What is Credit Issuance?

Credit issuance is the process by which importers guarantee to exporters that they will pay them in full once the conditions of the contractual agreement between them are fulfilled. Commonly, the actual issuance of credit is made to and from third-party banks or trade financiers assisting the two transacting parties, using a financial instrument known as a letter of credit. Letters of credit assure both parties that contractual obligations will be fulfilled and payments made; as such, they are a hugely important tool in international trade transactions

Credit Issuance – Definition

Letters of credit are generally used in international trade as a financial instrument for importers to pay their international suppliers via reputable financial intermediaries such as banks or specialist trade finance institutions.

For an importer to arrange credit issuance to an exporter through a letter of credit, they will need:

- A confirmed contractual agreement with an exporter, whereby the exporter will produce goods and transport them to the importer’s jurisdiction according to agreed terms and conditions in exchange for an agreed payment.

- An issuing bank supporting their operations, which will issue the letter of credit and cover the value of the payment to the exporter should the importer fail to meet their payments.

- A confirming bank supporting the exporter’s operations, who will confirm the credit issuance has been received and extend the line of credit to the exporter to provide cashflow whilst they fulfil the contract.

Credit issuance itself is the process by which the issuing bank authorises the confirming bank to issue a confirmation to the benefitting exporter of the credit issuance that the issuing bank’s client will make payment to them. This confirmation (made via a letter of credit) guarantees to the exporter that the importer will pay them on time and in full. In the event that the importer is unable to make that payment, the bank will cover the full or remaining value of the payment to guarantee that the exporter is not out of pocket having invested time and money in producing and shipping the goods requested in the contract.

Structuring Letters of Credit

Letters of credit can take many forms. Their structure and terms largely depend on the nature of the contract between the importer and exporter, and the corresponding type and level of support which both parties require from trade financiers to help them facilitate the transaction. Broadly, four key structural decisions affect letters of credit.

First, letters of credit have variable payment methods. A commercial letter of credit is a form of direct payment method – the issuing bank makes the payments issued in the letter direct to the beneficiary of the instrument. However, indirect or secondary payment methods also exist, whereby the issuing bank pays the beneficiary only when the holder of the letter cannot pay themselves. These are known as standby letters of credit.

Second, letters of credit are underpinned by different strengths of guarantee. In most cases, letters of credit are irrevocable in order to serve as a guarantee of the importers obligation to pay their seller. In some cases, banks can insist that letters of credit are revocable to grant the bank greater flexibility and time-limit the security of the issuance. However, these terms mean that revocable letters of credit are rarely used in international trade transactions.

Third, letters of credit can serve different parties and purposes. Most simply, importer LCs provide short-term cash flow to importers to enable them to make immediate payments before repaying the lender from the profits of a given transaction. In contrast, exporter LCs provide clear written instructions to the importer’s issuing bank to issue credit on the condition that agreed contractual terms are met.

Finally, LCs can contain a number of provisions to deal with specific issues within a given transaction. For example, traveller’s LCs provide international flexibility by guaranteeing that the issuing bank will honour withdrawals made with certain foreign banks or in given countries to support multinational trade transactions. Alternatively, if a party desires payment flexibility in a single jurisdiction, a revolving letter of credit will permit multiple withdrawals on the issued line of credit within a fixed time period. Finally, if all parties in the transaction are uncertain about the quality of the guarantee within an LC, a confirmation bank can guarantee the LC issued by an issuing bank in the event that the issuing bank defaults on their obligations.

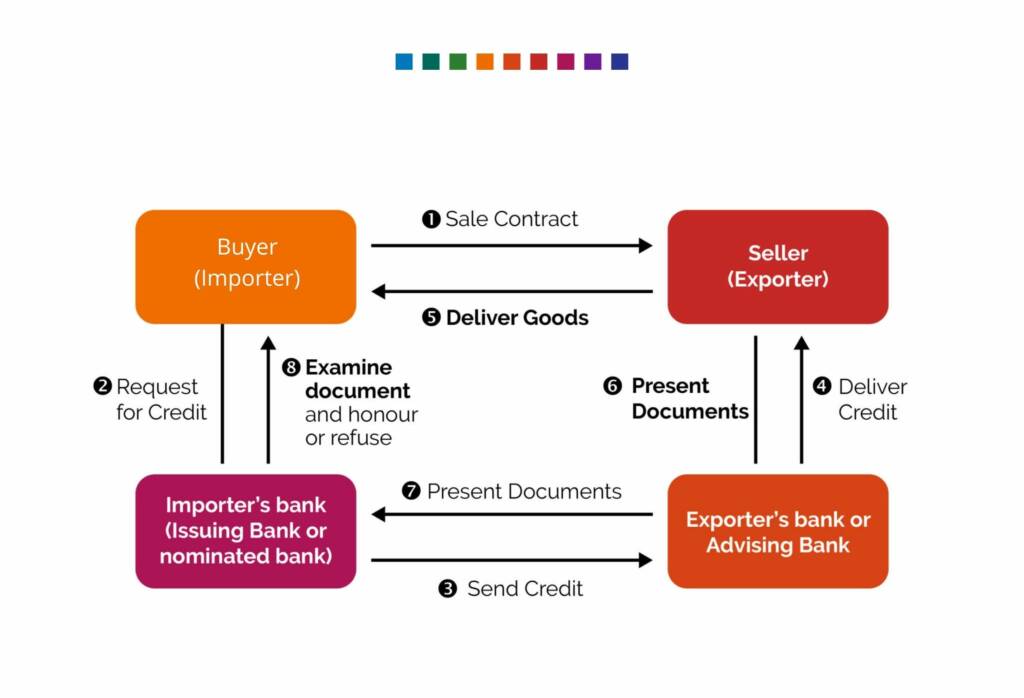

- An importer agrees a contract with a supplier in an international trade or legal jurisdiction (i.e. an exporter) to buy goods or services from them.

- A payment order is raised by the exporter confirming the contract.

- The importer approaches a trade financier to operate as their issuing bank. The issuing bank will assess the importer for credit worthiness, and then agree to issue a letter of credit to the exporter for payment

- Simultaneously, the exporter will approach a financial agent to operate as their confirming bank. In doing so, the agent will request the letter of credit documents from the importer’s issuing bank.

- The confirming bank will check those documents. If the terms of the credit issuance are correct, the exporter will then ship the goods knowing they will receive payment for them from the importer.

- The exporter provides proof of shipment to their confirming bank using a bill of lading. The confirming bank will examine the documents, confirm the exporter has met their contractual obligations, forward the documents to the issuing bank, and process the payment to issue finance to the exporter.

- The importer pays the issuing bank the funds to be passed to the exporter, and the issuing bank releases the bills of lading so the importer can claim their goods.

- The issuing and confirming banks transfer the importers money to the exporter, completing the transaction securely.

Credit Issuance vs Guarantees

Credit issuance via a Letter of Credit has a similar purpose to a guarantee, bond or surety; each product is a form of providing increased security and confidence in the activities of the party using the instrument.

However, there are three key differences between a letter of credit and a more conventional bank guarantee. First, letters of credit facilitate contractual transactions by providing conditional payments as parties complete their obligations. In contrast, guarantees provide reparation payments if contractual obligations have not been completed satisfactorily by one or both parties. Second, the products mitigate different risks; whereas guarantees mitigate the risk of inactivity by the exporter/supplier, credit issuance mitigates the risk of late or non-payment by the importer/buyer. Finally, guarantees are much more expensive than letters of credit, as the bank issuing the guarantee is agreeing to take on a much larger amount of risk on its own capital.

Latest Credit Insurance Insights

Risk and Insurance Hub

1 | Risk and Insurance

2 | Guarantees

3 | Bonds

4 | Bonds and Guarantees

5 | Credit Issuance

6 | Surety

7 | Claim Management

8 | Trade Credit Insurance

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom