UCP 600 (Uniform Customs & Practice for Documentary Credits) - What does UCP 600 mean?

UCP 600 and the Letter of Credit

1 | Introduction to the Letter of Credit

2 | Different types of Letter of Credit

3 | UCP 600 and the Letter of Credit

4 | UCP 600 – Ultimate Guide

5 | Problems with Letters of Credit

6 | Restricted Letters of Credit

7 | Letters of Credit vs Bank Guarantees

8 | Standby Letters of Credit

9 | eUCP Explained

10 | URC 522 and eURC

UCP 600 and the Letter of Credit

1 | Introduction to the Letter of Credit

2 | Different types of Letter of Credit

3 | UCP 600 and the Letter of Credit

4 | UCP 600 – Ultimate Guide

5 | Problems with Letters of Credit

6 | Restricted Letters of Credit

7 | Letters of Credit vs Bank Guarantees

8 | Standby Letters of Credit

9 | eUCP Explained

10 | URC 522 and eURC

The Uniform Customs & Practice for Documentary Credits (UCP 600) is a set of rules agreed by the International Chamber of Commerce, which apply to finance institutions which issue Letters of Credit – financial instruments helping companies finance trade. Many banks and lenders are subject to this regulation, which aims to standardise international trade, reduce the risks of trading goods and services, and govern trade.

The UCP 600 (“Uniform Customs & Practice for Documentary Credits”) is the official publication which is issued by the International Chamber of Commerce (ICC). It is a set of 39 articles on issuing and using Letters of Credit, which applies to 175 countries around the world, constituting some $1 trillion USD of trade per year.

What’s the purpose of UCP 600?

The UCP 600 replaced the UCP 500 on the 1st July 2007. It was brought about to standardise a set of rules aiming to benefit all parties during a trade finance transaction. UCP 600 was created by industry experts, and mandated by the Banking Commission, rather than through legislation. The first UCP was created in 1933 and has been revised by the ICC up to the point of the UCP 600.

Is the UCP 600 legally binding?

The UCP 600 rules are voluntarily incorporated into contracts and have to be specifically outlined in trade finance contracts in order to apply. They also allow flexibility for the international parties involved.

An accompaniment to the UCP 600 is the International Standard Banking Practice for the Examination of Documents under Documentary Credits (ISBP), ICC Publication 745. It assists with understanding whether a document complies with the terms of Letters of Credit.

Credits that are issued and governed by UCP 600 will be interpreted in line with the entire set of 39 articles contained in UCP 600. However, exceptions to the rules can be made by express modification or exclusion.

The UCP 600 are the most successful rules ever developed in relation to trade and most Letters of Credit are subject to them. At the recent ICC UK Winter Trade Finance Conference, there was a special programme which addressed the UCP 600. This looked at recent developments in industry practice and ICC policy, as well as a review of the latest Banking Commission Opinions.

Part 1 - What is a Letter of Credit and what are the benefits to its users?

Summary of the UCP 600

Here are a few of the key elements which make up the UCP 600:

- Definition of key terms which are prevalent in international trade (e.g. honouring [of payments], applicants, banking days, presentation)

- How international trade documents (Letters of Credit) can be signed and acknowledged by all parties

- The difference between documents, goods and services (and which parties deal with these)

- Which parts of a Letter of Credit are negotiable and non-negotiable

- How credit works, and how payment is made

- How banks can communicate the confirmation of goods (teletransmission)

- Transportation of the goods, modes of transport, and who bears responsibility

- How to deal with discrepancies, waivers and giving notice

- The provision of original documents or electronic copies

- Bills of Lading

- Insurance and covering the cost of goods

- Loss of shipping documents in transit

Will the UCP 600 be revised?

At Trade Finance Global, many people ask whether the UCP 600 will be revised. The UCP 600 is a set of rules developed by the International Chamber of Commerce on the issuance and governance of Letters of Credit, which account for a significant proportion of global trade finance transactions.

The UCP 600 has taken over 3 years to develop

When looking at the UCP 600, it is important to look at the market environment and general notes about the current guidelines. It is general consensus that UCP 600 will not be revised any time soon. Some of the reasons for this and general notes about the UCP are outlined below:

- there was a 14 year gap between UCP 500 and UCP 600;

- The consulting group was established with 41 members from 26 countries, who held meetings on over 15 occasions

- Over 5000 comments were received and reviewed once the first draft of the UCP 600 came about, being unanimously approved in October 2006

- UCP 600 is doing relatively well and works most of the time, there have been a low number of disputes, usually centred around some ambiguous wording that could not be agreed when the UCP 600 was drafted;

The big question is, if it were to be revised,

- who would draft it and who in the market has the expertise to do so;

- revision would take time and be at a high cost;

- there is a lot of regulatory uncertainty in the market and policy would need to be drafted before any advancement of the documents;

- it is unknown what will happen to various sanctions that are operating in the market;

- the ISBP is used to clarify points and there are further opinions that do the same; and

- the system will never be perfect as there will always need to be compromise – it covers over 150 trading countries and needs to reflect the commercial and legal realities.

Part 2 - Explanation of the UCP 600 rules and history of UCP

Part 3 - Evolution of UCP 600 rules – will we see UCP 700 rules?

Trade Finance Global interviewed Pradeep Taneja, Managing Director of Taneja Global Trade Consulting, Bahrain and Co-Chairman and Board member of ICC Bahrain to learn more about Letters of Credit. To read this inteview, click here.

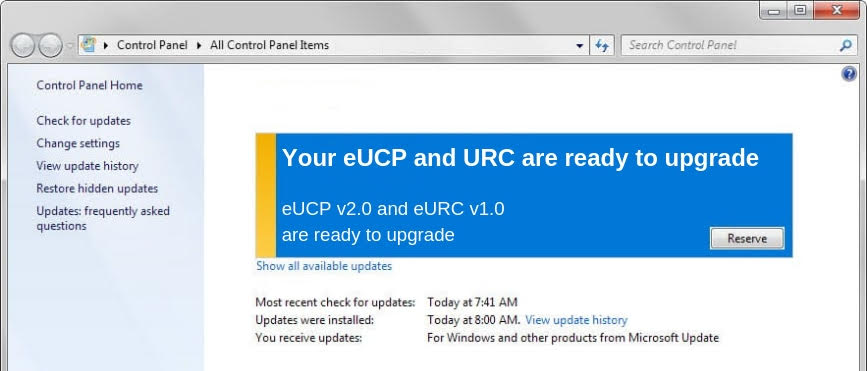

Electronic UCP (eUCP)

In 2019, the International Chamber of Commerce also released an updated supplement for the electronic rules (eRules) of the Uniform Customs & Practice for Documentary Credits. TFG covered the key changes for V2.0 of the eUCP rules, which can be found here.

Summary of the Key Articles in the ICC UCP 600

Articles 1 – 5 – General Provisions and Definitions

Articles 6 – 13 – Liabilities and Responsibilities

Articles 14 – Examination of Documents

Article 15 – 17 – Examination of Documents

Articles 18 – 28 – Documents

Articles 29 – 33 – Miscellaneous Provisions

Articles 34 – 37 – Disclaimers

Articles 38 – 39 – Transferable Credit & Assignment

What’s the difference between UCP 600 and UCP 500?

The UCP 500, was revised in 1993, a process which reviewed and overhauled opinions, decisions, URR525, ISP98 and eUCP.

Seven key articles were amended.

In comparison to UCP 500,

- New terminology added, concepts & wording introduced

- Reorganisation of the rules

- Substantive & cosmetic changes

- Improved clarity, yet created new ambiguity

Download our UCP600 Infographic (Free UCP PDF 2020)

UCP600 PDF Infographic:

Part 4 - 3 tips for using UCP 600 rules in Letters of Credit

What about the eUCP

ICC Update on UCP

Recently, the ICC updated eUCP 600 rules (eRules), to accelerate the digitilisation of trade finance. Trade Finance Global have published the updates on the eRules for ‘eUCP 600’, which are supplementary rules to these UCP 600 rules. Find out more here.

Videos you might like

Download our free Letters of Credit guide by filling in the form below:

Contents

1 | Introduction to the Letter of Credit

2 | Types of Credit

3 | UCP 600 and the Letter of Credit

4 | UCP 600 – Ultimate Guide

5 | Benefits of Letters of Credit

6 | Handling Document Discrepancies

7 | Restricted Letters of Credit

8 | Letters of Credit vs Bank Guarantees

9 | Standby Letters of Credit

10 | Sight Letters of Credit

11 | eUCP Explained

12 | URC 522 and eURC

13 | SWIFT Messaging Types

14 | Research

15 | BAFT & TFG Guide

16 | Parties Involved

17 | Letters of Credit Rules

18 | ISBP 821

19 | Financial Crime, Fraud and Sanctions

20 | Presentation of Documents

21 | Dispute Resolution

22 | Digitalisation and the Future

Speak to our trade finance team

Latest News- UCP 600 and Letters of Credit

Surecomp advances digital trade with rapid eBL transactions on RIVO platform

0 Comments

PODCAST| Diversifying investment portfolios with trade finance: Are we there yet?

0 Comments

Making an impact on Global Banking in 2024: ISO 20022, cross-border payments and AI

0 Comments

PIL becomes member of DCSA, furthering shipping digitalisation

0 Comments

IFC and DBS Launch $500m facility to promote trade flows in emerging markets

0 Comments

International Standby Practices (ISP98): 25 years later

0 Comments

BAFT and TFG launch a comprehensive Letter of Credit guide

0 Comments

Generative AI and LLMs in trade finance: Believe the hype (well, most of it)

0 Comments

The role of UCP in Standby Letters of Credit transactions

0 Comments

Understanding Letters of Credit & The UCP 600 Rules in Nigeria

0 Comments

Standby Letters of Credit (SBLC): Top tips and best practice for corporates

0 Comments

Navigating commodity trade finance: A comprehensive guide for borrowers

0 Comments

11 Swift Messaging Types (MTs), what they do, and how they are used in trade finance (MT700, MT707, MT710, MT700…)

0 Comments

VIDEO | Sustainability in MENA: First Abu Dhabi Bank’s approach to sustainable trade finance

0 Comments

Trade Finance Global: A Year in Review – 2023 Recap

0 Comments

Citi announces collaboration with Traydstream to streamline document services

0 Comments

Kuvera Resources v J.P. Morgan Chase: Certainty of payment vs risks of breaching sanctions under Letters of Credit

0 Comments

Three levels of ISO 20022 usage: Steps to harmonise trade finance transactions

0 Comments

14 key trade documents and data elements for cross-border trade: Inside the ICC’s KTDDE report

0 Comments

Afreximbank’s programme to support LCs reaches 80% of Africa’s banks

0 Comments

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom