When declaring goods to a customs authority, HTS codes are used alongside HS codes.

In this article, we explain how and why HS codes are paired with HTS codes, both for goods classification and tax purposes.

What are HTS codes?

‘HTS’ stands for Harmonized Tariff Schedule, and HTS codes help importers and exporters to easily find and calculate the duty or tax to be paid on their products.

HTS codes are unique, 10-digit numbers that are used universally in international trade, but their tax implications will differ in individual jurisdictions.

In the US, for example, the HTS codes are administered by the US International Trade Commission (USITC), which links the codes to the relevant duty and tax legislation in that jurisdiction.

In the US, this system is known as the Harmonized Tariff Schedule of the United States (HTSUS).

What does an HTS code look like?

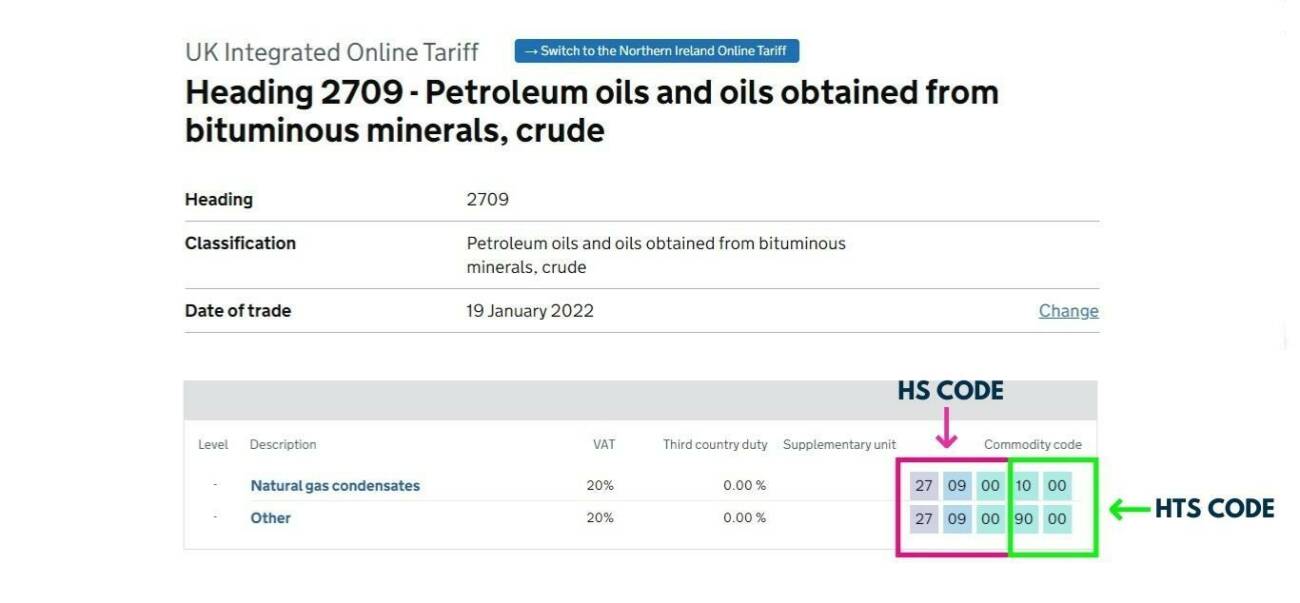

The first six digits are an HS code, and then the next two digits link to the sub-heading of the HS code, which establishes duty or tax rates for the product being shipped.

The final two digits are a statistical entry that is used to collect trade data, and thus has no bearing on duty or tax implications.

If required, this ‘statistical suffix’ must be correct, and if not required, it must be replaced with ‘00’.

In the UK, HTS codes are referred to as ‘commodity codes’, and are administered by Her Majesty’s Revenue & Customs (HMRC).

What are HS codes?

While Harmonized Tariff Schedule (HTS) codes denote the product duty or tax rate for a product being shipped, Harmonized System HS codes denote the product category.

The ‘HS’ stands for the harmonized commodity description and coding system, and the ‘code’ is the string of numbers that acts as a label for a certain type of product.

HS codes were developed by the World Customs Organization (WCO) – a United Nations (UN) agency – as an international product classification system for goods being imported or exported.

Having been in use since 1988, HS codes have grown to cover more than 5,000 product categories, and are used extensively in electronic messaging formats such as Electronic Data Interchange For Administration, Commerce and Transport (EDIFACT).

A combination of HS codes and EDIFACT messaging can be used to initiate a trade and/or trade finance transaction anywhere in the world.

This has helped HS codes to become the global standard for goods classification used by all WCO members.

What does an HS code look like?

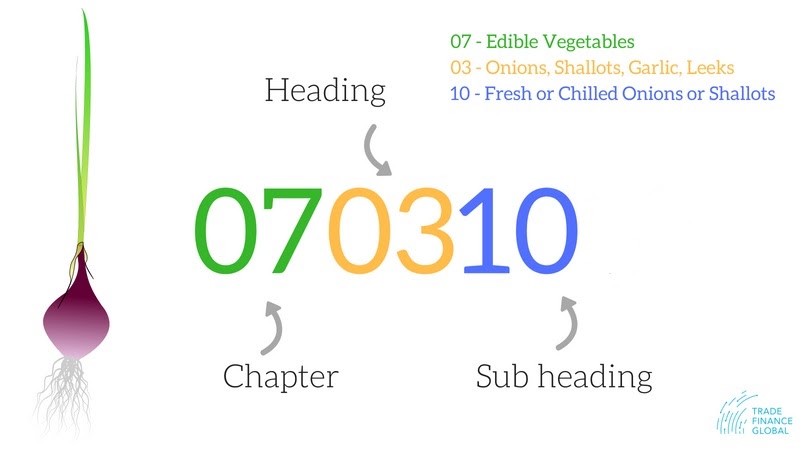

Each HS code has six digits and is divided into three parts: the first two digits denote the chapter in HS Nomenclature – a library of HS codes – that the goods are classified under.

The next two digits denote the heading within the relevant HS Nomenclature chapter, and the last two digits denote the sub-heading.

As such, HS codes are simply a labelling system that accords with the categories defined by the WCO.

For this to be possible, the WCO publishes a vast classification directory known as HS Nomenclature.

The WCO’s seventh and latest edition of HS Nomenclature came into effect on January 1, 2022.

In this edition, the WCO added new amendments for products such as electrical and electronic waste, novel tobacco and nicotine products, unmanned aerial vehicles (UAVs), and metal forming machinery.

Used together HC codes and HST codes can help importers and exporters know what tariff rates will be applied to their shipments.

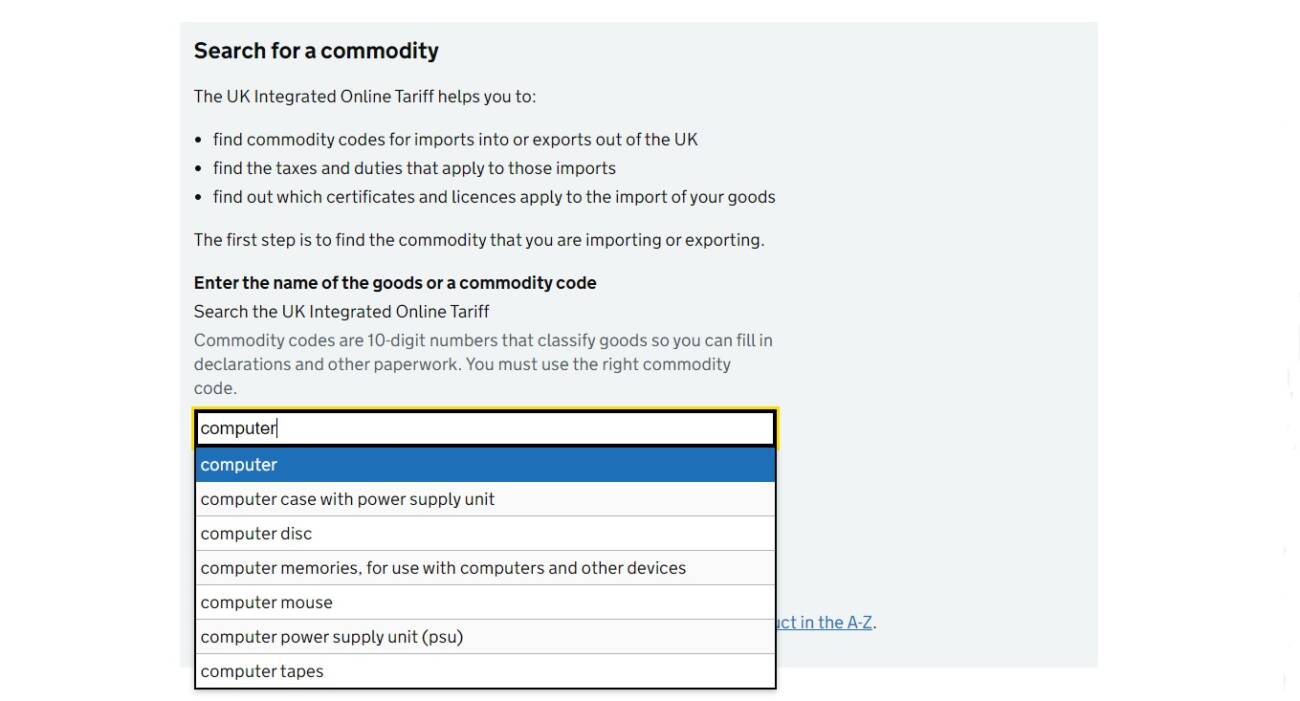

For importers, HMRC provides a UK Integrated Online Tariff tool that helps businesses find the right taxes and duties that apply to their product.

The UK Integrated Online Tariff tool also tells importers whether there are specific licenses or certificates required for the goods they are importing.

Let’s run through an example together…

Using the UK Integrated Online Tariff tool

Suppose that a company, Trade Finance Global, wanted to import a batch of computers to sell to other companies involved in trade finance.

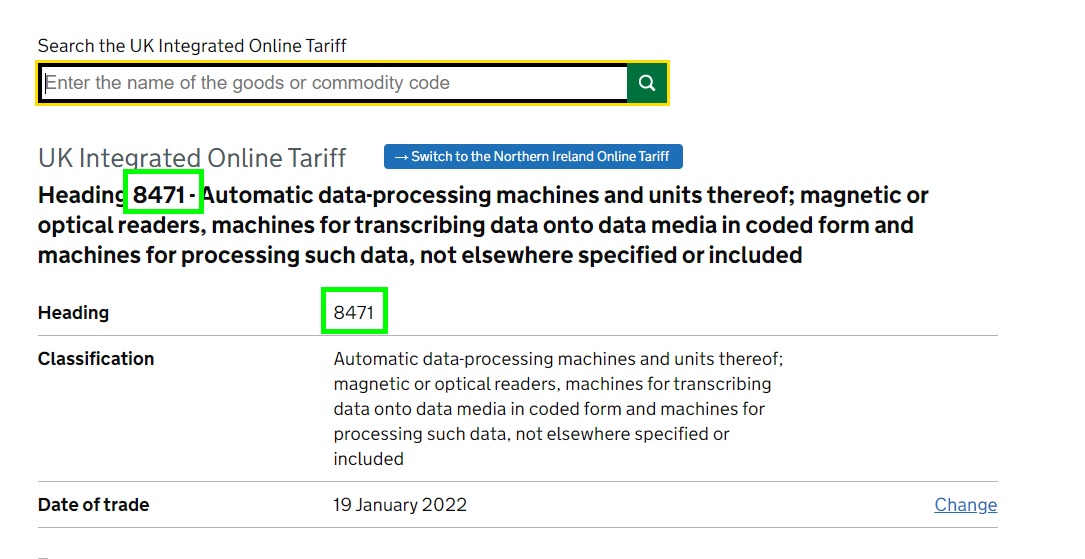

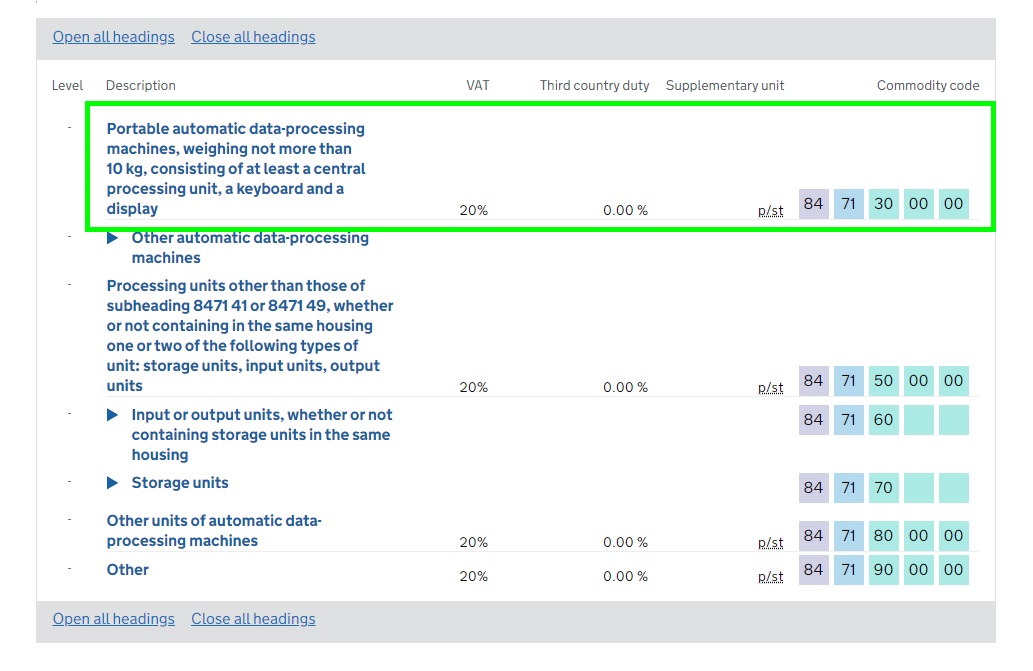

After searching ‘computer’, it becomes clear that the HS code heading for this type of product is ‘8471’.

And after clicking on the type of computer to import – the regular, office type – a user can see that the sub-heading for this product is ‘30’.

The HS Code for this batch of computers is therefore 847130.

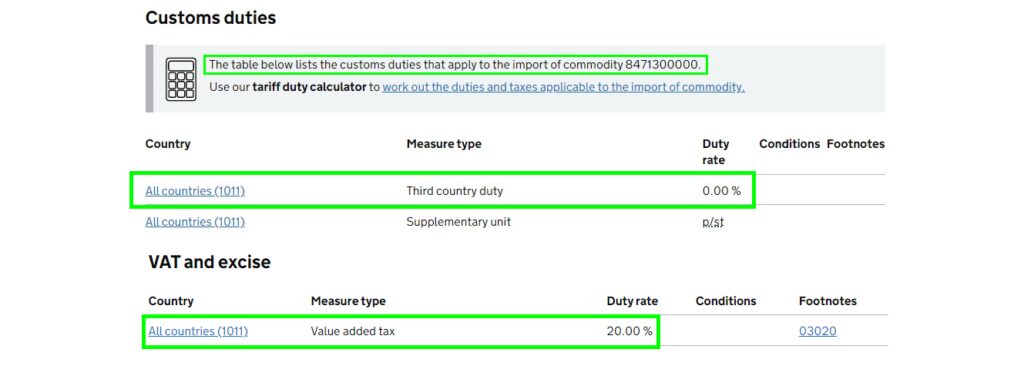

As seen in the image above, the HTS code for this particular product is simply ‘0000’.

This means that there is 0% in customs duty to pay as an importer, regardless of the product’s country of origin.

But there is a 20% value-added tax (VAT) to pay, again, regardless of the country of origin.

Get familiar with HS and HTS codes

The acceptance of HS and HTS codes as a universal language has made them an invaluable tool in international trade.

They also lend a helping hand to busy and often overworked customs agencies, but traders should be aware that HS and HTS codes must be used with care.

As noted above, the HS and HTS code system is constantly evolving, and for some products, there may appear to be grey areas or areas of overlap between categories.

It is therefore essential that traders use the right codes based on the right interpretation of the nomenclature, as failure to do may be looked on as non-compliance with customs laws.

Custom agencies can apply penalties for misdeclaring imports or exports, and that can hurt not only a business’s reputation, but also its bottom line.

Not to mention, it is possible to misdeclare your products into a higher tax bracket than necessary, which likewise wouldn’t be conducive to margins.

If you’re in doubt about the correct Harmonized System (HS) or Harmonized Tariff Schedule (HTS) codes to use, it’s prudent to consult with a customs official or with an expert at a customs clearance company.

Our team at Trade Finance Global (TFG) can help you on your import or export journey, and you can get in touch with us by clicking the link below.

Customs Hub

1 | Introduction to Customs

2 | HSN Codes

3 | HS Codes

4 | HTS Codes

5 | Import Controls

6 | Export Controls

7 | Phytosanitary Certificates

8 | Certificates of Origin

9 | Customs Brokers

10 | Single Window Systems

11 | Customs Clearance Process

Contact the trade team

Speak to our trade finance team

Latest insights – shipping, freight and logistics

Surecomp advances digital trade with rapid eBL transactions on RIVO platform

0 Comments

VIDEO | End of the Big Boat Era: Why demurrage, Incoterms and contractual obligations are more important than you think

0 Comments

RELEASED | Final KTDDE report: ICC DSI’s 18 month journey to harmonise trade documents

0 Comments

New sustainability approaches in shipping: Strategies for decarbonising the industry

0 Comments

PIL becomes member of DCSA, furthering shipping digitalisation

0 Comments

WTO’s “Global Trade Outlook and Statistics” report indicates positive movement amid challenges

0 Comments

Enigio’s trace:original eBL approved by IG P&I

0 Comments

What is Just-in-Time delivery? The evolution and impact of JIT

0 Comments

Choosing the right Incoterm: Ex Works (EXW) vs. FCA

0 Comments

Not just the Red Sea: Panama Canal crossings down 36%

0 Comments

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom