Bank Payment Obligation can act as a gateway for further trade finance technologies, says new Commerzbank whitepaper

- The whitepaper, “Leading the path of digital evolution” explains how increased market adoption of the BPO may spur the digitisation of trade:

- Commerzbank notes an increased customer interest for the BPO due to growing demand for faster and digitised processing of trade transactions

- The paper also highlights the hurdles to the tool’s wider use, such as raising customer and bank awareness of its advantages

In the face of slow market adoption for the Bank Payment Obligation (BPO), which serves as a legally binding undertaking to execute payment for goods or services, Commerzbank has launched a new whitepaper, “Leading the path of digital evolution”, which explores how to boost BPO adoption among banks and – crucially – their corporate customers.

2010 was a milestone for the BPO: it was then that it moved beyond the “proof of concept” stage and reached its “pilot”, as Standard Chartered Bank’s internal branch network facilitated a transaction between BP and Octal. The first cross-border transaction, between Bank of China and Bank of Montreal, took place the same year.

The BPO has since matured to its “commercialisation” stage. More corporates have used the instrument, and the number of “BPO- active” and “BPO-ready” banks is now about 40, situated primarily in Asia and Europe. Such BPO-active banks are citing growing BPO business and reporting that – slowly, but steadily – more corporates are being onboarded for the purpose of completing new BPO transactions.

Market adoption is crucial to the success of any given product; the BPO itself continues to be adopted because it both fills existing gaps in the market and satisfies the demand for value-added, client-centric digitisation. Yet market adoption of the BPO has been relatively slow.

“What’s more, BPO offers yet greater potential in the Supply Chain Finance space, where it can serve as an enabling framework by electronic matching of data of the physical supply chain to provide solutions along the financial supply chain in a digital environment. Not only does it secure the payment itself, but it can also provide security for financing against the payment by the recipient bank or the obligor bank, and allow a deferment of payment terms and maturity date. This is crucial for giving the buyer more autonomy over their working capital cycle and the supply chain in which they work, as well as preserving the liquidity and credit facilities of the supplier.” added Koll.

The paper suggests that adoption of the BPO has been slow, so far, because: trade is traditional, yet complex; there remains a scarcity of banks available to transact with the BPO; corporates and banks still need to be made aware of the instrument’s appeal; and the URBPO still largely position the BPO as a tool for banks, rather than for corporates as well.

How does a Bank Payment Obligation Work?

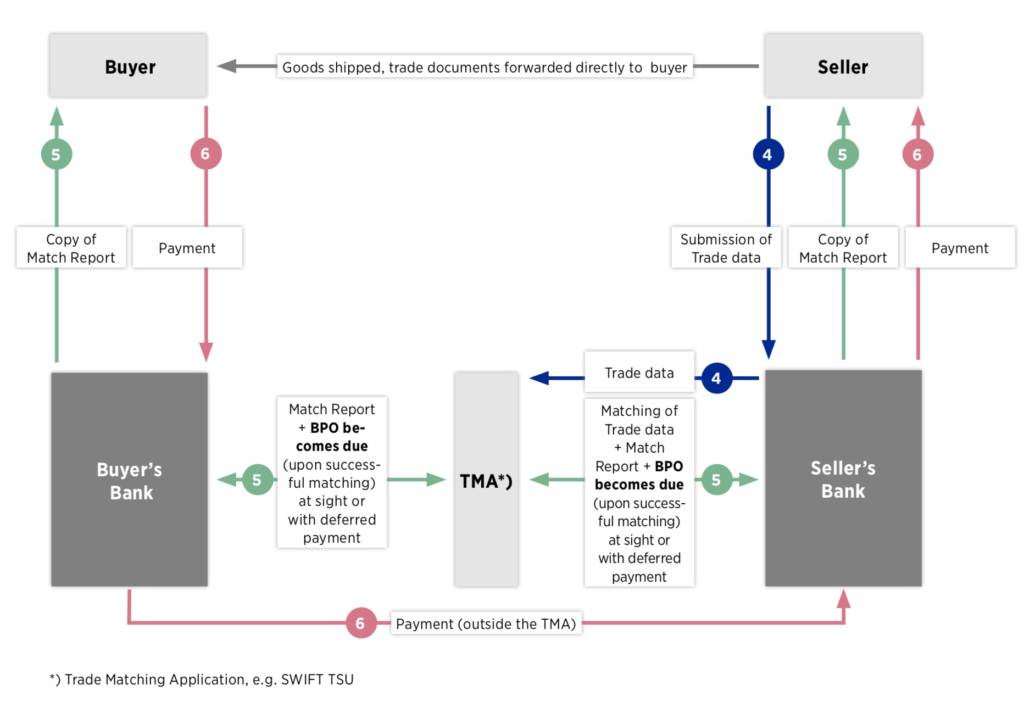

A BPO transaction flow consists of 2 data-matching processes:

1. Matching of Baseline Data (Establishment of Baseline)

The buyer and seller agree on the purchase order data as the basis for triggering the payment obligation after shipment. This data protocol is called the “established baseline”. Now the seller already has the assurance to receive payment at maturity if shipment is effected according to the agreed terms and the data presented in compliance with the baseline. The data flow is channelled through the involved banks and processed on the SWIFT TSU.

2. Matching of Trade Data (BPO becoming due)

After shipment, the seller provides the invoice and shipment data for matching against the baseline on the SWIFT TSU and sends the trade documents directly to the buyer. Upon successful matching of the data, the BPO becomes due and the obligor bank is automatically obliged to pay the BPO amount at maturity.

Koll adds: “While the trade finance community will pursue DLT advancements in the coming years, the BPO is available now – and has also already been demonstrated to be both commercially viable and valuable. To reach the tipping point, we need BPO-active banks to take a strategic approach to promoting the BPO as a product, both to their corporate customers and – critically – to other banks.”

Summary of the Benefits of the BPO

For all Parties:

- Enhanced trading relationship

- Enhanced trade opportunities and processing and use of the four-corner model

For both banks:

- Less effort and lower cost of onboarding clients (thanks to there being no additional KYC demands)

- Enhanced bank-to-bank international relations

- Fast, automated and seamless transaction processing

- Risk mitigation – and therefore lower costs – involved with trade finance

- Standardisation with other banks through the URBPO and ISO 20022TSMT Improved speed of handling mismatches on behalf of the client

- Improved visibility and transparency on the trade transaction

- The ability to “mine” the data that support transactions for future business development

Benefits for the seller

- Guarantee of payment in full on a specific due date

- Ability to raise finance on a BPO with deferred payment terms

- Lower implied cost of funding than would have been incurred under other financing structures

Benefits for the Buyer

- Guarantee of goods received as expected

- Flexible financing options at several stages of the supply chain

- Controlled input into the specifics of the payment conditions, as facilitated by data-matching on TMA/SWIFT TSU

- Early receipt of documents to avoid storage charges at the port of discharge

Benefits for Both Corporates

- Fast, automated and seamless transaction settlement processing

- Improvement to the efficiency of the working capital cycle

- Risk mitigation and financing for open account transactions

- Reduction of complexity involved with paper-based processes

Read the white paper here.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.