In trade transactions, payments need to be made in a secure and timely manner.

When establishing a new relationship, buyers and sellers tend to use intermediaries, such as banks, to limit risk by guaranteeing that payments are made on schedule.

As trust develops between a buyer and seller, businesses may switch to other payment methods like cash in advance or provide trade credit on open account terms.

Payments in trade finance have varying types of risk for the importer (buyer) and the exporter (seller).

As a business owner, it is important to understand the different risks of each type of payment method, to see which one is most favourable and suitable for your business requirements.

This article will examine four types of payment methods: cash advances, letters of credit (LCs), documentary collections (DCs), and open account sales.

Cash advance

A cash advance requires the importer (buyer) to pay the exporter (seller) before the goods have been shipped, placing all the risk on the buyer.

Cash advances are common with low-value orders, such as when purchasing from online retailers.

For a seller, a cash advance is the least risky payment method. It provides a seller with upfront working capital to produce and ship the goods, as well as security since there is no risk of late or non-payment.

Conversely, as a buyer, a cash advance is the riskiest payment method since it may lead to cash flow issues and increases the buyer’s financial risk exposure to the seller.

This method can be problematic if the delivered goods aren’t up to standard, faulty, or not delivered on time.

Letters of credit (LCs)

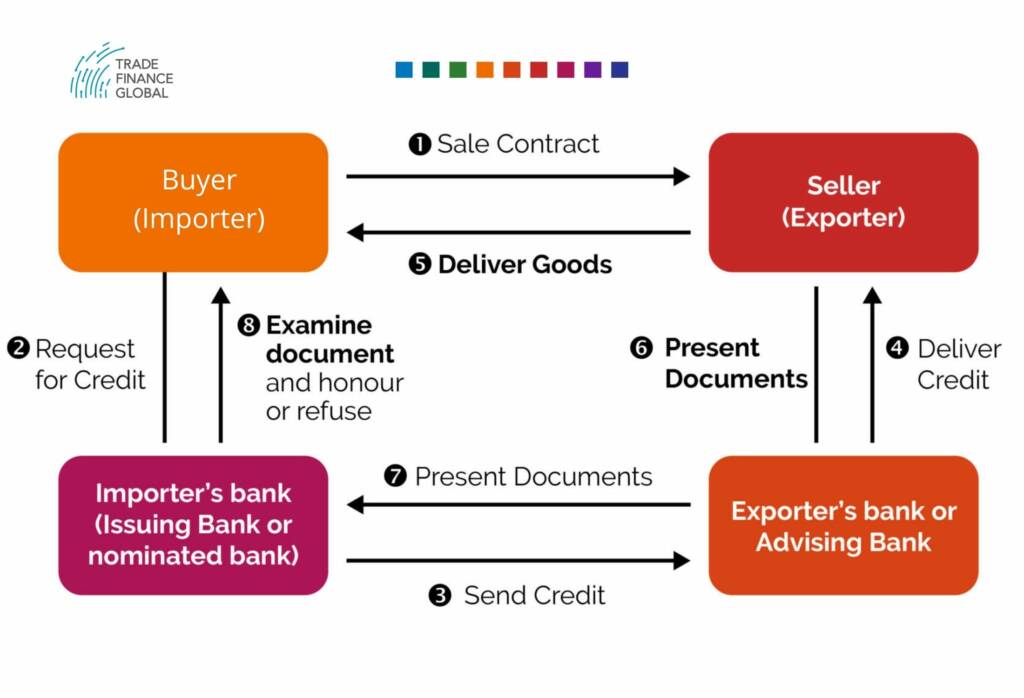

Letters of credit (LCs), also known as documentary credits, are financial, legally binding instruments, issued by banks or specialist trade finance institutions.

An LC guarantees that the seller will be paid on behalf of the buyer, as long as the terms specified in the LC are fulfilled.

An LC requires an importer and an exporter, with an issuing bank and potentially a confirming (or advising) bank respectively. The financiers and their creditworthiness are crucial for this type of trade finance.

The issuing and confirming bank effectively replaces the guarantee of payment from the buyer, reducing the risk to the supplier.

This is called credit enhancement.

An LC transaction generally happens as follows

- An importer agrees to buy goods from an exporter – a purchase order (PO) is issued

- The importer will approach an issuing bank (trade financier) which will issue an LC if the company fulfils the bank’s criteria (e.g. they are creditworthy)

- The exporter will work with a confirming bank, who will request that the LC documents be checked from the issuing bank (of the importer)

- The confirming bank will then check the LC and, if the terms are agreeable, the exporter will ship the goods

- The exporter then sends the relevant shipping documents to the confirming bank

- Once the confirming bank has examined the shipping documents in strict compliance against the LC terms from the issuing bank, they will forward these documents on to the issuing bank

- Payment is made according to the agreed terms; guaranteed by the issuing bank

- The issuing bank then releases the shipping documents so that the importer can claim the goods that were shipped

- Depending on the terms agreed, the issuing bank then transfers money to the confirming bank who will then transfer the funds onto the exporter

LCs are flexible and versatile instruments. An LC is universally governed by a set of guidelines known as the Uniform Customs and Practice (UCP 600), which was first produced in the 1930s by the International Chamber of Commerce (ICC).

Documentary collections (DCs)

A documentary collection (DC) differs from a letter of credit (LC).

In the case of a DC, the seller (exporter) will request payment by presenting its shipping and collection documents to its remitting bank. The remitting bank will then forward these documents to the importer’s bank. The importer’s bank will then pay the exporter’s bank, which will credit those funds to the exporter.

The role of banks in a documentary collection is limited; they do not verify the documents, take credit or country risks, or guarantee payment.

The banks just control the flow of the documents.

DCs are more convenient and more cost-effective than LCs and can be useful if the exporter and importer have a good relationship.

They are often used if the importer is in a politically and economically stable market.

Open account

In an open account transaction, the buyer pays the seller after the goods have arrived (typically 30-90 days later).

This is advantageous to the buyer but adds substantial risk for the seller, meaning that it is often used when the relationship between the two parties is already strong.

Open account trade helps to increase competitiveness in export markets and buyers often push for sellers to trade on open account terms.

As a result, sellers are more likely to seek trade finance to fund working capital while waiting for the payment.

Sellers can use trade credit insurance to reduce the risk of commercial losses, which could result from the default, insolvency, or bankruptcy of a buyer.

From the Editor – trade finance insights

PODCAST | Adapting to change: The future of factoring and supply chain finance – Trade Finance Global spoke with Çağatay Baydar, Chairman at FCI and Irina Tyan, Principal Banker, TFP at the EBRD about factoring and SCF.

PODCAST | Adapting to change: The future of factoring and supply chain finance – Trade Finance Global spoke with Çağatay Baydar, Chairman at FCI and Irina Tyan, Principal Banker, TFP at the EBRD about factoring and SCF. Video | IFC’s Nathalie Louat on Banking on Women Who Trade Across Borders – The International Finance Corporation, a member of the World Bank Group, has released a whitepaper, “Banking on Women Who Trade Across Borders”, exploring the gender disparity in international trade.

Video | IFC’s Nathalie Louat on Banking on Women Who Trade Across Borders – The International Finance Corporation, a member of the World Bank Group, has released a whitepaper, “Banking on Women Who Trade Across Borders”, exploring the gender disparity in international trade. Podcast | Empowerment through trade: IFC and Ecobank on tackling the gender disparity in global trade – This finding, from the IFC’s whitepaper “Banking on Women Who Trade Across Borders”, speaks to the gender disparity that still exists in the international trade space, particularly in emerging markets.

Podcast | Empowerment through trade: IFC and Ecobank on tackling the gender disparity in global trade – This finding, from the IFC’s whitepaper “Banking on Women Who Trade Across Borders”, speaks to the gender disparity that still exists in the international trade space, particularly in emerging markets. VIDEO | Riding the energy and commodities trading wave and what’s in stock for ETRM/CTRM in the next 5 years – At Commodity Trading Week (CTW) in London, where the commodity community was gathered for two days, Deepesh Patel, Editorial Director, Trade Finance Global (TFG) spoke with Ben Hillary, Managing Director at Commodities People.

VIDEO | Riding the energy and commodities trading wave and what’s in stock for ETRM/CTRM in the next 5 years – At Commodity Trading Week (CTW) in London, where the commodity community was gathered for two days, Deepesh Patel, Editorial Director, Trade Finance Global (TFG) spoke with Ben Hillary, Managing Director at Commodities People. Factoring and supply chain finance in the shadow of the Areni-1 cave: EBRD’s insights from Yerevan – The EBRD TFP conference gathered industry leaders to discuss evolution of factoring and supply chain finance in emerging markets.

Factoring and supply chain finance in the shadow of the Areni-1 cave: EBRD’s insights from Yerevan – The EBRD TFP conference gathered industry leaders to discuss evolution of factoring and supply chain finance in emerging markets. Video | ETRM leader spotlight: cQuant CEO on the race to renewables and what this means for energy trading – In light of the current global energy crisis characterised by rising fuel prices and geopolitical tensions, support for the energy sector – especially in the clean energy space – is critical.

Video | ETRM leader spotlight: cQuant CEO on the race to renewables and what this means for energy trading – In light of the current global energy crisis characterised by rising fuel prices and geopolitical tensions, support for the energy sector – especially in the clean energy space – is critical.Trade Finance Hub

1 | Introduction and the benefits

2 | Types of trade financing

3 | Methods of payment

4 | Pre and post-shipment finance

5 | Risks and challenges

6 | Trade and export finance providers

7 | The credit process and securing finance

8 | SME Trade Finance Guide

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom