What is Claim Management?

Claim management is a collective term for the myriad of advice and services provided by firms in respect of claims for compensation, reparation, restitution or any other remedy for financial loss or breach of contractual obligation. In the context of international trade finance, it generally refers to the services provided by trade financiers to settle firm’s claims against risk mitigation products such as guarantees, bonds, sureties or conventional insurance when their opposite commercial party has breached the terms of their contract.

Claim Management – Definition

A firm providing claim management services acts in three ways. The first core product offering of claim management is advisory; claim managers can advise policy holders about their claim against a given financial product, represent them to ensure they receive the full funds to which they are entitled, and investigate claims in greater detail to provide impartial evidence from a credible source about the circumstance, merits or foundation of a given claim. Claim management can also reduce the operational burden associated by a financial claim by registering claims, providing clear information to policyholders, ensuring key documents are processed and filed, and expediting any claim assessment procedures contained within the wider claims process.

Moreover, claim management refers to assistance with the claim itself; namely, determining which party is responsible for any wrongdoing under the terms of a contract and the amount to be paid as part of the claim. If the product is simple (such as a guarantee) or the terms of the product are clear, this can be as simple as paying a financial sum to the party holding the policy. In claims involving more complicated products (such as performance bonds), claim management can also involve investigating why contractual terms were breached and determining responsibility. Claim management also encompasses the recovery of the sum paid to a party from the other responsible party – for example, in the case of a surety triggered by a principal declaring insolvency, the claim manager will pursue the principal for the value of the surety paid to the obligee who held it.

Finally, claim management can also refer to an investigation into wrongdoing regarding trade finance products. This typically takes the form of fraud prevention services, where companies can investigate claims to determine whether any fraudulent behaviour has taken place quickly and thoroughly to avoid frustrating legitimate customers.

- Two parties are bound together by a commercial agreement with contractual terms and conditions. Party A has agreed to buy goods from Party B, who will make and export the goods to Party As a country.

- Party B asks for part payment for the goods up front to help with their businesses cashflow and the cost of production. Party A has provided this on the provision the payment is protected by a guarantee from a third party bank that the money will be repaid should Party B fail to meet their contractual obligations and a performance bond that Party B will make a payment to Party A to compensate for their failure.

- Party B accepts these terms and the payments but fails to meet its terms and produce and deliver the goods on time.

- Party A makes a claim against their guarantee with the guarantor.

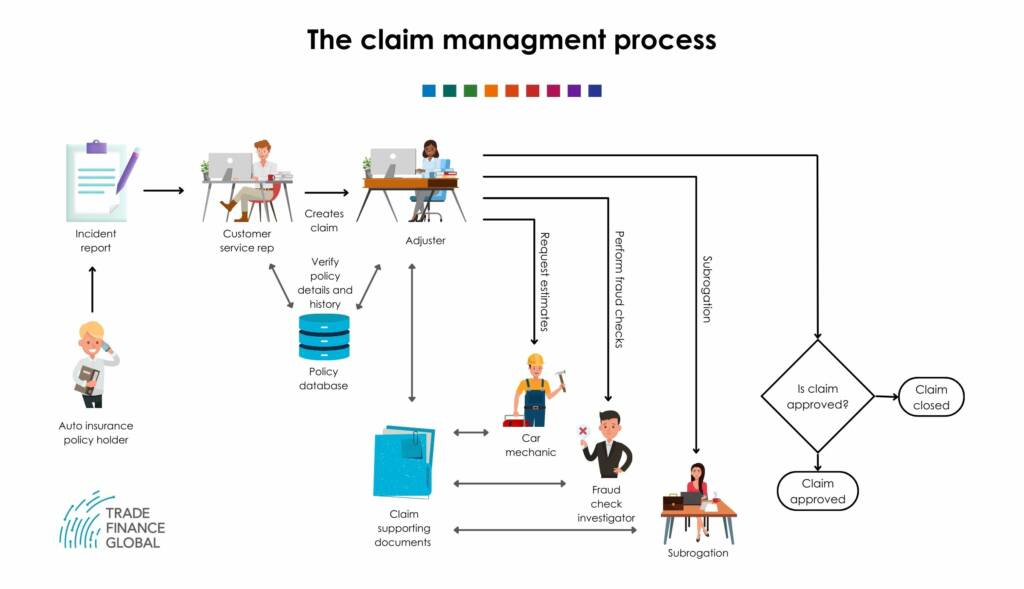

- A case handler working for the guarantor engages with Party A to understand the situation and get as much information as possible before opening a case file representing Party As claim.

- The guarantor will then serve as an investigator and adjudicator, reviewing the financial product, the contract, and the events of what has happened to investigate what wrongdoing has taken place, who is liable, and what compensation is appropriate.

- The guarantor will also perform fraud checks on both parties to ensure that the claim is not fraudulent, and will handle any complexities involved (such as any subrogation of either party regarding the financial liability involved).

- Having investigated the claim, the guarantor will either reject it and close the case file, or approve it.

- Having approved the claim, the guarantor will insure the correct payment is made to Party A immediately to compensate them for their loss.

- Depending on the nature of the product agreed, the guarantor may then pursue Party B for some or all or the compensatory amount.

Firms:

- Accurately assess claims and liability to avoid legal action.

- Maintain customer satisfaction with fast, thorough management and settlement of claims.

- Eliminate errors by maximising consistency across the claims process.

- Quickly identify fraudulent or suspicious cases and investigate them thoroughly.

- Maintain profitability by reducing delays and fraudulent claims.

Claimants:

- Get bespoke advice regarding a specific claim to maximise your security.

- Support throughout the process of reclaiming your finance.

- Expertise regarding legal, regulatory and financial complexities or issues.

- Reduce expenses incurred from potentially lengthy delays before settlement.

- Receive immediate payment from the settlement whilst claim managers pursue the liable principal in the contract for the funds owed.

How to access Claim Management

Generally, if you purchased a financial product aimed at limiting liability and financial risk from a trade financier, the provider will provide some level of claim management regarding that product. However, a number of banks, trade financiers and independent companies can also provide bespoke claim management services to both claimants (regarding specific complicated claims) and firms (regarding claims they need to investigate, value and pay).

Things to Consider

When you need to claim:

- Take your time: A breach of contract is a serious issue and often large amounts of finance are at stake. Take time to consider the implications for yourself and other parties involved and inform them of what has happened.

- Information is key: Investigate and understand the crucial terms of the financial product you have purchased – the payments, terms, and fees – and what procedure you must follow to claim against it.

- Clarify your position: You should discuss any potential claim with the trade financier who issued your product. You want to understand their process for managing your claim against that product, what firm and what team within that firm will actually conduct the work involved, and what guarantees they will make to you regarding its resolution.

When choosing a partner:

- Scour the market: there are many firms offering claim management services. Each can offer different expertise and capabilities. Your choice will affect the quality of service you receive as well as the outcome of your claim.

- Know your rights (and responsibility): strict regulations govern the claims management industry. Usually, representatives dealing with claims will need to be qualified individuals working at reputable institutions in order for them to manage claims effectively.

- Follow the money: fees regarding claim management depend on the services provided. Significant fees can apply in certain circumstances, such as if you subsequently opt out of a policy or wish to change your claim manager. Find this out before you engage a management partner.

When agreeing to terms:

- Consider your settlement: how your claim is managed can affect what form your settlement takes (i.e. how it is paid to you).

- Confirm your rights: many claim managers will restrict who you can engage with once your claim is under management. If you want to use other agents, firms or contractors, check your ability to do so.

- Give yourself flexibility: it is common for parties to have a legal right to cancel any claim management contract in a fixed window (usually 14 days). Ensure this is included in any negotiations over the contract for managing your claim.

Latest Credit Insurance Insights

Videos – Risk & Insurance

Risk and Insurance Hub

1 | Risk and Insurance

2 | Guarantees

3 | Bonds

4 | Bonds and Guarantees

5 | Credit Issuance

6 | Surety

7 | Claim Management

8 | Trade Credit Insurance

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom