Host: Eleonore Treu, ICC Austria

Featuring: Hugo Verschoren, Gover Trade technologies and Donald Smith, Global TRade advisory Ltd

What are Letters of Credit (LC)?

A Letter of Credit (LC) is a contractual payment undertaking issued by a financial institution on behalf of a buyer of goods. The LC benefits the seller; covering the amount specified in the credit payment, of which is conditional on the seller fulfilling the documentary requirements specified.

Despite being commonly used and providing certain benefits, LC use has been on the decline for the past 20 years.

As part of a media partnership with ICC Austria’s Trade Finance Week, TFG heard from experts Hugo Verschoren and Don Smith, on simplifying Letters of Credit and whether or not, it is time for the creation of a new type of Letter of Credit.

The demise of the Letter of Credit?

It appears that exporters, in particular, seem to want less and less to do with LCs, and will often minimise occasions to use them. Why? LCs are often associated with complexity and famous for creating discrepancies and processing challenges. As a result, it is unclear which market participants truly understand the nuances and peculiar characteristics of this instrument.

Letters of Credit are governed by ICC’s rules

There are a number of rules and regulations surrounding LCs. The International Chamber of Commerce’s Banking Commission has created 39 articles, totalling 34 pages in length of regulations. Additionally, the ICC recommends reading the International Standard Banking Practices in conjunction.

This extensive reading list, which is available for buyers, sellers and banks alike, adds to the complexity of LCs, making it a lengthy, time-consuming process that market participants will often skip. As a result, finding the solution to problems related to this instrument becomes an arduous task.

Discrepancies and loopholes

The payment of an LC is dependent on the presentation of certain documents stipulated in the agreement signed by both parties. Ambiguity and various loopholes in local regulations might

also cause parties to request superfluous additional documents which create more hassle and process. This then prolongs a process that really should have been fairly straight forward.

The panel strongly highlighted, through their own experiences, the lack of knowledge of these rules, which causes banks, buyers and sellers much more work to use LCs. So how can these problems be addressed?

Is LC ‘Lite’ the solution?

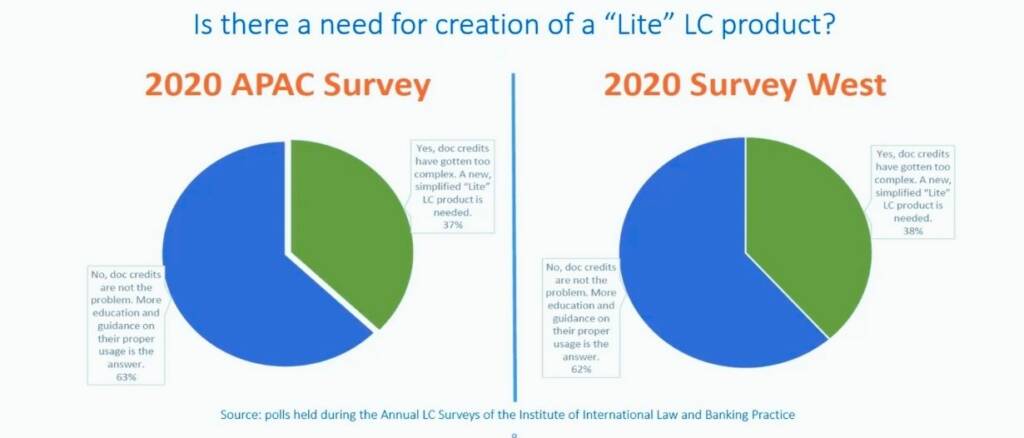

A 2020 set of surveys conducted in APAC and the West, were used to identify the key problems of LCs. According to the results below, a small portion of market participants leaned towards the creation of a new type of letter of credit as a response to increased complexity, whereas an overwhelming portion of respondents leaned towards education.

How to tackle a problem of lack of information? Education appears to be one of the ways forward. By educating not only their own employees, customers and freight forwarders, banks would be able to mitigate the pressing issue that are LCs. Now this would be a long, expensive process. The panel argues that despite its obvious short-term inconveniences, this would allow the problem to be tackled from the root and greatly reduce incongruencies in documents.

Circling back

The life of Letters of Credit is not over. Through focusing on educating market participants and dismitifying and simplifying this instrument it is possible to reap the intended benefits it can provide. It will require a continued and collaborative effort from all parties involved to ensure this issue is solved in the most efficient manner possible. Long live the LC!

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.