Welcome to our Supply Chain Finance hub, showcasing China – UK Trade Research on Supply Chain Finance Market

A global view on supply chain volumes shows that most (65.8%) come from cross border sales orders rather than domestic orders, and recent forecasts expected

In collaboration with ICC United Kingdom and East & Partners, Trade Finance Global released its whitepaper at the ICC Beijing Annual Conference: State of the Supply Chain Finance Market 2019, focussing on the UK – China trade corridor.

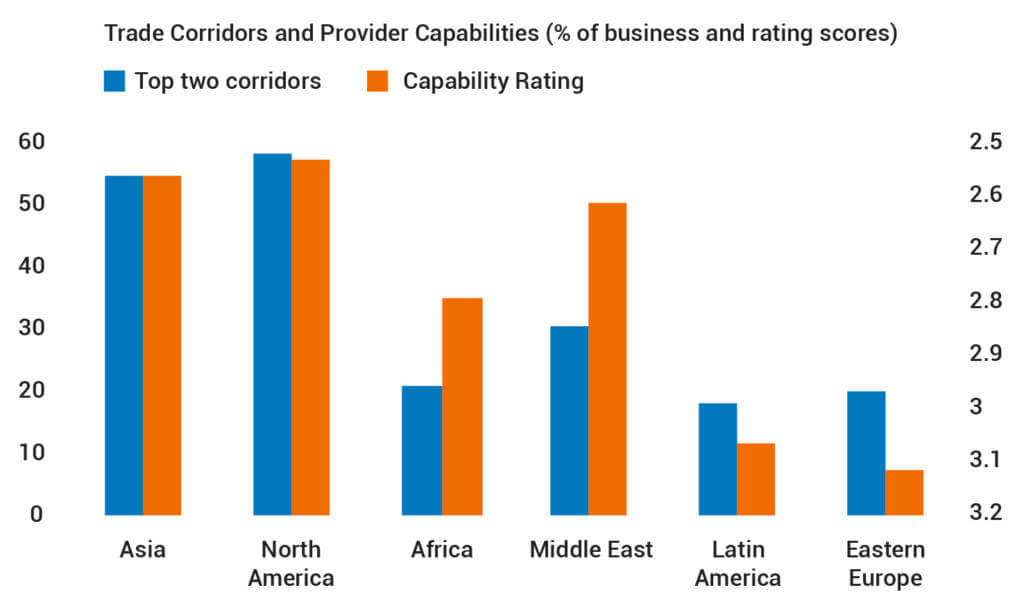

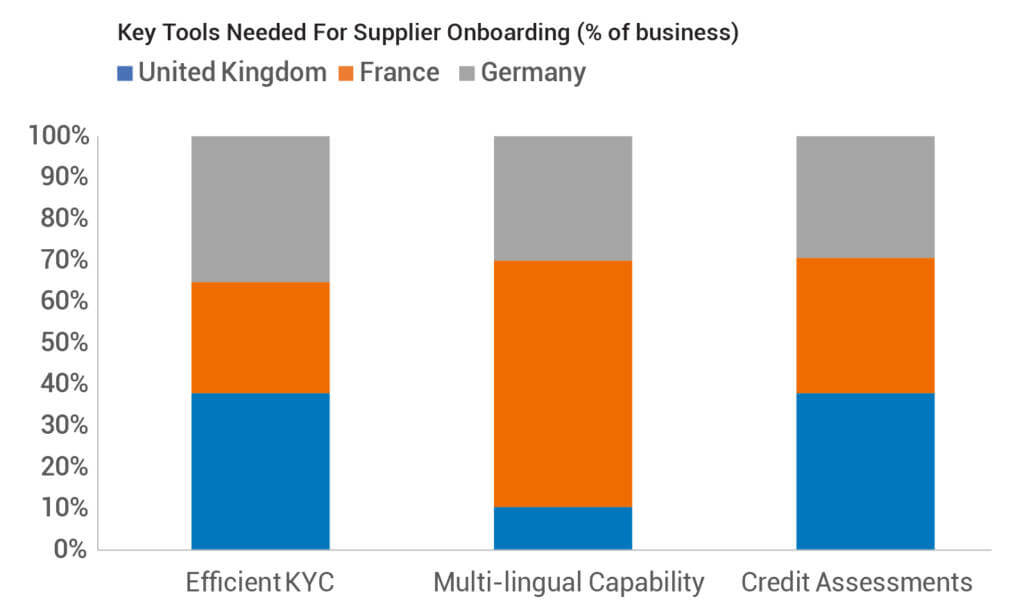

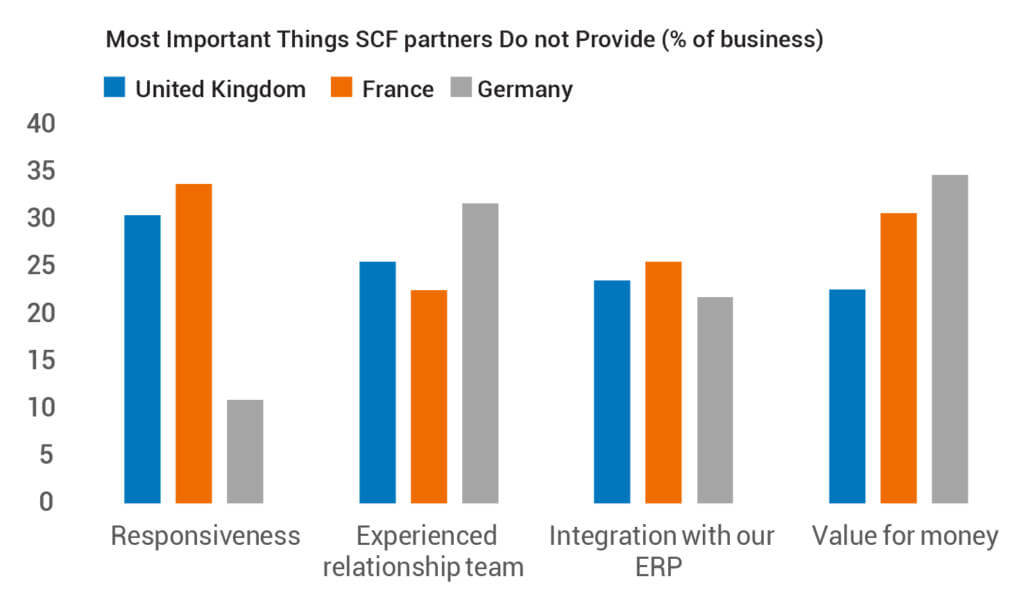

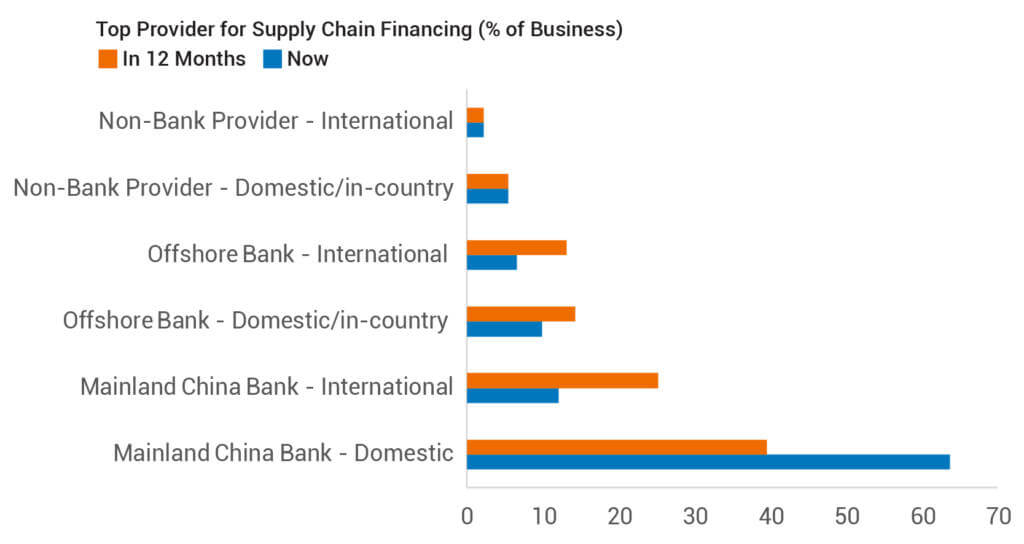

Graphs – UK China SCF Outlook

Download the Whitepaper

Articles

PODCAST | Adapting to change: The future of factoring and supply chain finance

0 CommentsVideo | ICC DSI: Scaling digital trade with the Key Trade Documents and Data Elements (KTDDE)

0 CommentsFactoring and supply chain finance in the shadow of the Areni-1 cave: EBRD’s insights from Yerevan

0 CommentsIFC and Absa Group announce $60m trade finance facility for Volcafe in East Africa

0 CommentsADB, Citi sign agreement to boost SME supply chain finance in Asia-Pacific

0 CommentsBanking on women: How IFC supports women entrepreneurs in international trade

0 CommentsRobotic process automation technology: Will it streamline international trade?

0 CommentsMaking an impact on Global Banking in 2024: ISO 20022, cross-border payments and AI

0 CommentsContributions

PODCAST | Adapting to change: The future of factoring and supply chain finance

31st May 2024 / 0 Comments

Video | ICC DSI: Scaling digital trade with the Key Trade Documents and Data Elements (KTDDE)

20th May 2024 / 0 Comments

Factoring and supply chain finance in the shadow of the Areni-1 cave: EBRD’s insights from Yerevan

17th May 2024 / 0 Comments

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.