90% of world trade – from bulk raw commodities to breakbulk and finished goods – is moved on approximately 60,000 trading ships, crewed by about 1.5 million seafarers. To most traders, the potential risks associated with any one of these vessels is an unknown.

How can you ensure that the ships you’re evaluating for supply chain activity are at an acceptable standard? How can you mitigate the potential risks associated with ocean-bound vessels?

Overview of risks in shipping

At a macro level, shipping is at an inflection point where circumstances are elevating the potential risks for traders.

One such risk is the increasing average age of the global fleet. This trend is driven by a number of factors, including hesitancy to order new vessels while new technologies are being developed.

Additionally, an increase in vessel value is associated with prolonged operational lifetimes. Volatile market conditions can also impact the maintenance regimes of ships, reducing the quality and reliability of assets as vessels can be traded harder in bullish markets and maintained more conservatively in bearish markets.

In addition to these factors, COVID-19 changed the reality of shipping. During 2020 and 2021, seafarers kept global trade moving. They were not, however, properly recognised as key workers and “no crew change” clauses combined with local port and global travel restrictions restricted the ability to repatriate crew.

This resulted in many seafarers serving well in excess of 12 months on board vessels without relief. Travel restrictions during the pandemic also limited the ability of shore staff and third-party organisations to undertake routine inspections of vessels.

A number of shipowners found the cost of maintaining their vessels was too great, so they opted to abandon them and their crews without any further consideration.

As such, 2022 saw the highest number of seafarer abandonment cases ever recorded.

These issues have been further compounded by the ongoing Russia-Ukraine war, and many experienced seafarers are leaving the industry as a result. This increases the workload on remaining crews, giving rise to a greater risk of incidents, and threatening the continuity of the industry.

This is at a time when the industry needs an influx of talent to meet industry demand, manage risks from new fuels and technologies, and maintain pace with a rapidly changing world.

Recent trends and inherent risks

This picture of heightened risk is reflected in the data from incidents and port state control deficiencies and detentions which show an observable increase.

In 2022, 4,604 incidents were registered by RightShip, with dry bulk vessels, cargo vessels, and chemical tankers having the highest incident numbers.

Incidents by vessel type

Incidents occurred on young and old vessels, with 46 incidents in the past two years occurring on vessels only one-year-old. Of these 46, 25% of the incidents were RightShip Category B, the second-most severe kind of incident (includes injury, significant vessel damage, severe structural damage, explosion, fire, flooding, etc.).

Tragically within these 4,604 incidents, 193 lives were lost, 113 crew members reported missing, and 86 seafarers suffered serious injuries.

Impact of incidents on traders and trade: the micro view

Time is a critical factor for most traders, which means important decisions on vessels can be made with very limited information at hand.

Ships can often be chosen based on their compliance with minimum requirements such as being registered under a flag state, classified by a classification society, and adequately insured. Some operators might also prefer newer ships.

However, these criteria only provide a very narrow perspective of a ship’s associated risks.

Poor quality tonnage, poor operational quality and a history of incidents can generate a broad range of potential risks and impacts for traders which can result in significant consequential damage.

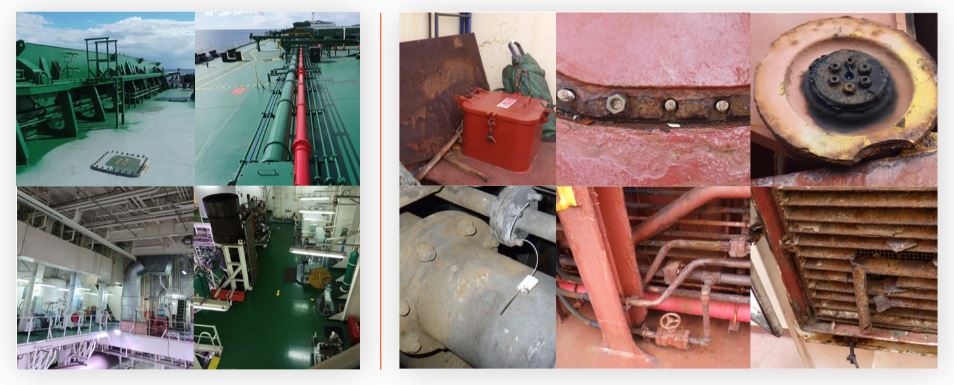

In the example below, we have two vessels. Both vessels are of a similar age, and both are flagged, classed, and insured. Yet the gap in quality between the two vessels – and therefore the difference in potential risk – is vast.

The range of conditions and risks that can impact a vessel is broad: from simple reduced maintenance, which can limit the performance capability of vessels; to unplanned machinery breakdown and stoppages, which can cause significant supply chain disruption; to even more serious incidents such as groundings, fires, explosions, and other significant events, which can result in serious environmental impact or loss of life.

The resulting potential impacts on a trader range from inconvenient to severe: from delays, performance claims, and missed deadlines, to breach of contractual sale and purchase provisions, damage to or loss of cargo, loss of a vessel, significant pecuniary costs, and reputational impact.

There is also an additional ESG dimension that can impact a trader’s potential risk scenario, with GHG emissions and extensive social risks involving seafarers coming into play, which are becoming increasingly common with the introduction of new supply chain social due diligence legislation.

The frequency of these incidents can surprise those not well-versed in maritime risk: RightShip data shows that 10.4% of vessels face some sort of detention at ports and terminals, where the average duration of detention is 5.4 days.

These detentions can be the result of hull and machinery damage (which accounts for nearly 18% of all incidents recorded by RightShip) and disruption or operational incidents have the potential to cause significant impact on the broader supply chain – as we saw in an extreme example with the Ever Given in the Suez Canal.

Increasing assurance through vessel trade check and vetting

RightShip’s vision is a zero-harm maritime industry. Over 22 years, we have helped charterers and traders gain greater assurance of the vessels used in their supply chain activities through, inter alia, due diligence processes that go beyond basic compliance with statutory and regulatory requirements.

The RightShip Vessel Trade Check is a digital solution used by traders, trade finance institutions, and insurers, to gain an instant evaluation of a vessel against a suite of customisable due diligence criteria that exceed basic statutory and regulatory requirements.

Criteria used in Vessel Trade Check include:

- checks on recent incidents and incident performance,

- port state control detention and deficiency activity and status,

- sanctions breaches,

- ILO or ITF open abandonment cases,

- other critical factors.

This provides traders with a greater level of assurance of a vessel – in a timeframe that caters to a trading environment.

If Trade Check highlights a potential risk with a vessel, traders can perform more thorough due diligence with RightShip’s full vetting process. This extensive process is managed by RightShip’s global vetting and operations teams and includes additional criteria such as evaluation of Class Survey Status reports, and incidents reports for suitable preventative measures for all recent incidents or events.

RightShip’s data shows that the detention ratio drops to 8.5% for vessels which have been vetted by RightShip’s Operations team, against those which have not been vetted (11.3% detention ratio).

The due diligence process also evaluates potential ESG risks, including environmental risks and the extensive social risks that can be part of shipping (such as crew welfare and seafarer abandonment).

Even aside from moral reasons, such risks can impact traders because of a higher potential for incidents, as industry data shows a strong connection between crew welfare and incident likelihood.

Third-party due diligence should be considered an essential part of a trader’s process. For our part, as an ESG-focussed digital maritime platform, RightShip provides flexible and continuous support for traders based on qualitative data-driven insights. Understanding and reducing the risks associated with vessels benefits not just the trader, but all involved in the transportation of ocean-bound cargo.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.