We recently published a post that explained a lot about trade finance on Simply Factoring Broker’s blog. In return, we asked Simply’s Head of Marketing, Shaun Thomas if he could explain a little about how recourse affects a business when using invoice finance.

Shaun said:

“The decision is a simple option of liability versus expense.”

What is factoring or invoice finance?

Short answer:

“After raising an invoice, your company will receive a pre-agreed percentage of the invoice value within 24 hours. Your business then receives the remaining percentage, minus fees, upon the settlement of the invoice.”

Recourse vs Non-Recourse Factoring

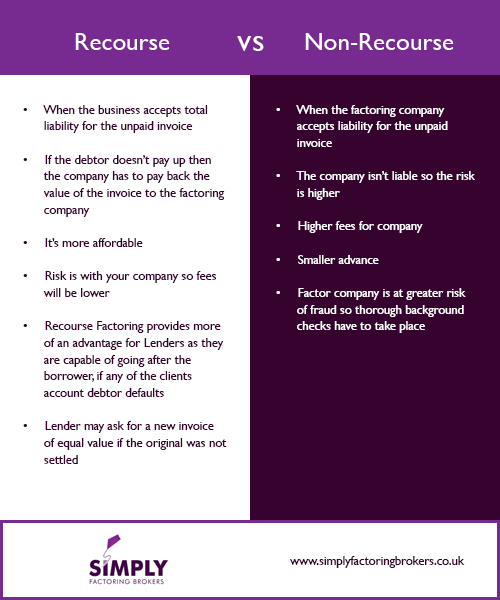

The industry defines the two forms of factoring by risk. Invoice finance is effectively a line of credit obtained on the value of your outstanding sales ledger. Here’s what happens if your debtors fail to pay the invoices after you have financed them.

What is recourse factoring?

Your business agrees to take full liability for the unpaid invoice when using a facility with recourse factoring.

This means if the debtor fails to pay the invoice then your company has to repay the finance provider the value of the invoice. This is often in the form of a direct payment or another invoice of equal financial value. In a full finance facility, your business will finance invoices continually and the debt is recoverable from future invoices.

Benefits of recourse factoring:

Fees are lower and the initial cash advance is larger.

What is non-recourse factoring?

The finance provider is liable for the unpaid invoice when you have a non-recourse factoring facility.

Non-recourse is riskier for the factoring company, which means:

- Fees are higher.

- Advance percentages are smaller.

- More checks on the debtors take place to offset risk of fraud.

Benefits of non-recourse factoring:

You are effectively selling your invoice and obtain finance without risk.

What’s the best form of factoring for your business?

The immediate needs of your company and the size of your sales ledger dictate which option is best for your company.

Your trading history and willingness of underwriters to sign off on a credit line will also dictate which options are available.

A full factoring facility with added ‘Bad Debtor Protection’ is a preferred and cost effective solution, particularly if you have concerns about your customer’s ability to pay for goods or services.

Marketplaces change and risk fluctuates with buyer confidence. Bad debt protection is a favoured option even when dealing with large, blue chip customers.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.