Estimated reading time: 3 minutes

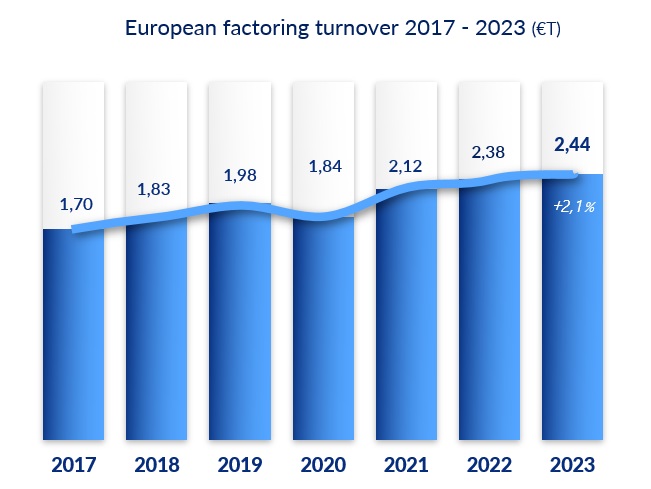

The European factoring industry saw a continuation of growth in 2023, albeit at a reduced pace compared to prior years. The industry’s total turnover reached €2.044 trillion, marking a 2.1% increase from the previous year.

This represents one of the lowest growth rates recorded by the EUF since it began tracking this data, suggesting a trend toward stabilisation in the industry following years of more rapid expansion. The six-year compound annual growth rate remains strong at 7.2%, highlighting the industry’s robustness and its prospects for ongoing expansion.

Factors contributing to the 2023 slowdown in growth, as reported by EUF members and partners, include:

- A slowdown in EU GDP growth,

- Elevated base interest rates in several countries, prompting a shift towards more economical funding options,

- Excess liquidity in certain sectors following profitable years,

- Reduced consumer spending due to inflationary pressures,

- The discontinuation of partnerships with financially deteriorating clients.

Graph 1. Factoring turnover 2017-2023 (€T)

The growth in factoring turnover in 2023 outpaced the annual increase in European GDP, similar to previous years. However, the average funds allocated per client dropped nearly 3% to €1.0 million, influenced by both a reduction in advances and an increase in client numbers. Conversely, average turnover per client rose by 2% to €8.0 million, driven by the year-on-year increase in overall factoring turnover.

The number of active factoring clients in Europe in 2023 approached 304,000, the highest figure recorded to date. This surge in clientele suggests that in the face of continued economic uncertainties, businesses are increasingly turning to factoring as a source of funding that also offers additional benefits like risk management and debtor control.

While the factoring market in Europe is reaching maturity, limiting the scope for explosive growth seen in recent years, the steady increase in turnover and client numbers indicates a return to the industry’s standard growth trajectory prior to the pandemic.

Commenting on the announcement, FCI chairman, Fausto Galmarini said,“It’s been an interesting journey in the world of factoring! After two years of double-digit growth in turn-over, in 2023 we were expecting a slow-down. The EU GDP took a hit, dropping from 3.5% in 2022 to 0.4% and the European Central Bank adopted some strict policies to get inflation under control, which led to lending rates skyrocketing.

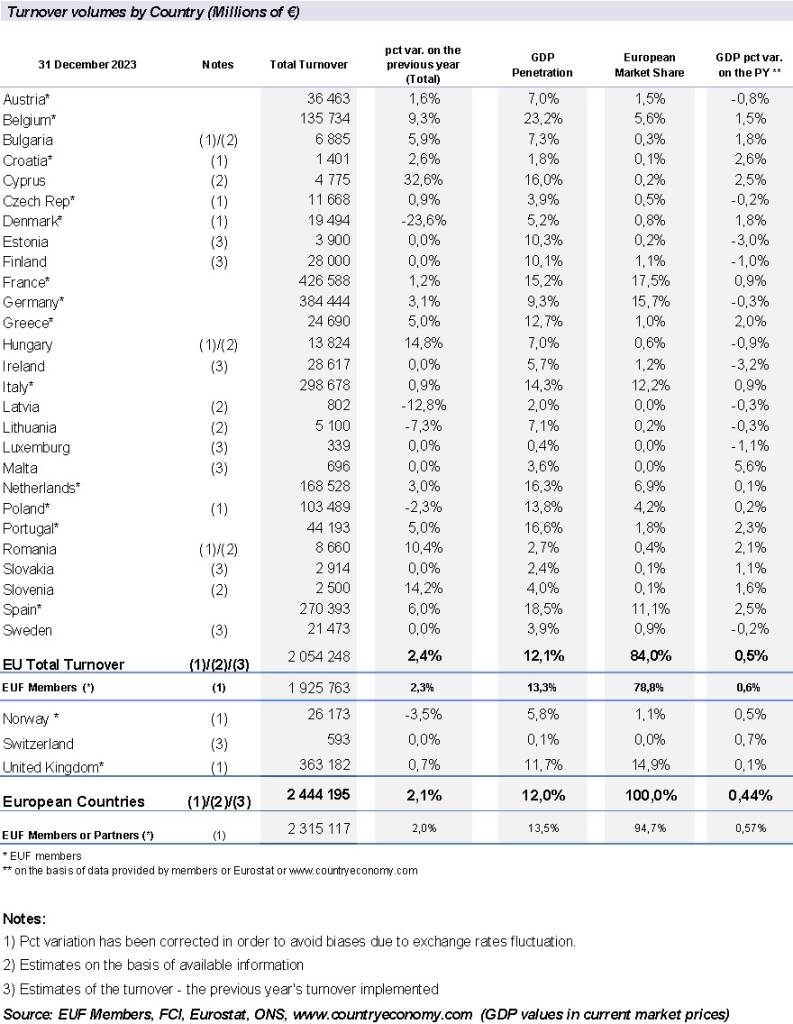

“Plus, the macro economic scenario was impacted by some major conflicts happening between Russia and Ukraine, and Israel and Palestine. But, even with all of that going on, the European factoring market is still strong, making up a whopping 66% of the world market. The factoring industry is playing a crucial role in the European real economy, with a stable 12% penetration rate in the GDP. In 2023 International factoring, accounting for 22% of the total turnover, has held its position steady. Non-recourse factoring, with a share of 53%, continues to dominate the market, demonstrating its adaptability to meet the clients’ needs and address the debtors’ risk.”

In 2024 we expect a turn-over growth slightly better than 2023 thanks to the recovery of the EU GDP, the reduction foreseen in the interest rates for the dropping of the inflation, even in a complex scenario because of the conflicts between Ukraine and Russia and Israel and Palestine that are far from finding closure.”

Table 1. Factoring turnover by country in 2023

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.