Trade Finance Global (TFG) surveyed firms throughout Europe to gain an understanding of SMEs’ trade finance usage norms and their propensity to pay for new or additional trade finance products and services.

A total of 64 firms with operations in the four target markets responded to the survey.

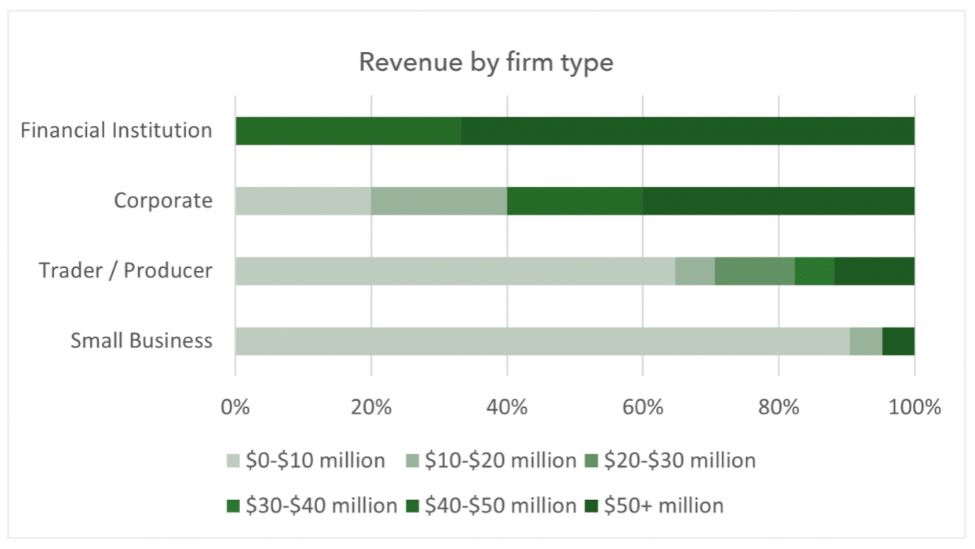

Over 80% of the firms surveyed self-identified as either small businesses, traders, or producers, and less than 20% self-identified as corporates or financial institutions.

60% of respondents reported annual revenues between $0-$10 million, while 14% reported revenues greater than $50 million.

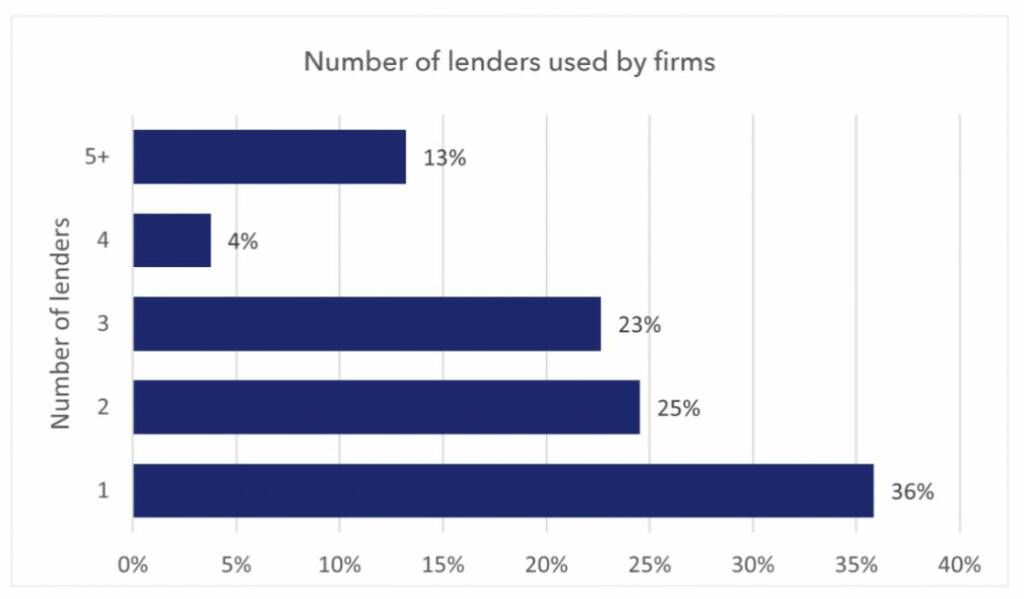

Number of lenders

The TFG survey found that over 80% of respondents used three or fewer lenders for their debt, while 36% used only one lender, and 13% used five or more.

When informed of a hypothetical new entrant coming into the market, firms using a single lender, and firms that use five lenders or more, are the two groups that showed the greatest interest.

On the contrary, firms that use two or three lenders indicated lower levels of interest.

This suggests that firms without a diversified lender base are interested in adding new lenders.

Moreover, firms that already exhibit strong levels of diversification also appear to be interested in adding new lenders to further diversify.

Conversely, the firms in between these two poles – who have already achieved some degree of diversification by using two or three lenders – were the least interested in acquiring new lenders.

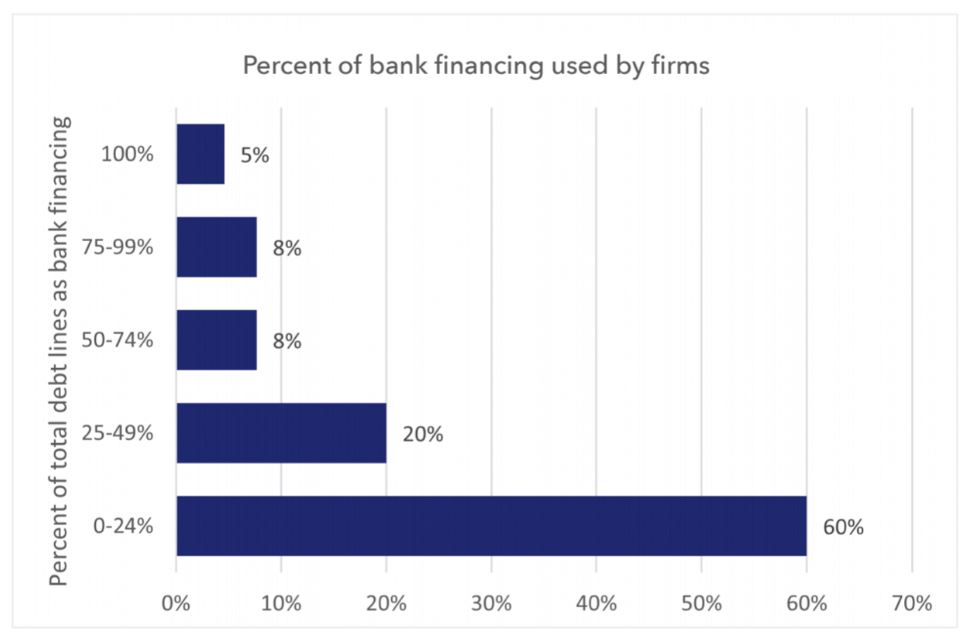

Percentage of total debt lines as bank financing

The survey revealed that 60% of respondents use bank financing for between 0%-24% of their total debt lines.

The number of respondents that use bank financing continually dropped as the number of total debt lines increased.

For example, only 20% of respondents use bank financing for 25% to 49% of their total debt lines, 8% use bank financing for 50% to 74% and 75% to 99% of their total debt lines respectively, and only 5% use bank financing for 100% of their total debt lines.

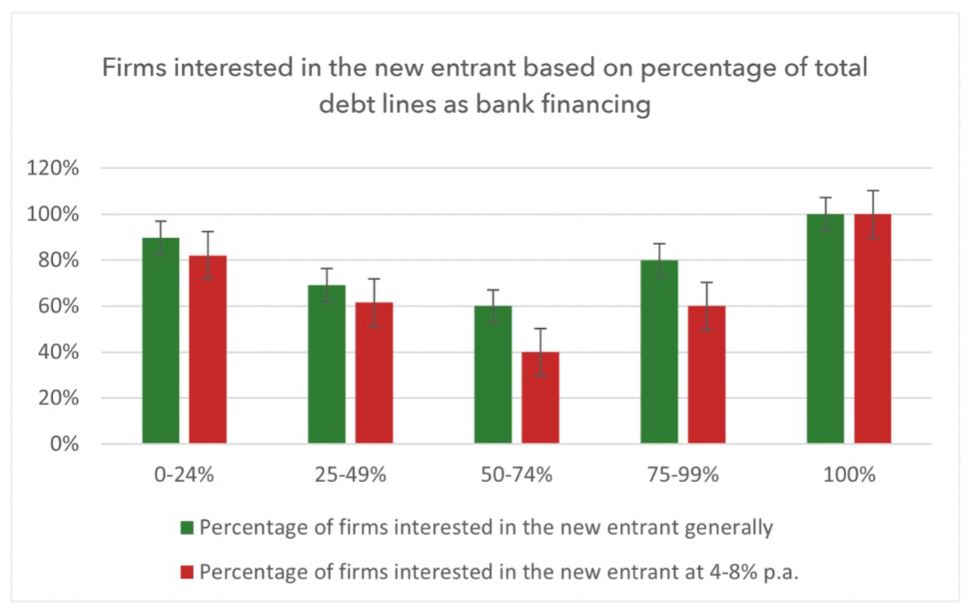

The level of interest in a potential new entrant offering these types of services was highest among firms with the smallest amount of bank debt as a proportion of their total debt lines, and among firms with the largest amount of bank debt as a proportion of their total debt lines.

Conversely, interest was lowest among firms in the 25% to 74% range.

According to this pattern, both the least and most diversified firms are more willing to take advantage of new offerings, while companies with some diversification are less likely to do so.

Propensity to pay based on firm type

Small businesses, traders, and producers are generally highly interested in the opportunity of a hypothetical new market entrant, even at a 4%-8% price point.

In contrast, corporates showed the lowest interest overall, and that interest dropped considerably at the 4%-8% price point.

This may be due to the fact that respondents who self-identify as corporations or financial institutions earn significantly more annual revenue than do small businesses, traders, or producer respondents.

Based on this observation it is difficult to determine whether these trends ought to be attributed to differences in firm type or to differences in revenue.

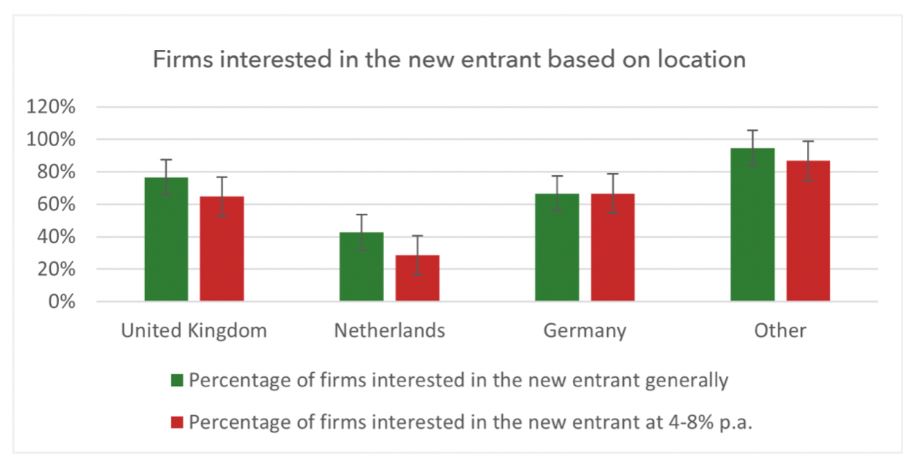

Propensity to pay based on location

To examine the respondents’ propensity to pay based on operating location, we grouped them into four categories: those based in the UK, those based in the Netherlands, those based in Germany, and those based in any other region of the world.

Firms based in the UK, Netherlands, and Germany indicated lower levels of interest overall compared to firms based elsewhere in the world.

Notably, firms based in the Netherlands indicated the lowest interest overall, at 43%, and that figure dropped to 29% at the 4%-8% price point.

Among firms based in the UK, interest also dropped with the 4%-8% at price point, falling from 76% to 65%.

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.