Estimated reading time: 6 minutes

This article is co-authored by Deepesh Patel, Editorial Director at Trade Finance Global (TFG) and Lisa Mendes, Copy Editor and writer for Trade Finance Global (TFG)

we.trade, a blockchain-based trade finance network owned by 12 European banks and IBM, told shareholders in May that it had run out of cash.

What does this mean for the future of fintech and blockchain technology?

we.trade, one of the world’s earliest and fastest-growing blockchain-based trade finance platforms, has ceased operating after failing to raise enough capital to fund operations for the remainder of the business year.

The we.trade platform provided clients with a number of trade finance related products including: auto-settlement, bank payment undertakings (BPU), BPU financing, and invoice financing.

Despite managing to raise €5.5mn in capital during a 2021 investment round, the Dublin-based consortium, failed to generate much revenue and continued to lose money until it shuttered its doors last month.

In a memo first seen and reported by GTR dated 26 May 2022, the company admitted that it had been “forced to discontinue” business activities after failing to reach an agreement amongst its joint venture shareholders on a solution to its cash flow problems.

This is not the first time that the firm has run into money problems.

Although the company raised capital from 16 different investors over the course of five funding rounds beginning in February 2018, they struggled to generate revenue.

In fact, the company which builds blockchain-based trade finance platforms for banks and licenses its products to institutions in at least a dozen countries has been reporting steady losses in revenue as far back as 2019.

For many backers behind blockchain for trade platforms, the risk of bankruptcy or failure is inevitable.

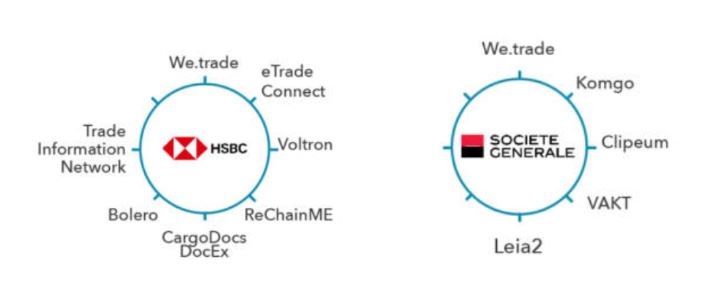

In TFG and the WTO’s November 2020 whitepaper on blockchain and DLT in trade, we profiled all the platforms that the major global banks were participating in at the time.

The results made it clear that banks like HSBC and Societe Generale were diversifying their investments in the sector.

Revisiting the Gartner Hype Cycle

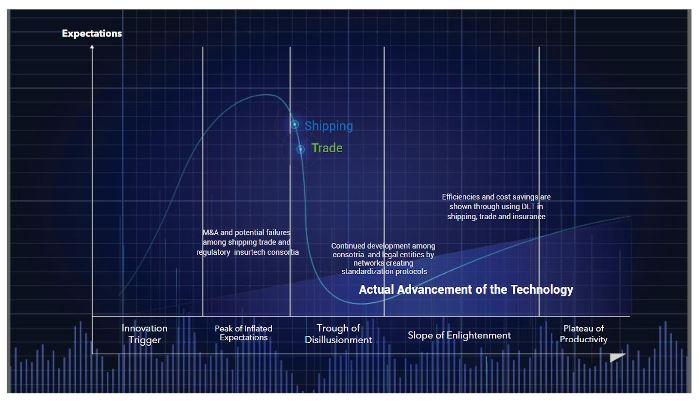

Back in June 2019, TFG profiled we.trade in our first Blockchain and Trade Finance whitepaper.

In it, we used the Gartner Hype Cycle as a tool for mapping the past and predicting the future path of the state of the technology for shipping and trade applications.

As we.trade moves down into the trough of disillusionment – it seems that the hype cycle has yet again proven to be a useful guidepost for anticipating technological advancement.

It seems plausible that in the coming months and years, other venture-capital propped blockchain in trade initiatives will face a similar fate, as changing economic conditions force investors to reconsider their risk allocations.

De-risking and cashflow problems part of wider trend

we.trade’s demise comes amidst several insolvencies by similar institutions.

Earlier in April 2022, the Dutch trade finance firm, Amsterdam Trade Bank (ATB) announced that it had filed for bankruptcy, citing sanctions against its Russian parent company, Alfa Bank, in response to the conflict in Ukraine, as the reason for their ‘operational difficulties’.

Economic and trading conditions worldwide have worsened since the start of the pandemic, despite government intervention designed to ease the pain.

According to figures quoted by the BBC, since 2020, more than 114 million people have lost their jobs worldwide, household debt in the US stands at $15.2 trillion and inflation is soaring globally due to supply chain issues and the conflict in Ukraine.

All of which suggests that trading conditions have become difficult for conventional companies, let alone those businesses dealing with untried or risky technologies.

Due to worsening market conditions, many investors are changing their risk management strategies, which is having an impact on cash flow and creating a catch-22 situation for lenders.

There has been a lot of financiers de-risking – getting out of the market when there’s really been an increased need for liquidity.

That’s partly price driven but also driven by a movement from just in time to just in case, which means companies are holding more inventory on their balance sheet, and need more working capital as a result.

This creates a real need in the market for liquidity alongside the current uncertainty that financiers are facing in terms of providing additional liquidity.

This may partly explain why we.trade found itself in the position that it did – that its failure says less about the long-term viability of blockchain and more about the cash flow challenges faced by an early adopter unable to show demonstrable revenues and business partnerships.

The promise of blockchain for trade finance

Although emerging technologies do tend to be capital-hungry initially, some experts argue that disruptive innovations like AI, robotics, and blockchain – whose trajectory has been accelerated by the pandemic – will ultimately prove to be deflationary in the decades ahead, creating greater value for investors through their ability to eradicate current inefficiencies in the marketplace.

Indeed, in the long term, many still believe that blockchain technology will revolutionise the trade finance sector, making financial services more efficient and increasing access to funding for both consumers and SMEs.

This is because of the technology’s ability to streamline historically slow processes and reduce costs for financiers.

While there may be short-term pain for many companies due to the macro-economic environment, the future looks bright for those who manage to survive post-pandemic market conditions:

Despite current trading conditions, many forward-thinking companies and institutions continue to see the use-case for blockchain technology.

Comparing it to previous revolutionary innovations like the internet or the telephone, they don’t believe that it is going away anytime soon.

Read the latest issue of Trade Finance Talks, June 2022

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.