A new report by Euler Hermes has found that the UK economy is “trapped by policy choices” going into the end of 2021 and beginning of 2022.

In its report of the same name, released yesterday, Euler Hermes said the Bank of England (BoE) is “caught between a rock and a hard place” as the UK faces both elevated inflation and upcoming fiscal consolidation.

But with inflation likely to last until Q4 2022, Ana Boata, head of economic research at Euler Hermes and co-author of the report, also warned that failure to take action by the BoE could lead to even greater inflation.

Going into the BoE’s monetary policy meeting tomorrow, Euler Hermes – the trade credit insurance arm of Allianz – said it expects the BoE to significantly cut growth forecasts as the UK’s economic slowdown intensifies.

The slowdown is believed to be the result of supply chain disruptions driven by “global trends” – such as inflation and the COVID-19 pandemic – and exacerbated by Brexit.

With that being so, Euler Hermes expects the UK economy to grow by 0.6% q/q in Q4 2021, and by 1% q/q on average in 2022.

Podcast: The freight crisis – HGV driver shortage, shipping blockages and the digital future of freight

Rates hikes incoming?

The upside to these numbers is that they should buy more time before the BoE’s next rate hike – its first rate since August 2018 – which Euler Hermes expects to take place in early 2022.

The report also notes, however, that hawkish statements from BoE Governor Andrew Bailey have triggered an immediate market repositioning, with participants now anticipating a much earlier start of the hiking cycle.

Embarking on an earlier monetary policy tightening cycle could be premature, Euler Hermes believes, and could raise the risks of a ‘technical’ recession, especially as the UK will be the first major economy to start fiscal consolidation in 2022.

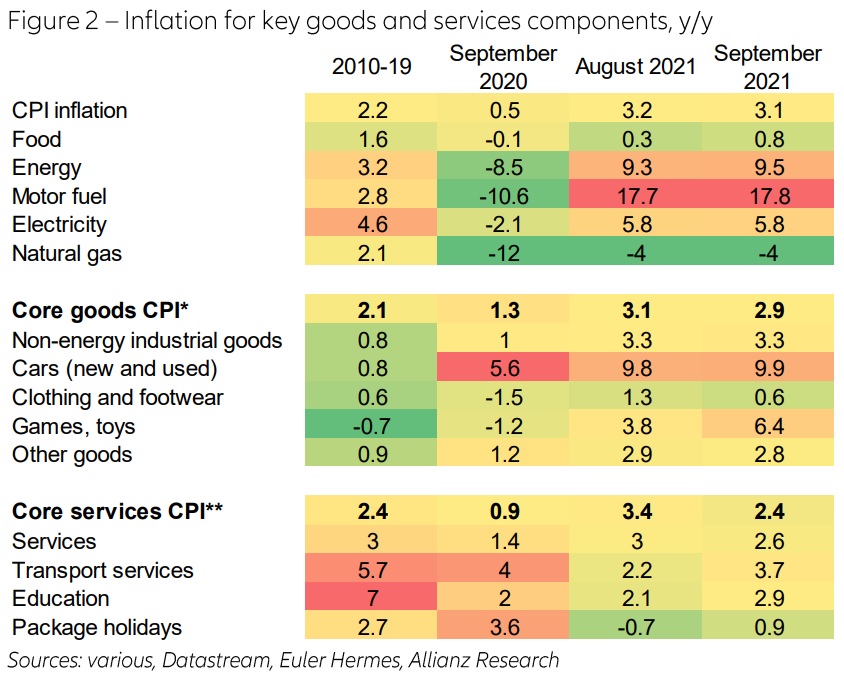

The UK’s labour market is far from full employment, and the report notes that two thirds of the ongoing surge in inflation is driven by temporary factors such as COVID-19 and rises in taxes, wages, and energy prices.

Euler Hermes therefore predicts that inflation should reach 2.4% y/y in Q4 2021, down from a peak of above 4% in Q4 2021 and H1 2022.

Tax and import effects

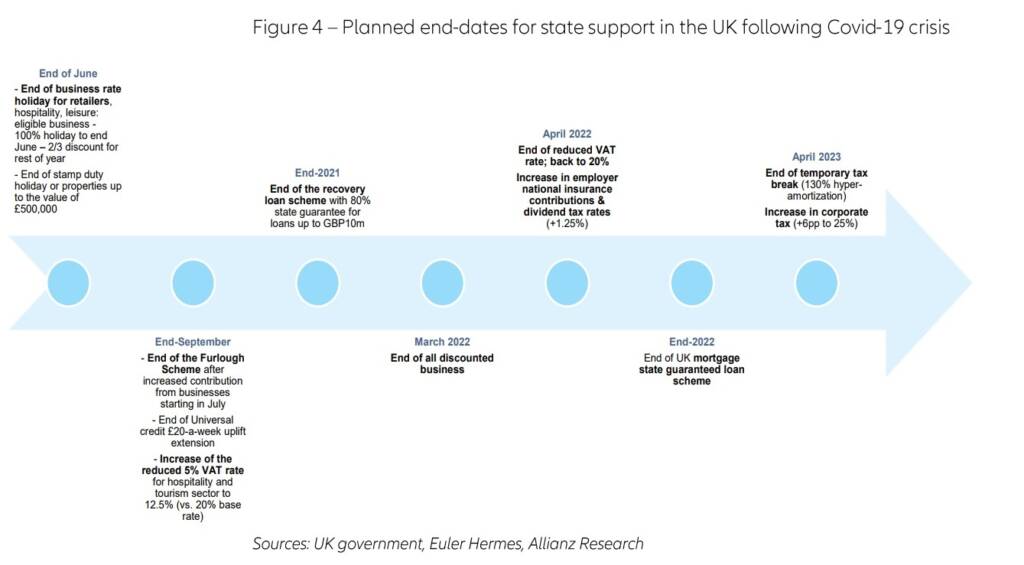

While other G7 countries continue to implement significant amounts of fiscal stimulus, 2022 will bring about the freeze of personal tax allowances and thresholds for households in the UK, the report noted.

Worse still, this will be followed by an increase in the headline tax rate from 19% to 25% in 2023 for corporates with profits of £250,000 or greater (around 10% of firms), bringing the headline corporate tax rate slightly above the advanced economy average.

According to the report, this means that the tax rises announced in the 2021 Budget will increase the tax burden from 34% to 35% of GDP in 2025-26 – its highest level since the late 1960s.

If the BoE decides to remain “in wait-and-see mode”, Euler Hermes believes that sterling could depreciate by as much as 8%, triggering a self-fulfilling feedback loop of runaway inflation.

According to the European Central Bank (ECB), the FX pass-through to import prices in the UK is one of the highest, given the country’s dependence on foreign inputs.

Around 55% of UK import prices are estimated to reflect changes in FX, compared to 10% in Germany and 5% in France.

The UK’s import share is highest for manufacturing goods, including food, clothing, and transport.

Overall, 29% of UK consumer expenditure is dependent on imports, and research quoted by Euler Hermes shows that, between June 2016 and June 2018, the impact of a 10% depreciation in sterling boosted inflation by 2.9 percentage points.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.