Blockchain & DLT in Trade

A Reality Check

Building on the WTO publication “Can Blockchain Revolutionize International Trade?” authored by Emmanuelle Ganne and TFG’s white paper “Blockchain and Trade Finance”, this study provides an overview of the main projects underway in trade, with a focus on trade finance, shipping, and the digitalization of trade documents, and assesses their stages of maturity. Based on a survey of more than 200 actors in the field, it analyses the key challenges that companies involved in blockchain projects are facing and discusses actions that may need to be taken to allow the technology to truly transform international trade. After years of hype around blockchain, the time has come for a reality check.

Copyright © Trade Finance Global 2020. Please reference Trade Finance Global when citing this publication

Authors

Contents

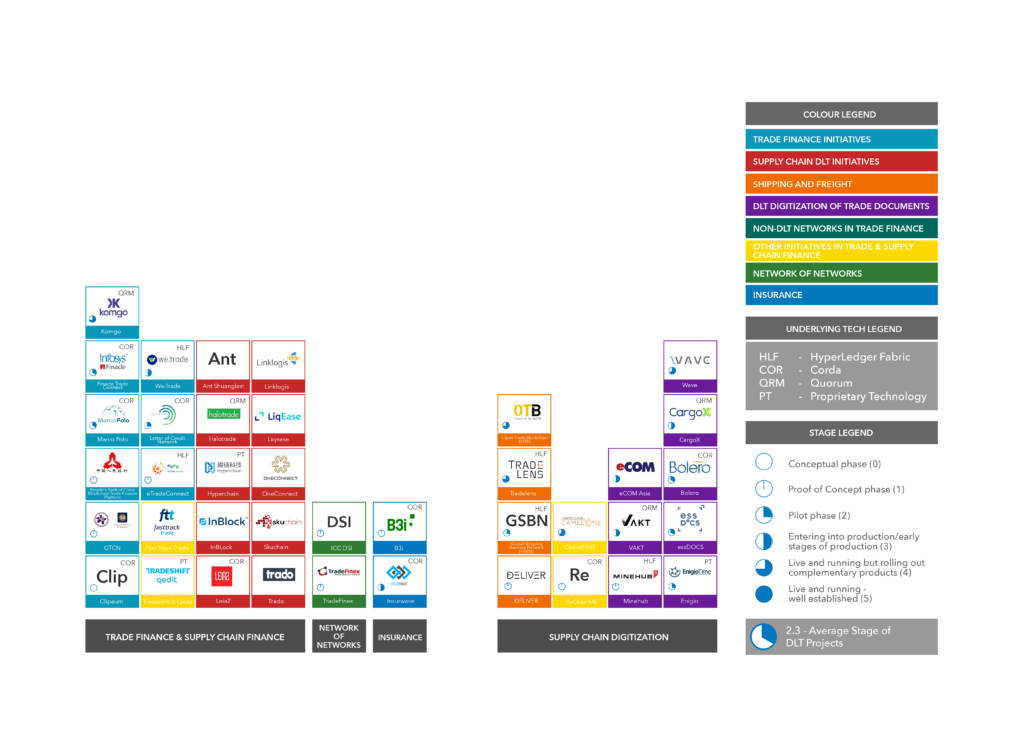

- Periodic Table of DLT Projects

- Description of Projects

- Projects by Product

- Projects by Bank

- Future Looking Perspective

- Conclusion

Copyright © Trade Finance Global 2020. Please reference Trade Finance Global when citing this publication

We’re living through exciting times. While international trade in goods has seen little innovation since the invention of the container in the 50s, the tedious, labour- and paper-intensive processes required to ship around the world could well become a story of the past thanks to the advent of new technologies, particularly distributed ledger technology (DLT) – colloquially termed “blockchain”.

Rarely has a technology spurred so much hype and hope amongst the trade and trade finance community. Not without reason: The possibilities that blockchain unlocks to track transactions and exchange assets in real-time, in a trusted and highly secure environment using peer-to-peer validation and networks makes it an appealing tool to remove many of the inefficiencies that hinder one of the oldest forms of traditional finance today.

Over the past few years a myriad of projects have been launched to enhance processes related to trade finance, to digitalize trade documentation, and to reduce inefficiencies in transportation and logistics. Some take the form of multi-player consortia and networks, others are building a fabric layer to interconnect these different projects, and others are built to digitize particular aspects of the trade and supply chain.

These international trade actors are changing fast, but how many of these initiatives have moved beyond a proof-of-concept? What are the challenges that these new actors now face as we go past the trough of disillusionment and exploratory phase of DLT in trade?

Industry Association Partners

Assistant Editor and Lead Researcher

Carter Hoffman, Trade Finance Global

Questionnaire Design

Cécile André Leruste, Accenture

Special Thanks To

- David Bischof, ICC Banking Commission

- Olivier Paul, ICC Banking Commission

- Alisa Di Caprio, R3

- Jerry Defeo, Trade Finance Global

- Fabiana Fong, World Trade Organization

- Persiana Ignatova, Trade Finance Global

- Hans J. Huber, ICC DSI

Contributors

Pierre Sien, Euler Hermes (Clipeum Participant)

Mohua Banerjee, Finacle Blockchain solutions

Souleïma Baddi, KomGo SA

David Bischof, ICC DSI

Atul Khekade, TradeFinex Tech Ltd.

Ken Marke, B3i

Daniel Wilson, Maersk GTD

Lionel Louie, CargoSmart Limited

Horace Mak, eCOM Asia

Jacco de Jong, Bolero International

Gunnar Collin, EnigioTime

Whitman Knapp, GTBInsights LLC

Hans J. Huber, ICC DSI

Adi Weinstein, Wave

David McLoughlin, we.trade

Shona Tatchell, Halotrade

Dani Cotti, TradeIX

Mariana Gomez, ING

Marta Piekarska-Geater, Hyperledger

Emily Fisher, Hyperledger

Vivek Gupta, ANZ

Alisa Di Caprio, R3

Paul Smith, HSBC

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.