Receivables Discounting | The 2024 Guide for Buyers and Sellers

What is Receivables Discounting?

Receivables discounting is a type of asset financing which involves obtaining a short term loan against accounts receivable. It is first important to understand what a receivable looks like and the reason that this type of funding is subsequently used.

Receivables discounting can be used for many reasons. This type of financing is frequently used to help growing businesses access capital secured against invoices. Receivables discounting can help prevent companies running into working capital complications.

What is a receivable and what is receivables discounting?

A receivable is a promise of future incoming value into a company. This may be monetary worth or something else of capital worth. It is important to note that it is a future defined value flowing to the business and is not received at the point that a transaction is made. At its most basic form, this will be an invoice that is submitted to an end buyer when a product is purchased. The reason that the goods are not paid for on purchase is due to the end buyer being provided with credit days from the supplier. This attracts buyers to work with sellers, as they will have a period of time in which to provide payment. The reasons for these ‘credit terms’ may be varied; it will assist with the cash flow of the ultimate buyer, will allow an element of sell through of the stock prior to payment and will permit flexibility of the purchaser. This may also be a deciding factor for the purchaser; of who the supplier will be.

The concept of having credit terms is used to attract the end buyer. In the event that no credit terms are provided; payment is received at the point of delivery or pick up of the product.

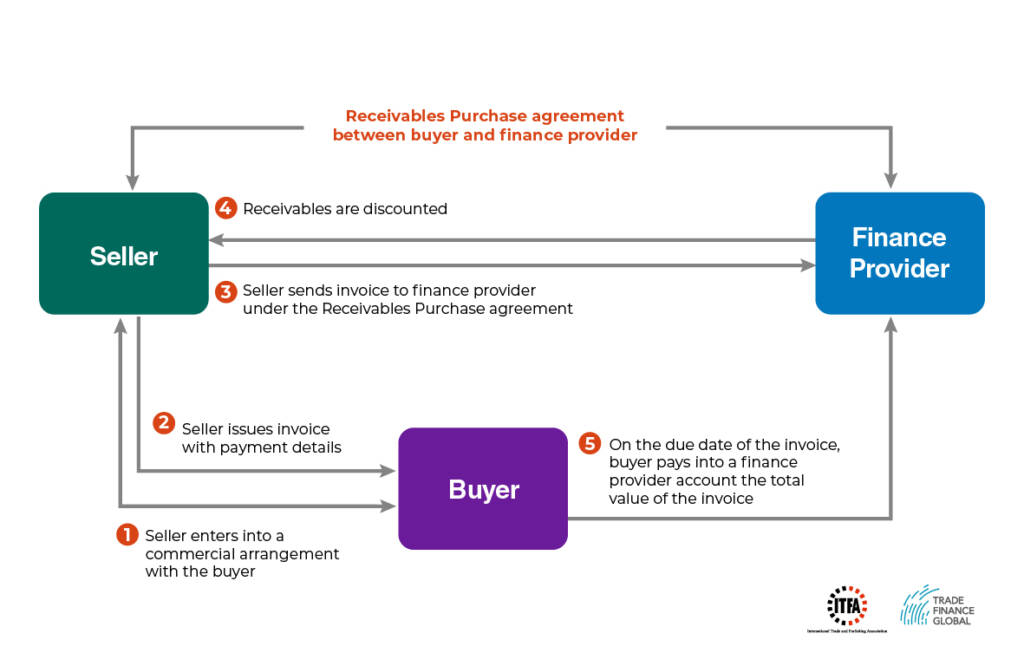

Diagram - Receivables Discounting

Why is providing credit terms a problem?

The cash flow of a business is of central importance, as it allows expansion and forward momentum. In order to grow, there is always a need for finance and so providing long term credit days can make expansion a difficult process. In effect, providing credit terms may starve the business of finance.

Receivables discounting (also known as receivables factoring) is a mechanism in which finance is provided against receivables; such as invoices. The typical way this will happen is for 75-90% of funding to be provided against the invoice value. In terms of chronology, at its most basic form an invoice is sent out to the end buyer; this is acknowledged and assigned in favour of the funder and a percentage of funding is advanced against it. When payment is made to the lender at the defined time; usually within 30, 60 or 90 days, the funder will deduct their fees and the amount lent or advanced. Any remaining funds are paid back to the borrower.

The process above is called receivables discounting or invoice finance. There are many other terms for it but at its most basic; funds are provided towards against an incoming receivable or invoice.

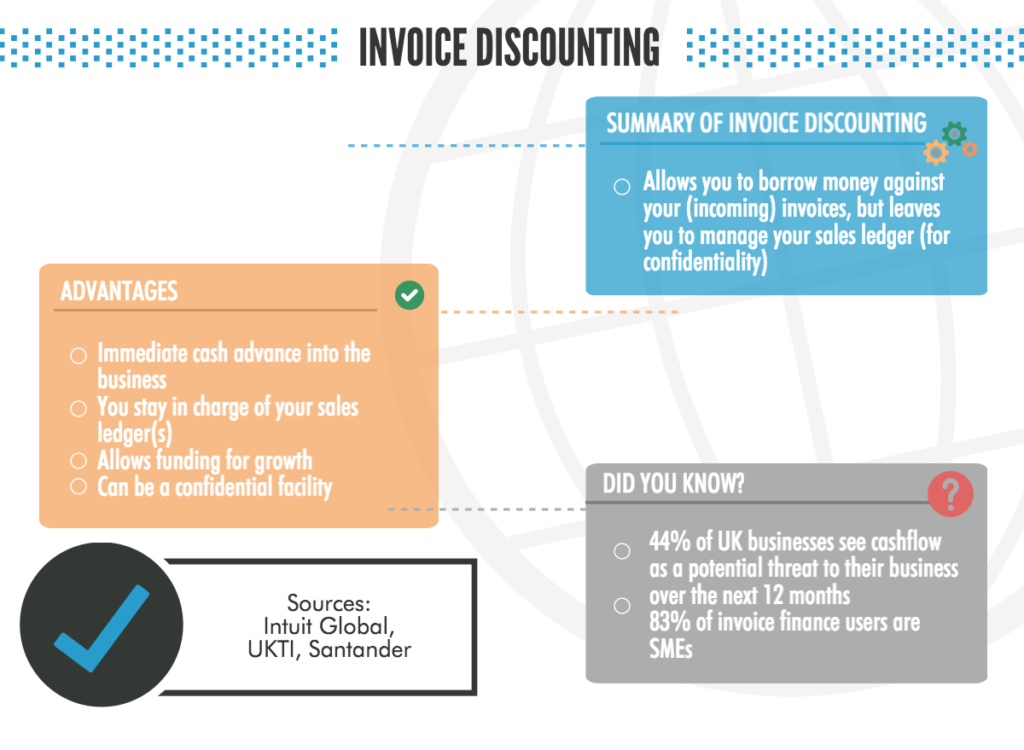

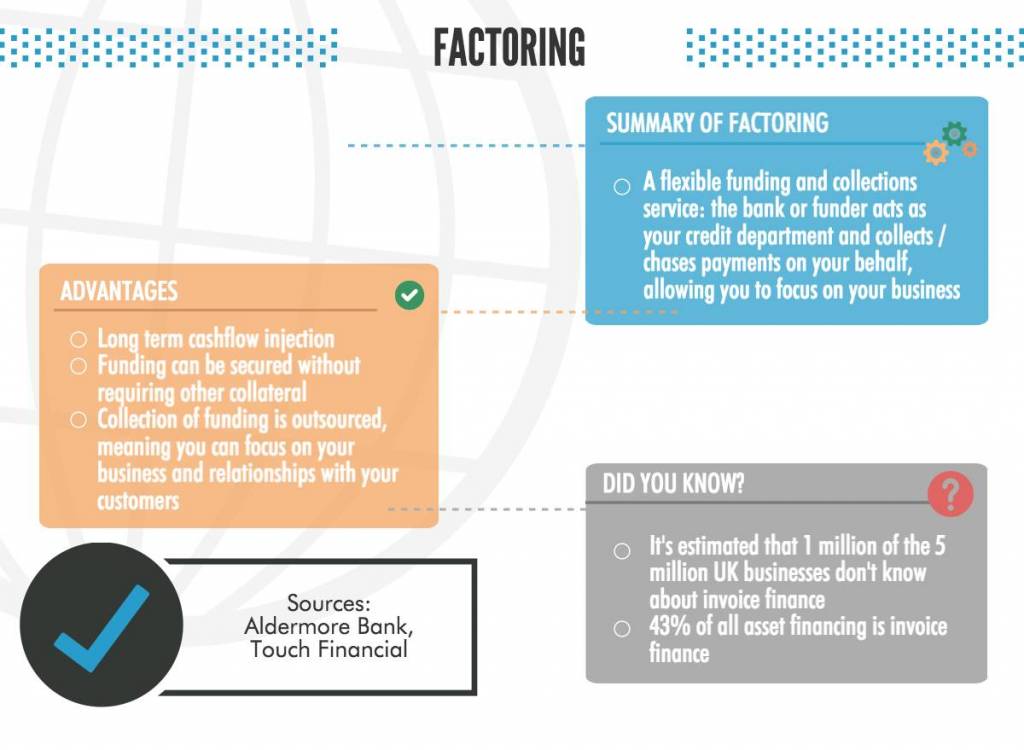

Want to find out more about invoice finance? Check out our handy infographic – a comprehensive guide which defines invoice discounting, factoring, as well as the differences between the two!

Case study: Wholesaler of soybean produce

Company X is exporting soybeans to the UK from Peru. The soybeans are stored in a warehouse in the UK until the customer wishes to buy the produce. A receivables discounting agreement would be used to enable Company X to receive funds once the end customer is sent an invoice and a funder agrees to discount the invoice (paying Company X on 30-90 day terms).

Invoice and Receivables Finance Hub

Speak to our trade finance team

Latest News

Factoring and supply chain finance in the shadow of the Areni-1 cave: EBRD’s insights from Yerevan

0 Comments

PODCAST | FCI’s Neal Harm on kicking off inclusive growth in the factoring industry

0 Comments

Bridging the gap: The transformative potential of factoring in Africa

0 Comments

PODCAST | Year ahead: Swift CIO on balancing uneven payments regulation and advancing CBDC

0 Comments

Switching the Pound for the Peso: Three reasons why you should consider settling invoices in local currencies

0 Comments

FCI scores hat-trick in Marrakesh: A giant leap for factoring

0 Comments

A common credit insurance hub: The solution to streamline credit insurance?

0 Comments

ISO 20022: A game changer for Canadian corporations

0 Comments

Global invoice factoring market poised for exponential growth by 2032

0 Comments

PODCAST | Breaking: First cross-border factoring facility between Armenia and Georgia supported by EBRD

0 Comments

PODCAST | Factoring in the UAE: Developments and global implications

0 Comments

Evolution of electronic invoicing: watch for the explosive growth

0 Comments

VIDEO | Visa: the highs and lows of B2B payments

0 Comments

Bill discounting vs. invoice factoring – what’s the difference?

0 Comments

Driving sustainability in global trade with digital collaboration

0 Comments

While the… Read More →

World of Open Account (WOA) cofounders on the changing face of receivables finance

0 Comments

What is structured trade finance (STF)?

0 Comments

Is the time ripe for the formation of a global receivable exchange?

0 Comments

SME appetite for trade finance

0 Comments

Podcast: FCI – why the factoring industry is experiencing a boom

0 Comments

Debt vs. equity finance: how do European SMEs use third-party financing?

0 Comments

City Week exclusive: Bob Wigley on UK SME lending in 2022

0 Comments

VIDEO: Factoring strikes back – FCI’s Aysen Çetintas on expanding trade finance education after COVID-19

0 Comments

Explained: How these 5 trade finance instruments can help your business grow in 2022

0 Comments

2021 – A Year in Review with Trade Finance Global

0 Comments

Do you export? Take part in our access to finance survey

0 Comments

South Africa’s Standard Bank chooses Flutterwave for Africa digitalisation drive

0 Comments

BNP Paribas executes green repurchase agreement (repo) with EDF

0 Comments

Can SMEs benefit from digital solutions in trade finance?

0 Comments

FCI Launches 53rd Annual Meeting through new virtual platform

0 Comments

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom