pound Outlook”. In summary, expectations of the Pound’s decline were based around negative expectations of the economy such as slowed growth and cost-push inflation. It also highlights The Bank of England’s Governor Mark Carney’s announcement shortly after Brexit, warning that monetary easing is set to come into action.

Figure 1: GBP vs EUR, Source: Financial Times

With a lower rate of interest, we will see the pound traded less, leading to a lower performance over the Euro. This is shown in the above GBP/EUR graph.

GBP/EUR Since Brexit

In Figure 1, we see GBP/EUR levels fall significantly after Brexit, but more importantly, levels have remained deflated for the Pound sterling. Pre-Brexit saw the Pound at €1.30, then down to €1.09 four months down the line. A 16.15% fall in the Pound, with roughly half of that fall happening on the three days following the announced result.

The lowest it fell to was the Flash crash on 6th October, where the Pound fell 6.1% within minutes, but corrected itself soon after. This is believed to be algorithmic trading, which is the process of using computers that are specifically programmed to execute certain trade orders under specific conditions. According to Bloomberg, there were certain trades done in Asia during their trading hours, including the pound which were triggered by an algorithmic trade.

A weaker pound has had a real impact on many companies nationwide. Because imports became more expensive, we are seeing cost-push inflation in the economy. Cost-Push Inflation means that the general price level is pushed higher as producers/ suppliers have increased costs due to higher prices for inputs, which are passed onto the consumer.

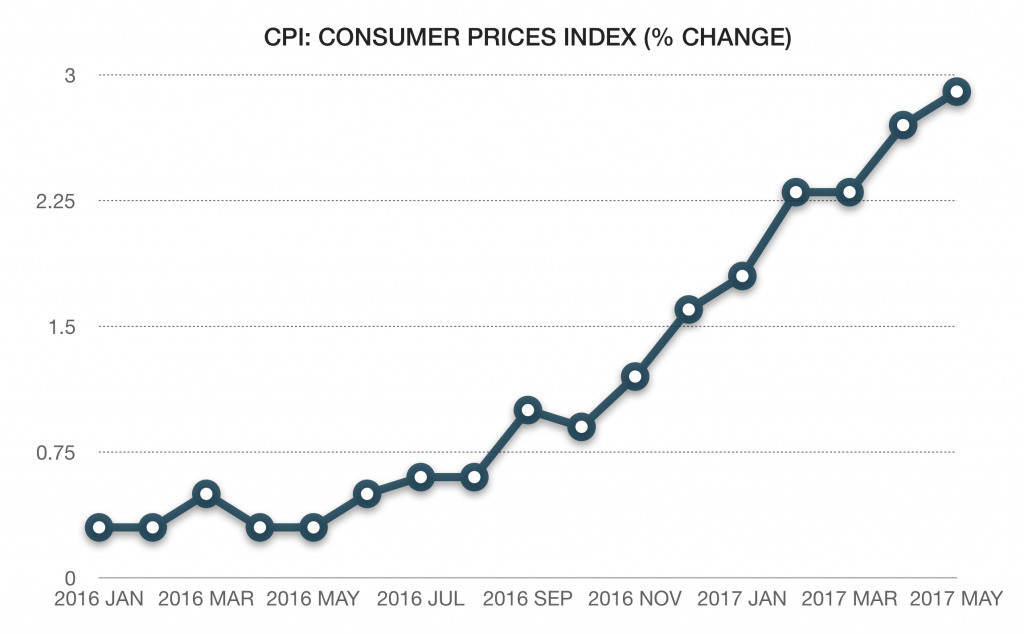

Figure 2: British CPI % change January 2016 – May 2017.

So not only are foreign prices increased, home prices are now also inflated meaning real trouble for many companies who not only depend on reasonably priced stock from the EU, but now have to charge the consumer more for their goods at home, which the consumer may not pay.

How the Dollar is affected?

Backed with a AAA rating, the United States Dollar is supported by the U.S Federal government, and is a world reserve currency.

Given the aforementioned increased volatility, and uncertainty surrounding the Pound and the Euro, it would be expected that investors fleeing away from the two uncertain currencies, would move toward the ‘guaranteed’ Dollar, which would then push up the price of the Dollar.

USD/EUR Since Brexit

In the above we see the expected increase in the value of the dollar. From July of 2016, the sell-off of the pound lead many toward the more-stable dollar, resulting in the move from €0.878 on June 23rd, to €0.908 on July 26th. These effects then wore off, as the Pound sterling started to recover, and held a very slight upward trend. Donald Trump then won the Presidential election, after a long campaign in which he had expressed his intentions to deregulate the banks and business.

Figure 3: USD vs EUR since Brexit. Source: Financial Times

This is essentially a reverse of Brexit’s effect on the Pound. Brexit caused probable business complications, leading to a fall in Investor confidence surrounding the UK/ Pound. Trump promised easier business, with less corporation tax to pay, which encouraged business and trade, leading to more interest in the USD, and thus, a higher price.

For more detail on Donald Trump’s affect on the American Economy, see Trade Finance Global’s ‘Trump on the US Dollar’.

What to expect as Brexit unfolds…

Brexit has caused quite the storm in British Politics, after PM Theresa May called a snap election (see Snap Election) due to parliamentary turmoil, in the hopes for a larger majority. She did not get that. This complicates the process even further because the government has become less unified, and now includes coalition members the Democratic Unionist Party.

PM Theresa May will need the DUP’s parliamentary support – without that she will not be able to pass bills through parliament as easily as before with her majority government. The DUP have been supportive so far.

This complication instils more uncertainty around the process of actually leaving the European Union. This then creates doubt around the British economy, which will inevitably result in less interest in the pound. That being said, British indicators have been relatively stable as of late, with Inflation at 2.7% (close to the 3% target), Unemployment at 4.5%, and GDP growth at a steady 2.3%.

If the above indicators can hold relatively stable, and Brexit negotiations go well, the currencies discussed will fluctuate, but hold a similar trend in the long run.

Summary

Complications with the negotiations, and the payment deals agreed to will play a major role in how investors react to the currency market. If the UK has to pay an exit bill, this large sum will affect confidence in the UK and affect the pound’s value poorly. If this is accompanied by a poor trade deal, and dim new trade prospects, the results could be disastrous. However, only time will tell.

Keep a close eye on Brexit negotiations, the Pound Sterling, as well as what the EU has to say. Fluctuations are to be expected anyway, let alone at such a turbulent time. However, developments in Brexit’s process, negative or positive, are sure to impact the currency markets greatly.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.