Trade Finance Global surveyed firms throughout Europe to gain an understanding of SMEs’ trade finance usage norms and their propensity to pay for new or additional trade finance products and services.

The survey was designed to gain insight into how the current financing costs, revenue, and inventory levels impact the likelihood of European SMEs to pay for new trade finance services at a 4%-8% per annum price point.

A total of 64 firms with operations in 31 countries responded to the survey.

Over 80% of the firms surveyed self-identified as either small businesses, traders, or producers, and less than 20% self-identified as corporates or financial institutions.

The majority (60%) reported annual revenues between $0-$10 million, while 14% reported annual revenue of $50 million or more.

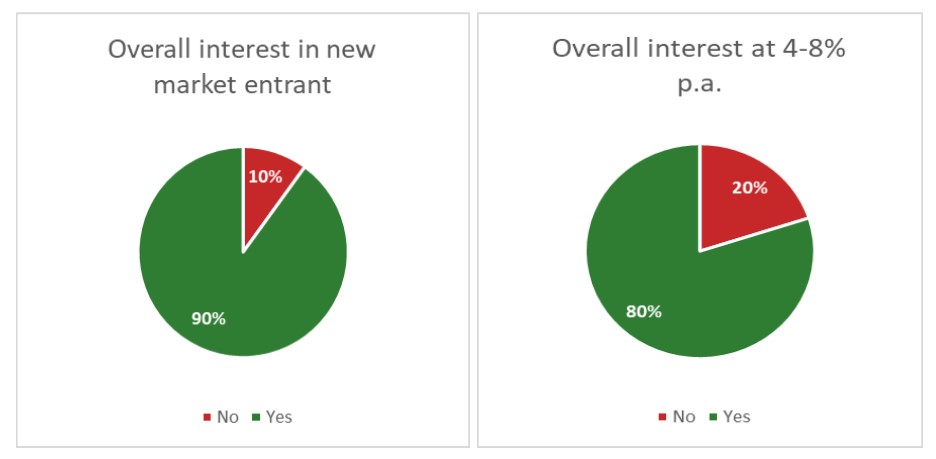

General interest in a new market entrant

When informed of a hypothetical new market entrant coming in to provide trade, inventory, and invoice finance, 90% of respondents indicated that this would be of interest, as it would facilitate financing to pay suppliers and hold stocks, and for invoice finance purposes.

However, when provided with the specific price point of 4%-8% per annum for these services, interest in the new entrant dropped to 80%.

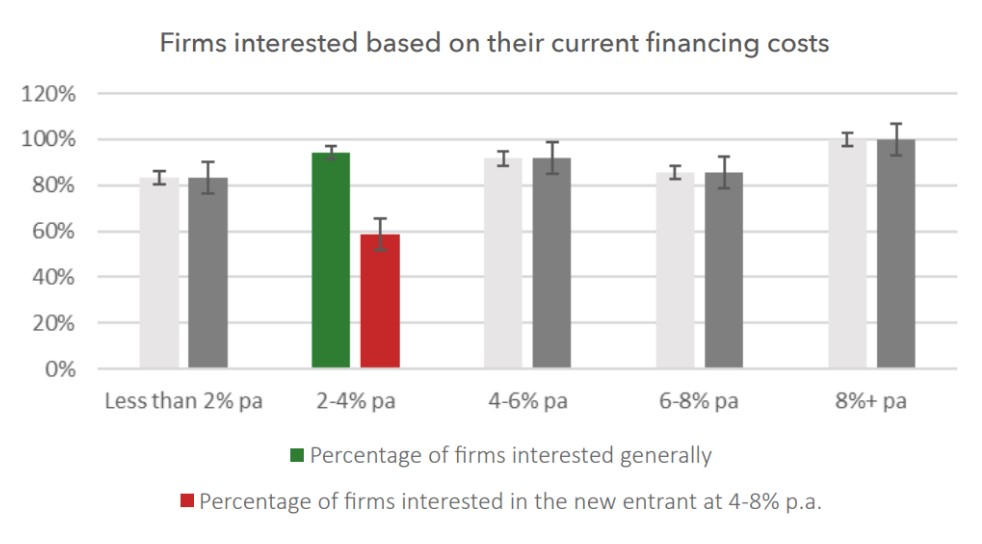

Impact of current financing costs on SME propensity to pay for trade finance services

The largest overall drop in interest at the stated price point came from those firms that are already paying 2%-4% per annum.

In general, 94% of firms that said they pay 2%-4% for their current financing indicated an interest in the new entrant, but that figure dropped to 59% at the 4%-8% price point.

This decline in interest among firms that currently pay 2%-4% is notable, as this group contains one-third of the total respondents, which is the largest of any price point.

Interestingly, the 12% of respondents that currently pay less than 2% for financing did not seem any less interested in the new entrant at 4%-8%.

It is also important to note that every firm currently paying 8% or more for financing was interested in the new entrant.

In total, 16% of respondents currently pay 8% or more for financing.

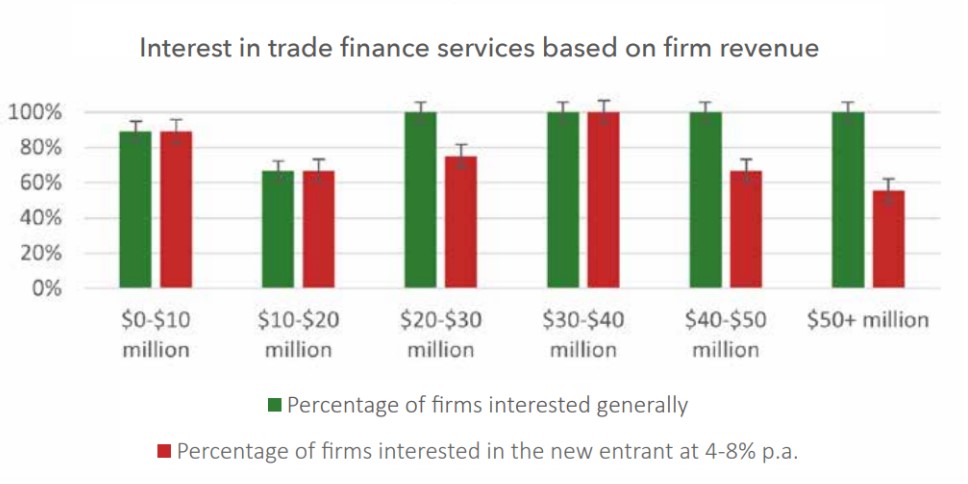

Impact of firm revenue on SME propensity to pay for trade finance services

A firm’s annual revenue also appears to have an impact on the price that it would be willing to pay for the services of a new entrant.

Companies that make $50 million per year or more in revenue tend to be much more price-conscious, with their level of interest dropping from 100% to 56% at the 4%-8% price point.

There was a similar decline among firms in the $40 million to $50 million annual revenue category, with interest dropping from 100% to 67% at the 4%-8% price point.

Among firms that earn less than $10 million per year, however, there was no decline in interest at the 4%-8% price point.

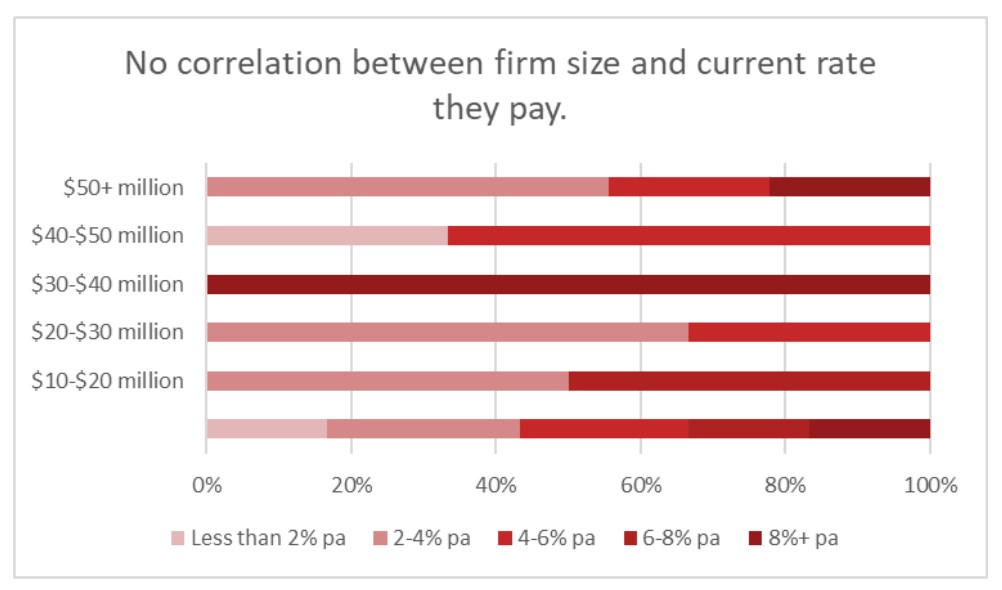

Interestingly, there is no correlation between a firm’s annual revenue and the current rate that they pay for financing.

This suggests that the increased price-consciousness of firms with higher revenue is not related to the ability of these firms to obtain lower prices for financing products.

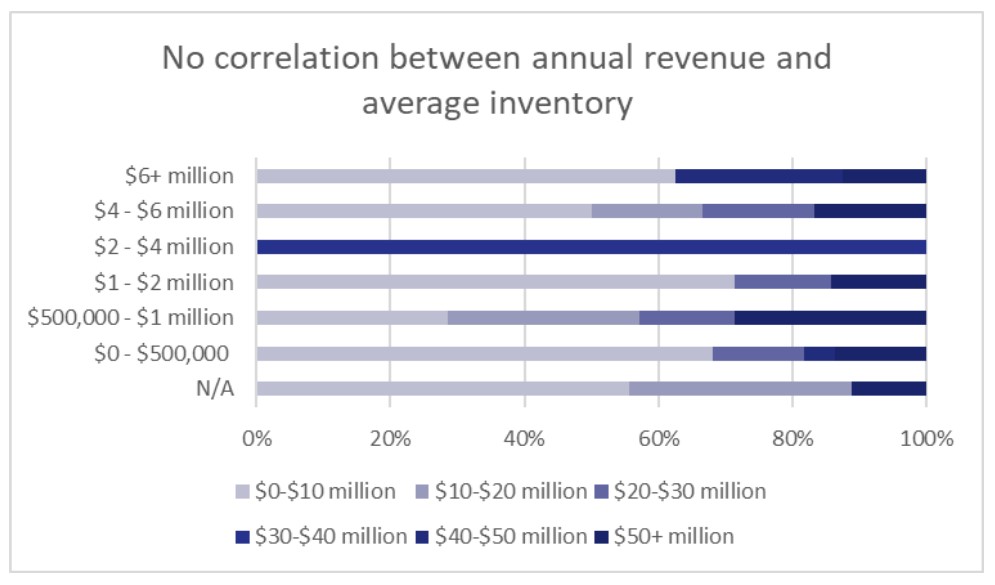

SME propensity to pay for trade finance services based on inventory levels

In general, interest in the new entrant increased alongside the level of inventory that a firm holds.

Firms that do not hold any inventory showed the lowest interest overall, whereas all firms that hold more than $2 million in inventory said they would generally be interested in the new entrant.

This seems to indicate that the more inventory a company holds, the more they are interested in the means of acquiring financing for that inventory.

Firms that hold over $4 million in inventory on average lost significant interest in the new entrant’s services when offered at the 4%-8% price point, despite being interested in the new entrant in general.

This seems to indicate that, while firms that hold significant amounts of inventory do see the importance of new financing methods, they are not willing to pay higher prices for it.

It is also important to note that there is no correlation among respondents between their annual revenue and their average inventory (R2=0.0074).

This suggests that the aversion to higher prices among firms with larger annual revenues is unique to those with larger annual inventories.

Read the full report

TFG’s full report, Is SME Finance Viable: a Europe outlook, explores several other factors to determine which have the greatest impact on SME interest in new trade finance services.

The report also explores business type, operating location, use of third-party financing, current number of lenders, current debt utilisation, and current cost of debt financing, in addition to factors discussed in this article.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.