Ireland Invoice Finance

Welcome to TFG’s Ireland invoice and receivables finance hub. Find out how our team can help your Ireland-based company unlock working capital from domestic and international invoices, on both a recourse and non-recourse basis. Alternatively, learn more about the different types of invoice finance: discounting and factoring, through our latest research, information and insights, right here, in our receivables finance hub.

What is invoice finance?

Invoice finance is a common form of business finance where funds are advanced against unpaid invoices prior to customer payment. Invoice finance houses include banks, alternative investment providers and private lenders, used by businesses who trade both domestically and globally. There are two types of invoice financing methods; discounting and factoring.

How can invoice finance benefit my business?

- The invoice financier will sometimes take on the responsibility to look after your sales ledger which means the business owner can have more time to focus on the business

- An invoice financier will conduct due diligence (including credit checks) on customers, which reduces the risk of not receiving funding

- Invoice discounting can be done on a confidential arrangement, which means that your customers will not know that you’re using a finance house; this can help protect your reputation

- Invoice finance allows you to maintain a good relationship with your customers, as you can fulfill larger orders on time without worrying about cash flow and working capital problems

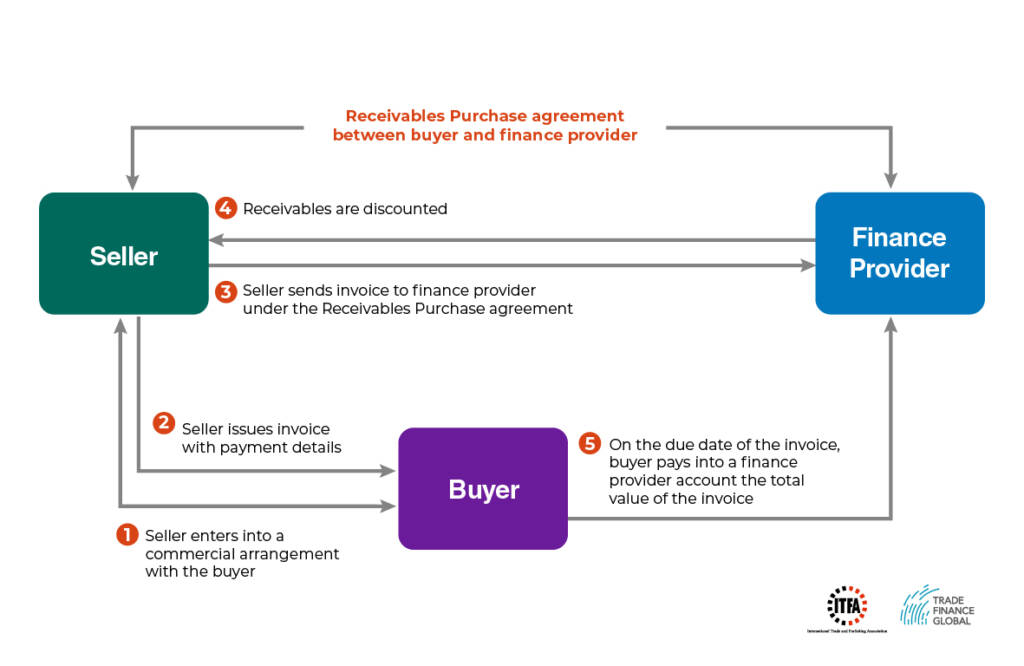

Diagram: How invoice finance (receivables purchase) works

How can we help?

The TFG’s Ireland invoice and receivables finance team work with the key decision-makers at 270+ banks, funds and alternative lenders globally, assisting companies in accessing factoring and discounting facilities.

Our team are here to help you scale up to take advantage of both domestic and international opportunities. We have product specialists, from commodities to finished goods.

Often the financing solution that is required can be complicated, and our job is to help you find the appropriate invoice finance solutions for your business.

Read more about Trade Finance Global and our Ireland team.

Get started – talk to our Ireland team

If you have an invoice finance or receivables enquiry, please use the contact form below.

Finance Queries:

ie.team@tradefinanceglobal.com

trade.team@tradefinanceglobal.com

Partnership Queries:

introducers@tradefinanceglobal.com

Find out more about partnering with us here.

Want to learn more about Invoice Finance?

You’ve come to the right place. Here you can find our latest Ireland features, receivables research and trending articles in the world of invoice finance. Sit back, and catch up with the latest thought leadership and interviews from the region, listen to podcasts and digest the top stories in invoice and receivables finance right below.

From the Editor - Invoice Finance Insights

Factoring and supply chain finance in the shadow of the Areni-1 cave: EBRD’s insights from Yerevan – The EBRD TFP conference gathered industry leaders to discuss evolution of factoring and supply chain finance in emerging markets.

Factoring and supply chain finance in the shadow of the Areni-1 cave: EBRD’s insights from Yerevan – The EBRD TFP conference gathered industry leaders to discuss evolution of factoring and supply chain finance in emerging markets. PODCAST | FCI’s Neal Harm on kicking off inclusive growth in the factoring industry – To better understand the principles of financial inclusion, equitable regulation, and sustainable growth in the factoring industry, Trade Finance Global’s (TFG) Deepesh Patel spoke with new FCI Secretary General, Neal Harm.

PODCAST | FCI’s Neal Harm on kicking off inclusive growth in the factoring industry – To better understand the principles of financial inclusion, equitable regulation, and sustainable growth in the factoring industry, Trade Finance Global’s (TFG) Deepesh Patel spoke with new FCI Secretary General, Neal Harm.  Bridging the gap: The transformative potential of factoring in Africa – Factoring in Africa allows businesses to sell their accounts receivable at a discount to gain immediate cash flow, is gaining traction across the continent, buoyed by significant growth and the support of institutions like Afreximbank and FCI.

Bridging the gap: The transformative potential of factoring in Africa – Factoring in Africa allows businesses to sell their accounts receivable at a discount to gain immediate cash flow, is gaining traction across the continent, buoyed by significant growth and the support of institutions like Afreximbank and FCI.Latest Ireland Insights

Global Factoring and Receivables Finance Industry increased by 6% in 2018 – In 2018 the world factoring industry volume continued its upward trend with a total reported figure of over 2,767 billion euro representing over 6% growth compared to the previous year.

Global Factoring and Receivables Finance Industry increased by 6% in 2018 – In 2018 the world factoring industry volume continued its upward trend with a total reported figure of over 2,767 billion euro representing over 6% growth compared to the previous year. Videos - Invoice and Receivables Finance

Hub Articles

- Invoice Finance for SMEs

- Comparing Invoice Finance Providers

- Invoice Factoring versus Invoice Discounting

- Recourse or Non-Recourse Factoring?

- Bill Discounting and Factoring

How to use Invoice Financing for your Small Business

Invoice factoring for small businesses is fairly straightforward. As an example, an end customer might not pay the £100,000 invoice issued to them for up to 90 days, but your company needs the funds in 2 weeks, in order to pay for business expenses and salaries.

How to use Invoice Financing for your Small Business

Why should I compare invoice factoring or invoice discounting providers?

There are several bank and non-bank providers of invoice finance, from large instutions to small alternative funders, each offering different propositions and solutions for customers.

What is the difference between invoice factoring and invoice discounting?

Invoice factoring and invoice discounting are both types of asset backed finance aimed to help businesses release cash which are tied in invoices.

What is the difference between recourse factoring and non recourse factoring?

The industry defines the two forms of factoring by risk. Invoice finance is effectively a line of credit obtained on the value of your outstanding sales ledger. Here’s what happens if your debtors fail to pay the invoices after you have financed them.

What is bill discounting and how does it differ from factoring?

Bill discounting, also known as purchase of bills and invoice discounting are all the same type of financial instrument used to provide working capital to small and medium enterprises from invoices raised.

Invoice Finance - Frequently Asked Questions

Invoice finance is a type of receivables finance, which includes factoring and discounting.

Factoring is present when a business assigns their invoices to a third party and the factoring company has full visibility of the sales ledger and will collect the debts when due.

- The customer has knowledge that the invoices have been factored. (This is the typical route a lot of funders offer, however – some can offer Confidential Factoring)

- Factoring gives businesses up to 90% pre-payment against submitted invoices

- This enables improved cashflow, and reduces the need to wait for payment

- The company may receive their funds up to two days after invoices are sent out. Many factoring companies will offer to send money same day (TT Payment, usually carries a charge) or by BACS (Free)

- A business can choose a ‘selective’ factoring or invoice discounting facility, dependent on the funder.

Typically, with Invoice Discounting, the borrower will have more control over their ledger. Again – like factoring, there is the option to do this on a completely confidential basis.

- Invoice discounting is an alternative way of drawing money against the invoices of a business

- The business retains control over the administration of their sales ledger

- Invoice discounting usually involves a company reconciling with their invoice financier monthly

- With factoring – each individual invoice is uploaded – with Invoice Discounting, a bulk figure is uploaded and then drawn down against with the monthly reconciliations showing where money is allotted to

- Under a selective facility a business can opt to factor (i.e. lend) or invoice discount just some of the submitted invoices

- A selective facility is a good option if a business needs a certain amount of cashflow guaranteed each month or if one or two customers are good payers.

The main difference between factoring and invoice discounting is that with factoring, a funder will have full visibility of your sales ledger and maintain this by chasing debts on your behalf. Invoice discounting on the other hand, allows you to keep your credit control in house but as we already discussed, it would require a monthly reconciliation with the invoice financier. Naturally, management fees for invoice discounting are usually a lot lower, however a company must demonstrate they have the correct procedures in place to support an Invoice Discounting facility.

Factoring solutions offer the seller of a receivable a wider service than just the advance of funds to shorten its cash conversion cycle as the entity buying the receivable will also usually take on the responsibility of collecting the debt.

Factoring can take several forms. For example, a factor may agree, subject to limits, to buy the whole of a seller’s receivables. This is known as whole turn-over factoring. Conversely, a factor may select which invoices he wishes to buy. It can be with or without recourse to the seller and may or may not be notified to the buyer or obligor.

The vast majority of factoring is domestic and individual invoices are often of a low value. Cross-border factoring is possible using the two-factor system. One factor is in the buyer’s country (known as the ‘Import Factor’) and the other in the seller’s country (known as the ‘Export Factor’). The two Factors establish a contractual or correspondent relationship to service the buyer and the seller respectively under which the Import Factor in effect, guarantees the receipt of funds from the importer and remits payment to the Export Factor. Typically, the two factors use an established framework such as the General Rules for International Factoring (GRIF), provided by FCI. Read more about factoring here.

Invoice discounting solutions tend to focus on shortening a seller’s cash conversion cycle, as opposed to encompassing debt management and collection aspects. The degree of disclosure to the debtor under this type of facility varies, ranging from full disclosure to no-disclosure, depending on the level of comfort taken by the purchaser of the receivables over the nature and standing of the seller. In most cases, the greater the control the financing entity/purchaser of the receivables manages to attain over the process, the better the discounting conditions offered.

An invoice discounting facility without disclosure to the debtor will grant the seller of the receivables full confidentiality, and therefore avoid reputational hazards. Most invoice discounting is without recourse to the seller so as to ensure de-recognition of the receivables from the seller’s balance sheet (so-called “true sale”) but recourse is normally retained for commercial dispute e.g. where the buyer refuses to pay because the goods or service are defective. Read more about invoice discounting here.

Strategic Partners:

Get in touch with our Ireland Invoice Finance team

Speak to our trade finance team

Quick Links

Ireland Homepage

Importing from Ireland

Exporting to Ireland

Trade Finance – Ireland

Invoice Finance – Ireland

Download our free invoice and receivables finance guide

Latest Ireland feature from Trade Finance Talks

Our Ireland factoring and invoice finance partner

Latest Ireland News

Transparency International highlights need for EU-wide beneficial ownership rules

0 Comments

Marco Polo Network runs insolvent with €5.2m debts

0 Comments

Weigh anchor! UKEF supports new export fishing contract for Middlesborough boat builders

0 Comments

UK Export Finance unlocks trade to Egypt and supports UK jobs with a £1.7bn guarantee

0 Comments

‘Brexited’ – What the new UK-EU agreement means

0 Comments

Euler Hermes: Government extends shield to sustain UK trade

0 Comments

A&O advises the lenders on New Look’s financial restructuring and recapitalization

0 Comments

UK secures vital rollover trade deal with Canada and agrees to start negotiating more advanced deal next year

0 Comments

Is the freeports bidding process too ambitious for ‘all nations’ in the UK?

0 Comments

First exports of UK beef to the USA in 20 years underway

0 Comments

ING advises AIB on their first green bond issuance

0 Comments

Government announces new Board of Trade

0 Comments

Liz Truss brings key industries closer to trade negotiations

0 Comments

Euler Hermes survey – Four in five UK CFOs “unprepared” for Covid-19 sales slump

0 Comments

Government’s post-transition border plan published today (13 July): 10 things traders need to know

0 Comments

UK inward investment projects increase in 2019

0 Comments

Liz Truss launches future trade strategy for UK tech industry

0 Comments

Trade Credit Insurance backed by £10 billion guarantee for business-to-business transactions

0 Comments

Visit our Global Hubs

Australia 🇦🇺

France 🇫🇷

Germany 🇩🇪

Hong Kong 🇭🇰

India 🇮🇳

Japan 🇯🇵

Netherlands 🇳🇱

Singapore 🇸🇬

United Arab Emirates 🇦🇪

United States of America 🇺🇸

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom