SME Finance | 2024 SME Trade Finance Research

Welcome to TFG’s 2024 SME trade finance research

Trade Finance Global (TFG) surveyed firms in the target regions of Belgium, the Netherlands, Germany, and the UK to better understand SMEs’ trade finance usage norms and their propensity to pay for new or additional trade finance products and services.

Research Context & Overview

According to the World Trade Organization (WTO), 80% to 90% of world trade relies on trade finance.

The tools and instruments that are used to finance the world’s trade flows come in many different forms and can be used for a wide array of applications.

Traditionally, the letter of credit (LC) or documentary collection (DC) have been the main instruments used, but in recent decades global forces have increased the volume of open account trade conducted.

This report begins with a brief overview of relevant economic and geographic data from the four markets of interest: Belgium, the Netherlands, Germany, and the UK. It will then explore the results of our SME market survey before concluding with our analysis and insights thereof.

What’s in the SME trade finance research?

During the current times of high inflation, record energy prices, and geopolitical uncertainty, we wanted to take stock on SME attitudes toward trade finance in Europe.

Both funded and unfunded trade finance products are often a lifeline to cross-border SMEs, particularly during economic downturns.

Trade Finance Global (TFG) surveyed firms in the target regions of Belgium, the Netherlands, Germany, and the UK to better understand SMEs’ trade finance usage norms and their

propensity to pay for new or additional trade finance products and services.

TFG also compared macroeconomic export data, provided by Trade Data Monitor, to assess sentiment towards digital trade finance and export opportunities, by trading partner and commodity type.

The SME survey asked respondents to indicate their interest in trade, inventory, and invoice finance. The survey also investigated the likelihood of SMEs to pay for these services at certain annualised price points.

Other examples of areas researched:

- Trade Finance Market Overview

- Views on Documentary Collection & Letters of Credit

- Propensity to pay – optimal margins

- Usage of Letters of Credit

- Market proposition

Download our free SME trade finance research

Research Insights | In A Nutshell

Despite high inflation, record energy prices, and geopolitical uncertainty, demand for trade finance SMEs is on the rise.

The 70-page report comes amid a tumultuous macroeconomic landscape of high inflation, record energy prices, and geopolitical uncertainty and seeks to explore the interest that European SMEs have in trade, inventory, and invoice finance.

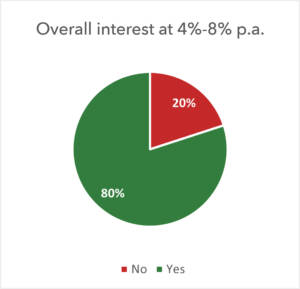

This report suggests that there is sufficient market demand at a 4%-8% annualised price point for trade finance lending over the next 5 years and that the beneficiaries of new trade finance products would be firms that generate up to $30 million in annual revenue and hold up to $2 million of inventory.

The Asian Development Bank estimates the current trade finance gap to be $1.7 trillion, with SME applications disproportionately rejected due to stringent regulations and large manual processing costs.

Regardless of the reasons, banks and MSMEs agree that access to trade finance is a major barrier that must be addressed

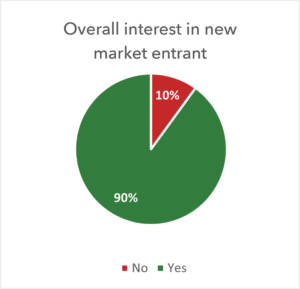

Of the 64 firms surveyed, which collectively operate across 31 countries, 90% exhibited an interest in new trade finance services.

The largest reluctance to pay 4-8% annualised for these services came among firms that currently pay 2-4% annualised, with interest dropping from 94% generally to 59% at this suggested price point.

Analysis of the survey data also revealed that firms that use letters of credit showed a higher interest in new trade finance services than those that do not use this traditional trade finance instrument.

The full report delves into several other variables such as firm revenue, inventory levels, debt utilisation, number of lenders, firm type, and operating location, among others.

Frequently Asked Questions

To acquire the data presented in this analysis, TFG surveyed firms in the target regions to gain a better understanding of SMEs’ trade finance usage norms and their propensity to pay for new or additional trade finance products and services.

The survey was designed to gain insight into firms based on numerous factors, including business type, operating location, annual revenue, use of third-party financing, average inventory levels, current number of lenders, current debt utilisation, current cost of debt financing, and letter of credit use.

The survey asked respondents to indicate their level of interest in a new market entrant that seeks to provide trade, inventory, and invoice finance.

It also investigated the likelihood of SMEs to pay for these services at a 4%-8% per annum price point.

The world’s trade finance gap is growing.

According to the Asian Development Bank (ADB), the global trade finance gap hit a record $1.7 trillion in 2020, up 15% from a previous high of $1.5 trillion in 2018.

Other estimates from the UK All-Party Parliamentary Groups (APPG) on trade finance put the current gap as high as $3 trillion to $5 trillion.

Regardless of the exact size of the gap today, there is no debate that it disproportionately impacts micro, small, and medium enterprises (MSMEs).

In order to gauge the market gaps for trade finance, TFG asked respondents whether a specific SME trade finance lending product would be of interest.

90% of respondents showed interest, as it would facilitate financing to pay suppliers and to hold stocks, as well as be useful for invoice finance purposes.

However, when provided with the specific price point of 4%-8% per annum for these services, interest dropped to 80%.

Some of the factors that influence propensity to pay:

- Current financing costs

- Firm revenue

- Inventory levels

Slightly more than half of all respondents use LCs in some capacity, and more than 95% of those consider them to be an important part of their business operations.

Consequently, it is clear that LCs and DCs still hold a prominent position in trade finance for SMEs.

That being said, firms that do use LCs reported a significantly higher propensity to pay for trade, inventory, and invoice facility services from the new entrant than those firms that do not.

In the current environment, we see demand from many mid-market corporates and SMEs, which are looking for additional flexibility from their trade, inventory, and receivables finance partners across structures, their asset base, and terms.

We have seen the same demand for liquidity increasing in the corporate space, coupled with a shortage of expertise from the trade finance industry.

Therefore, a bank offering such services allows for flexibility with the client, where there is a modest compromise on pricing.

This creates an appealing offering as it sits in between clearing banks and alternative finance options

How can we help?

The TFG team works with the key decision-makers at 270+ banks, funds and alternative lenders globally, assisting companies in accessing trade & receivables finance.

Our international team are here to help you scale up to take advantage of trade opportunities. We have product specialists, from machinery experts to soybean gurus.

Often the financing solution that is required can be complicated, and our job is to help you find the appropriate trade finance solutions for your SME.

Read more about Trade Finance Global and our global team.

Download our free SME trade finance research

Download our free Letters of Credit guide by filling in the form below:

Download the export finance guide

Contents

1 | Introduction to the Letter of Credit

2 | Types of Credit

3 | UCP 600 and the Letter of Credit

4 | UCP 600 – Ultimate Guide

5 | Benefits of Letters of Credit

6 | Handling Document Discrepancies

7 | Restricted Letters of Credit

8 | Letters of Credit vs Bank Guarantees

9 | Standby Letters of Credit

10 | Sight Letters of Credit

11 | eUCP Explained

12 | URC 522 and eURC

13 | SWIFT Messaging Types

14 | Research

15 | BAFT & TFG Guide

16 | Parties Involved

17 | Letters of Credit Rules

18 | ISBP 821

19 | Financial Crime, Fraud and Sanctions

20 | Presentation of Documents

21 | Dispute Resolution

22 | Digitalisation and the Future

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom