Listen to this podcast on Spotify, Apple Podcasts, Podbean, Podtail, ListenNotes, TuneIn, PodChaser

Season 1, Episode 41

Host: Deepesh Patel (DP), Editor, Trade Finance Global

Featuring:

Tanya Epshteyn (TE), Head of Structured Finance, Czarnikow

Stephen Geldart (SG), Head of Analysis, Czarnikow

The ongoing impact of the global Covid-19 pandemic has severely impacted many businesses. Alongside the downfall of the oil industry and many others, we discuss the impact on a common commodity in everyone’s household – sugar.

TFG is very delighted to hear from Tanya and Stephen of Czarnikow discussing in detail the impact of Covid-19 on sugar supply chains. Czarnikow buys, sells, and moves sugar, food ingredients, packaging, and ethanol around the world.

Deepesh Patel (DP): Thank you for joining us, here on Trade Finance Talks. So to begin with, a quick overview, who are you, where are you from, and what do you do at Czarnikow?

Tanya Epshteyn (TE): My name is Tanya Epshteyn, I joined Czarnikow right at the start of this year and it’s fair to say that I am very excited to be on this side of the barricade in the current environment. I have been working with Czarnikow since 2009 when I joined Bank Leumi where Czarnikow was already a client for well over a decade.

In fact, until Jan this year my career has been dedicated entirely to banking, and so I’d like to think I am reasonably familiar with how the infrastructure of a commodity finance bank operates.

Although I am no longer part of that world, I have sympathy for what my former colleagues in the sector are currently going through.

Either way, be it banks or corporates, we are in this together and when it comes to weathering the storm, if we chose our partners with diligence and care before it started, it is likely such partnerships will see us all through the worst of it and back to the good weather.

TFG are proud media partners of TXF Commodities Virtual 2020, a two-part virtual and physical event in May and November 2020, where we will be joined by experts from across the commodity finance sector, which is currently facing unprecedented challenges.

Stephen Geldart (SG): Hello, I’m Stephen Geldart and I’m the head of analysis at Czarnikow. I joined the company 12 years ago as an analyst having previously worked for a few years in the oil industry. Today I’m responsible for a team of 15 analysts around the world who make sure we understand the markets we operate in as well as we can and to try to identify opportunities to help our customers. We make all of our analysis available on our app Czapp, which is online at Czapp.com and also mobile through Google Play and Apple app store.

Sugar and Ethanol – Market Overview and Importance

DP: Could you tell us a little more about Czarnikow? What’s the importance of both sugar and ethanol, can you give us a market overview, and who are the biggest producers and buyers?

Tanya Epshteyn (TE): As a global supply chain service, Czarnikow buys, sells and moves sugar, food ingredients, packaging, and ethanol around the world. Czarnikow has been operating for over 150 years and was founded by a rather eccentric character called Julius Ceasar Czarnikow, who was born in Germany to Polish parents in 1838. His work and legacy led to the expansion of the business all over the world and has meant that for many years Czarnikow was best known as a player in the sugar industry.

Czarnikow buys, sells, and moves both raw (unrefined) and white (refined) sugar around the world, but in recent years we have also extended our product portfolio to include food ingredients and packaging.

Last year, Czarnikow bought, moved, and sold 4.3m mt of raw sugar, nearly 1.3m mt of refined sugar, and 39,000mt of ingredients. This year, we have incorporated a new JV in Brazil which will be dedicated entirely to trading ethanol. So in many respects, although we are an old business, we are working with the same entrepreneurial spirit that our founder introduced in the late 19th Century. For example our app, Czapp, is like an online and interactive version of the sugar newspapers that Ceasar Czarnikow himself used to distribute amongst industry players, at a time when transparency in trading was unheard of.

SG: I hope everyone is familiar with sugar. Virtually everyone in the world eats it and it’s one of life’s little inexpensive luxuries; it tastes good. In fact, as a food ingredient sugar has a lot going for it. Obviously most people like sweet flavours, and this also applies to savoury foods, where a hint of sweetness can balance other flavours. Try making a tomato sauce with and without a pinch of sugar if you don’t believe me. Sugar also attracts and retains moisture in food. This means it can act as a preservative because it draws moisture out of bacteria. This is why people used to preserve fruits by turning them into jam. This moisture retention also gives foods pleasant texture. It makes your ice cream creamy for example. Sugar also caramelises, which helps make cereals and biscuits crisp and gives baked goods a rich brown colour. Finally, it provides bulk. A cake without sugar is rather sad and flat.

I hope I’ve not made your listeners too hungry. If you’re working from home, please step away from your biscuit tin.

The other thing to note about sugar is you get all these benefits for a very low price. Sugar is cheap. Think about the times when you were still allowed to go to a Starbucks to get a coffee, this time last year. Starbucks charged you a lot of money for the coffee but gave you all the sugar you wanted for free.

Sugar is grown from two different plants – cane and beet. Cane is tropical whereas beet is temperate. Cane dominates. Most of the world’s biggest sugar producers and exporters make sugar from cane. When looking at the major producers we are thinking about Brazil, India, and Thailand. Europe and the USA make a lot of sugar from beet but most of this is consumed near where it’s made. Sugar also comes in different grades. Pure sucrose is a white crystalline substance. Virtually all sugar in the world has some form of impurity. Sparkling white refined sugar has very little impurities. The expensive organic dark brown sugar my wife likes to buy for baking actually has quite a lot of impurity. That’s where the depth of flavour comes from, or so she says. Refined sugar and many other special brown sugars are food grade products that need to be transported in proper conditions. However, you can also make raw sugar from cane, which is an industrial product which is loaded directly into a rail car, truck, or ship’s hold and transported to a sugar refinery for further processing. Czarnikow helps the supply chains for both raw sugar and white sugar. The big buyers are exactly who you’d expect. Everyone eats sugar. The world’s largest food and beverage companies use a lot of it.

In some countries, sucrose is also converted to ethanol for use as a road fuel. This happens notably in Brazil. The cane industry there is one of the more interesting ones in the world because mills can choose whether to make ethanol or sugar depending on the amount of money they will earn from each. India, Thailand, and China are trying to roll out ethanol programmes, or at least, they were before coronavirus hit road fuel demand around the world. American ethanol comes from corn, not sugar. As well as being a biofuel and so renewable and low carbon, ethanol helps oxygenate gasoline and so helps make engines more efficient.

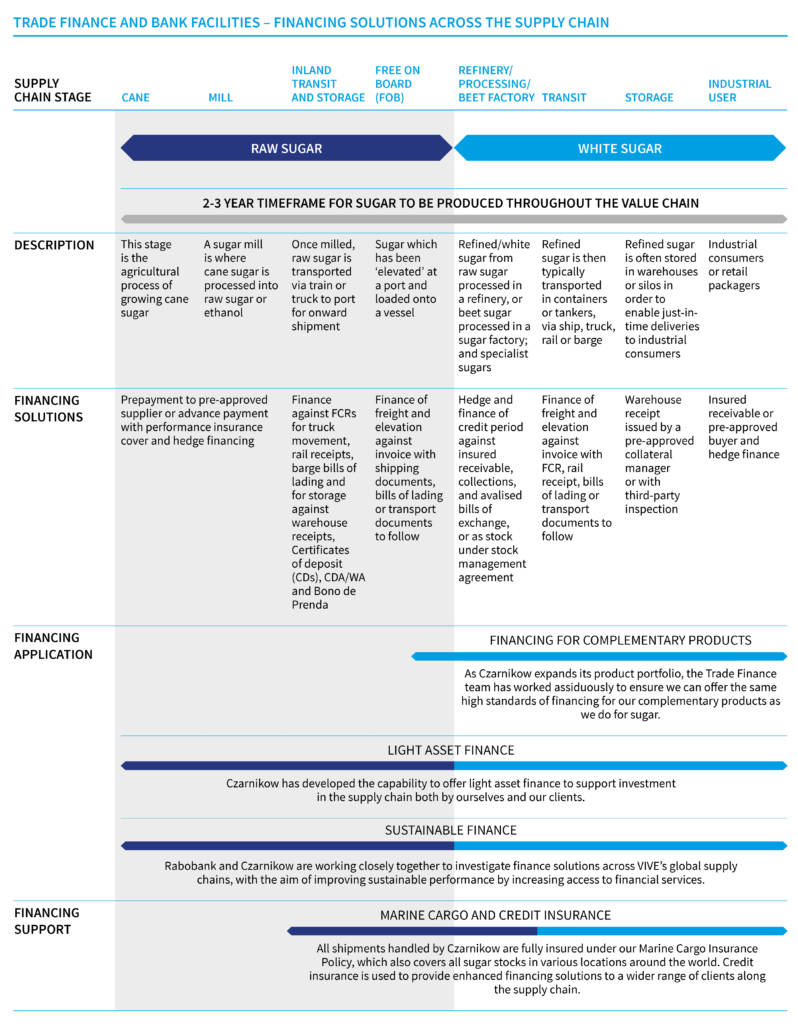

Trade Finance vs Structured Trade Finance

DP: Now, of course, the financing of sugar and ethanol is key, i.e., pricing risk, physically trading commodities, and financing the complex supply chain. For commodity traders and the commodity finance industry, a lot of this is done through trade finance. Can you explain the difference between the two main types of pre-payment finance; trade finance and structured trade finance?

TE: The two are extremely similar and there is a massive overlap, especially since globalisation has practically erased borders in international trade and travel. However, there remains a subtle difference.

Traditionally, trade finance managed all aspects of the relationship between producers, sellers, and buyers, assisting them all with bridging the trade cycle funding gap. For the sake of explaining it in a simple way, an exporter requires an importer to pay for goods delivered. To protect their cashflow, the importer would ask the exporter to show documents which demonstrate that the goods have been shipped, provided by 3rd party, for example, a shipper.

In turn, the exporter’s bank will assist by issuing a letter of credit to the importer, therefore providing assurance of payment upon presentation of documents. This basic principle provides a standard transactional documentation chain which then serves as the basis for a lender to make a loan to the exporter backed up by export contract.

For a bank, this serves as a base for a self-liquidating transaction where the movement of goods is evidenced by standard documents. This then obviously gives a role to play for forwarders, shippers, warehouse operators, independent inspectors, agents, etc. The role of trade finance specialists, be it at a bank or trading company, is to connect all these parties, like a conductor of the orchestra would manage timely contribution from the different instruments to produce a perfect sound. Trade finance professionals will make sure that every party on the chain steps in at the right time, ensuring that cashflow moves in unison with the documentation chain, which in turn correlates with the movement of goods.

Structured finance – A Look Further up the Risk Curve

It would normally entail a structure which enables a producer to get financing before material is produced, and carries performance risk which cannot be covered by the classic documentation chain evidencing the movement of goods, quite simply because the goods do not yet exist. Another example of that would be a stock carry in a commodity which cannot be hedged. Stakeholders in a such transaction would look at other types of security, be it alternative collateral, price, and risk management strategy, locations swaps, etc.

In simple terms, structured finance products would look to offer design to create cash flow which can be made available ahead of production, with the intention of repaying the loan once exports begin, whereby performance or price risk are protected by an alternative asset class, made available from a pool of collateral which is not directly linked to the commodity contracted for in the export contract. Structured commodity finance is there to design tailor-made financial products which help manage supply, demand, or price shocks, in multiple jurisdictions.

However, as I said before, overlap is big, and close collaboration between TF and structured finance is absolutely paramount to offering a farm to fork service to clients.

Covid-19’s Impact on Sugar Supply Chain: Macro-economic Perspective

DP: Let’s start with a macro-economic perspective – what’s the impact of halted supply chains, the closing down of the hospitality/entertainment sector, and economic shock on sugar supply chains?

SG: Corona and social distancing. In many countries, the majority of sugar consumption was out of home and is now lost. In-home has of course increased, but can’t make up the gap. Think for example about going to the cinema. In England the regular drink size you used to be able to buy, regular (!), was more nearly two-thirds of a litre. A large drink was more than a litre. Drinking that volume of soda at a movie or sports event or concert was normal behaviour in the old days. But imagine doing this at home. Imagine if my wife and I decided to watch something on Netflix tonight and I walked into the room with a litre of soda and a bowl of ice cream. She’d think I’d gone mad. If we look in a bit more detail, there are winners and losers. Soft drink consumption has fallen sharply this year, because bars, restaurants, cinemas, and theatres are shut and sporting events and festivals aren’t being held. But confectionary and biscuit consumption is up. Sugar is a little luxury and we all need some help right now with the stress of the pandemic. The in-home/out-of-home consumption divide is also rather a first world problem. But in other parts of the world, the problem can be far more profound. India went into lockdown at the end of March. Millions of people there are employed as casual labourers for daily cash payments. These people now cannot work and so cannot afford to buy sugar at all. This is why we think sugar consumption has fallen in 2020.

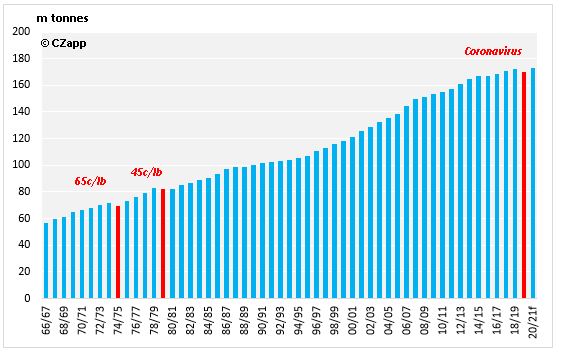

This is incredibly rare. For all the bad press it gets, sugar consumption generally doesn’t fall each year, not on a global level. The last time global sugar consumption fell in a year was in 1980, when raw sugar prices were incredibly expensive and hit 45c/lb. Today they’re close to 10c/lb, which is rather cheap. So we’re into unchartered territory with coronavirus.

Sugar Consumption Over Time

I should point out that these problems aren’t unique to sugar. The global dairy industry has had to respond to changes in consumption following the pandemic. In the UK, more than 50% of fresh milk used to be sold to the catering industry – for coffee shops, restaurants, and canteens. But now we’ve found that the daily cappuccino on the commute actually isn’t as essential as we thought it was and so farmers are struggling to shift fresh milk. My in-laws are dairy farmers and so I must urge every listener to help out by eating as much cheese as they possibly can during the pandemic!

Despite all of these challenges, sugar supply chains have been very robust. It’s been remarkable. The sugar supply chain is fully globalised. Cane is grown in the interior of Brazil, it’s made into raw sugar and driven 1,000 kilometers to the port and then loaded onto a bulk ship. This ship sails to a refinery in the Middle East – Dubai or Saudi Arabia, for example – where it is processed into high-quality refined sugar. It’s then bagged and loaded into a container which is moved by ship to East Africa where the sugar is used at a bottling plant or biscuit factory, before being ultimately consumed in Kenya or Uganda. It’s a remarkable process. Despite our initial worries, every link in the chain has operated well and we’ve not heard of any major stockouts anywhere in the world. Ports are operating close to normal with some quarantine measures in place, factories are operating with social distancing. If anything, it’s the supply chain to the final retail consumer which is the hardest. As a commodity industry, I think this is something we can all be proud of. During the biggest challenge in a generation the world’s food supplies have so far continued to flow close to normally. Finally, if you’re interested in monitoring all of these developments live as they happen, we are updating the situation daily on Czapp. We have a map of current port disruptions and when we see problems emerging we write about them to tell you exactly what they mean on the ground and how they might be resolved.

Covid-19’s Impact on Sugar Supply Chain – Financing Perspective

DP: We’ve seen commodity markets go into oblivion in recent weeks following the outbreak of the COVID-19 pandemic. From rock bottom (and even negative) oil prices to a shift in ownership of commodities, and also a material change in lender and insurer appetite, what have you seen from your perspective? Starting with lenders, i.e., banks, FIs and funds, what’s been the impact so far?

TE: On this point, could I once again direct you to the Opinions section on our site, where in March and April this year we have posted two articles on this exact subject.

Without giving you too many spoilers, what we saw when the Coronavirus first struck in January this year, was a gradual but determined reduction in risk appetite from across the sector.

It is very interesting how these things often correlate. Taking example of the quarantine today, peoples’ incomes have dropped however prices for groceries have increased. Latest government advice in the UK is not to take public transport unless absolutely necessary however the congestion charge in London has just been increased to aid the loss of income in TfL.

Business Liquidity

International borders having to shut down and people forced to disburse lead to the severe disruption to transportation channels and the physical movement of goods, escalating counterparty risk.

At present, the environment for lenders is unprecedented, with businesses drawing on every available USD, Euro or any other currency permitted by pre-pandemic agreed loan terms. Rather like those who we’ve seen rush to the supermarket to buy far more pasta than they normally would.

Conversely, the disrupted transport infrastructure is showing signs of a clogged up storage system, generating unprecedented demand for financing stocks at origin. If we look at Brazil again, we can see this happening in real-time.

This current preference for sugar comes at a time of bumper exports for soya and corn, meaning that supply chain infrastructure will be put under pressure. We expect that demand for vessel loading at the port of Santos will exceed maximum capacity from July to October this year, meaning goods will therefore need to be in storage longer and thus require financing: a situation that is normally perfect for banks. Not so much right now, as due diligence visits are impossible and price risk is very pronounced. An alternative is to leave the crop in the field longer and process more slowly.

In light of overflowing stocks and governments’ stimulus, anyone operating within the commodities space is currently puzzled by just how little interest, or indeed base rate reductions, has filtered down to the borrower.

The answer is simple. Banks assess lending risk on the basis of three principal questions – am I going to get my money back, how, and when?

In basic terms, the entire investment banking infrastructure is centred around a repayment schedule driven by the timely movement of goods. However, when shipments are delayed or postponed due to port closures, this has a knock-on effect on the repayment schedule.

Delayed shipments, coupled with massive drop in the price of oil, means that banks’ credit infrastructure is inundated with the tsunami of waivers, and is forced to prioritise existing business over anything new, like the NHS trying to first take care of the sick while the healthy are asked to stay at home. The entire finance community is currently working on making sure existing borrowers continue to have access to funding and are not subject to a default.

However, we are seeing some examples of banks adapting their funding terms to specifically address the pandemic, such as pivoting their activity towards short-term solutions and support, prioritising emergency funding for medical equipment and food.

This is also true for insurance companies, and we will touch on this later.

It is important to remember that banks and insurance companies are all remunerated on the basis of the absolute value of the trades, not physical volume. Given the falling price of most commodities coupled with low interest rates, incomes will fall while risks will be perceived as having increased.

Consequently, there has been talk of repricing however this exercise alone is not the driver in better managing risk. What it really means is that banks will strengthen their origination and credit teams, who will be more discriminating in the type of deals they work on. These are likely to be bigger in value and have potential for scalability. Such deals are work-intensive, requiring larger teams and therefore more expensive to implement.

The sector looks worse than it is.

It is easy to forget that we have all been through the crisis before. Banks, much like insurance companies, will learn their lessons and come out the other side. But this will take time.

Time creates an opportunity for alternative lenders to step up, as they are able to act with more flexibility than banks, and may be able to fund collateral that sits outside of the Basel-imposed collateral valuation rules. I am talking about the funds community of course but they have their own fires to fight in the short-mid-term.

Firstly, funds are not too dissimilar to banks in terms of their assessment of risk, except their stakeholders are faster to react. On a positive note, one would expect that a term view would be less sensitive to immediate market volatility, as uncertainty would be expected to settle over longer periods of time. However, post declaration of the global pandemic and in the absence of any visibility in the medium term, an opportunity for a private investor to exit is attractive. Private and institutional investors want to better understand risk already on the books. Quite simply, the physical location of goods within the supply chain and who holds the title. This means due diligence visits, but the borders are closed.. so it’s a catch 22 scenario.

All in all, it is clear that the normal finance community infrastructure is under stress. Return on capital becomes less important versus getting your money back.

Insurer’s Perspective

DP: And now moving into an insurer perspective. Given that the risks and exposures are the same, and the expectation that defaults will increase, what have you seen?

TE: Insurance companies follow the banks’ strategy and risk appetite very closely, albeit a step removed from the front line. It is important for them to trust the controls of their insured, make sure that all the necessary tools remain in place, and that the cash cycle continues to be transparent. Insurance companies, like banks or indeed trading companies, choose their partners with diligence and care, and when the infrastructure is stress tested and proves robust, relationships continue. At a time like this, information sharing and transparency is key and the more your partners know about your business, the more open they will remain to doing business with you. Business partners and colleagues from my banking days know that I always liked to compare bank – client relationship to a barter exchange – provided there is the right flow of reliable, verifiable information, liquidity will be made available. Insurance is just the same.

PODCAST: KYP (Know Your Policy) – Learnings from CPRI in a post-Covid world (S1 E40)

Risk Management – Room for Change?

DP: Moving forwards as we move towards reopening economies, trade flows and supply chains, as people go back to work in phases, how are traders approaching risk management and new market opportunities?

TE: To be honest, I think it is fair to say that our risk management practices have not really changed following the pandemic. Our IT capabilities have been significantly enhanced to embrace the new culture of working remotely but in terms of risk practices, Czarnikow is a conservative company which operates in accordance with long-established risk management principles which stood the test of time and numerous stress testing scenarios.

But this is not the same for business of course. It is no secret that with port closures around the world and record sugar crop in Brazil, it is likely that stock carry opportunities will be plentiful, and not only at origin. The one lesson that this pandemic has taught the producers is that diversification of supply channels and stocks of all ingredients, not just raw material, is key to the continuous production of food. Therefore, the just in time delivery stock operations at destination are also an area of focus for us this year, as well as diversification of our product offering to enlarge our newly formed ingredients line.

The basis of our business model is risk management and cost control, and this is particularly important given the geographies where we operate. A few years back I read “The King of Oil” about Marc Rich, written by Daniel Amann, and came across the definition of the “resource curse” or the “paradox of plenty”. I was speaking about the demographic of the sugar industry earlier… only 20% of sugar in the world is produced in OECD countries. The balance comes from emerging economies, and this is why we have physical presence in Brazil, China, Miami, Thailand, etc.. we control the risk by putting our own people on the ground, Czarnikow local employees and expats, who can go and see the operation first-hand, understand the points of tension, and manage the risk.

Czarnikow: Blockchain-Ready

DP: Do you think that new technologies – DLT / blockchain, IoT, automation and ML can unlock new opportunities for driving efficiencies, making KYC and doc checking easier and also automating areas of structured trade finance and commodity supply chains?

TE: We are developing our systems to be Blockchain ready. We have an event-driven system which records the flow of a good from producer to consumer. Independent verification of each event can be useful but is not always essential. We have learnt, through our Vive Sustainability program, about the importance of traceability. If we take the container market as an example, IT could potentially give us the exact GPS location of an individual container at any time. However, this is of no interest to the seller as once delivered to port their interest wanes. Equally, the end buyer just wants to know that the goods will be arriving in the agreed timeframe. We have spent a lot of time training our teams to be product owners when it comes to IT development. We have completely developed our own ERP system over the last 5 years and have found it essential that the business communicates the needs to the IT development team rather than developers trying to guess what the business needs. We have automated our KYC process and are investing heavily in our Trade Finance software.

Further, when I think about blockchain technology and the many attempts at its variations, I think of its main objectives. To my mind these are ultimately increased transparency, traceability, and sustainability of the entire production infrastructure.

Having joined Czarnikow, blockchain in my mind now resonates with VIVE, our sustainability programme which was created in 2015 and is jointly owned by Czarnikow and Intellync. Its objective is to benchmark performance of its participants against global sustainability standards and is centered around four universal improvement objectives – governance, people, environment, and traceability.

Following recent upgrades, VIVE can now cope with the current concerns such as Coronavirus pandemic, placing emphasis on workers’ health and disease prevention, etc.

Now launched! Summer Edition 2020

Trade Finance Global’s latest edition of Trade Finance Talks is now out!

This summer 2020 edition, entitled ‘Coronavirus & The Fourth Industrial Revolution’, is available for free online, covering the latest in trade, export credit insurance, receivables and supply chain, with special features on fintech and digitisation.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.